Business Sectors

Events

Contents

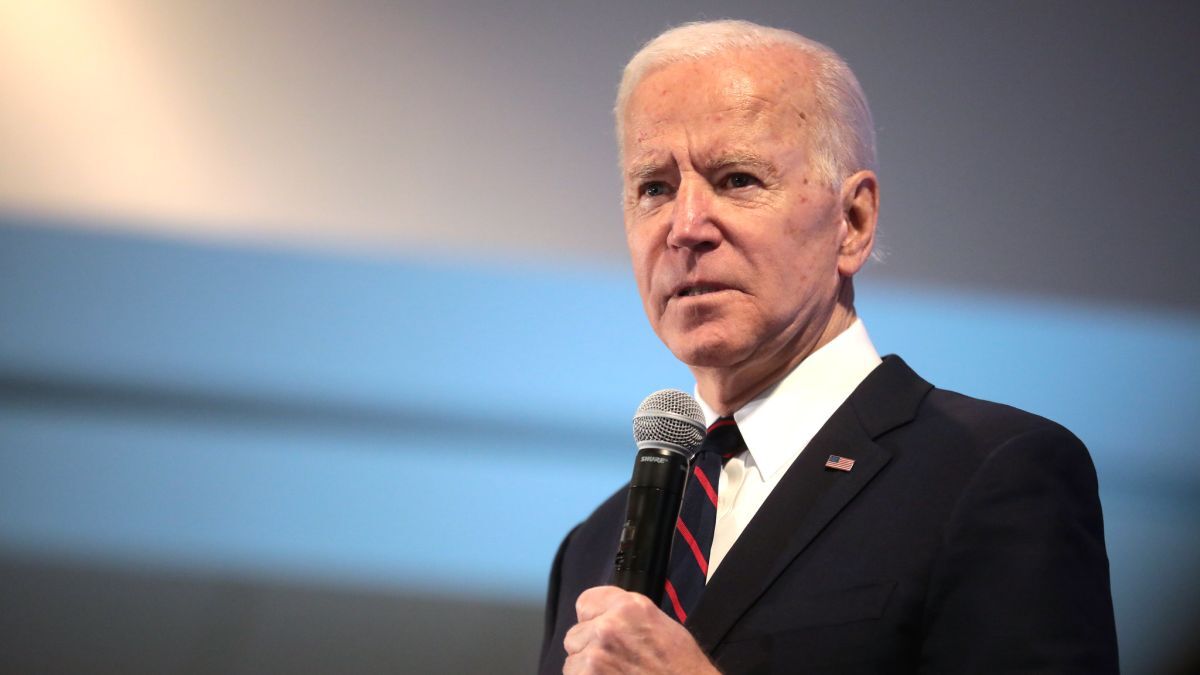

US bans Russian oil imports, UK to 'phase out' imports by end of year

US President Joe Biden has announced an embargo on Russian oil imports to target the ’main artery of Russia’s economy’

Announcing the embargo, President Biden said the US will ban imports of Russian oil, gas and energy.

"That means Russian oil will no longer be acceptable at US ports and the American people will deal another blow to [Russian President Vladimir] Putin’s war machine," President Biden said.

President Biden said the embargo followed "close consultation with our allies, especially in Europe," noting that the US’ position as a "net oil exporter" allows the country to make the move when others are unable to do so.

“We can take this step when others cannot, but we are working closely with Europe and our partners to develop a long-term strategy to reduce their dependency on Russian energy as well,” he said.

US Energy Information Administration figures show Russian crude oil made up about 3% of all crude shipments coming in to the US in 2021 and that total Russian petroleum product imports made up about 8% of US oil imports.

Following an address via video feed to the UK Parliament by Ukrainian President Volodymyr Zelenskiy, UK Prime Minister Boris Johnson announced a phased approach to eliminating imports of Russian energy that will see a complete embargo by the end of 2022. The UK Prime Minister said the country would "press on with tightening the economic vice around Vladimir Putin, and we will stop importing Russian oil".

