Business Sectors

Events

Contents

Register to read more articles.

WinGD CEO: 'We may have all bet on the wrong horse'

WinGD poured R&D investment into dual-fuel technology, aggressively supporting the uptake of ammonia and methanol, only to find MEPC-83 may favour LNG and ‘pay to pollute’, says chief executive Dominik Schneiter

It was hard for WinGD chief executive, Dominik Schneiter, to hide his disappointment with the draft regulations outlining IMO’s Net-Zero Framework at MEPC-83.

“Until we know the level of reward for sustainable fuels, LNG and to pay to pollute appear to be the best options” to comply with the tier one and tier two taxation levels, says Mr Schneiter. “There is a big risk of locking in LNG fossil energy up to 2040, without those incentives for the sustainable fuels,” he says.

Draft regulations approved at the 88th Session of the Marine Environmental Protection Committee (MEPC-83) for IMO’s Net-Zero Framework set a mandatory global fuel intensity (GFI) standard and greenhouse gas (GHG) emissions pricing for shipping.

An analysis of the Net-Zero Framework, as well as the existing FuelEU Maritime regulations, by Rystad Energy sheds light on the cost structure. The energy analyst says very low-sulphur fuel faces fewer penalties under the IMO Net-Zero Framework compared to the penalties imposed by FuelEU Maritime. It projects costs to remain below US$1,000 per tonne until 2035, and then rising above US$1,100 per tonne.

“We fundamentally question the approach”

Rystad