Details, although sparse, were announced by UK Business Secretary Kwasi Kwarteng.

"The UK will phase out imports of Russian oil in response to Vladimir Putin’s illegal invasion of Ukraine by the end of the year," a statement from the Department for Business, Energy and Industrial Strategy (BEIS) said.

Russian imports account for 8% of the UK’s total oil demand. The BEIS statement said the UK is "a significant producer of both crude oil and petroleum products, in addition to imports from a diverse range of reliable suppliers beyond Russia".

"The government will work with companies through a new Taskforce on Oil to support them to make use of this period in finding alternative supplies," the statement said.

Europe has released a draft plan to reduce it’s reliance on Russian energy. The EU is more exposed to Russian energy flows, with heavy reliance on both oil and gas imports from Russia. Russian natural gas flows make up less than 4% of UK supply.

An International Energy Agency plan released in early March, outlining measures for the EU to reduce its reliance on Russian energy supplies said that in 2021, the European Union imported 155 billion cubic metres of natural gas from Russia, accounting for around 45% of EU gas imports and close to 40% of its total gas consumption. Similarly, nearly a third of European oil and half of the continent’s coal supplies come from Russia.

EU Commission President Ursula von der Leyen said “We must become independent from Russian oil, coal and gas. We simply cannot rely on a supplier who explicitly threatens us. We need to act now to mitigate the impact of rising energy prices, diversify our gas supply for next winter and accelerate the clean energy transition. The quicker we switch to renewables and hydrogen, combined with more energy efficiency, the quicker we will be truly independent and master our energy system. I will be discussing the Commission’s ideas with European leaders at Versailles later this week, and then working to swiftly implement them with my team.”

Oil and gas prices have hit historic highs around the world in reaction to the war in Ukraine and the sactions imposed on Russia.

In his address, President Biden spoke directly to energy companies, warning against profiteering.

"To the oil and gas companies, and to the finance firms that back them: we understand that Putin’s war against the people of Ukraine is causing prices to rise. That’s self-evident. But that’s no excuse to exercise excessive price increases," he said.

"Russia’s aggression is costing us all and it’s no time for profiteering or price gouging.”

ExxonMobil said it will halt new investment in Russia and discontinue operations at the oil and gas facilities on Sakhalin Island in Russia’s far east.

TotalEnergies has stopped short of a total Russian exit, saying it will stop new investments and implement EU sanctions as required "regardless of the consequences" on its economic activities in Russia. TotalEnergies reportedly holds a 19.4% stake in publicly traded natural gas producer Novatek, Russia’s largest producer of liquefied natural gas. Novatek is not currently under sanction by the US, UK or EU, but the UK has sanctioned Volga Group founder and Novatek shareholder Gennady Timchenko, who has held a 23.5% stake in Novatek, according to Bloomberg data.

"Exposure to Russia is concentrated in the hands of a few: BP and TotalEnergies have by far the largest positions of the majors," analysts at global energy consultancy Wood Mackenzie said.

BP announced on 27 February it is exiting its 19.75% interest – valued at US$14Bn – in Russian oil giant Rosneft, which reportedly has been under sanctions from the US and EU since Russia annexed Crimea in 2014. Meanwhile, Equinor’s board said it would stop new investments into Russia, and start the process of exiting Equinor’s Russian joint ventures.

On 1 March, Shell joined British oil major BP and Norway’s Equinor in exiting Russia-linked oil and gas investments in response to the Kremlin’s war on Ukraine. Shell’s interests in joint ventures with sanctioned Gazprom and related entities and its stake in the Nord Stream 2 pipeline from Russia to Germany top US$3Bn in value. Yesterday, Shell apologised for buying a cargo of Russian oil in the wake of Russia’s invasion of Ukraine and committed to pulling out of all Russian hydrocarbons.

Riviera Maritime Media will provide free technical and operational webinars in 2022. Sign up to attend on our events page

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.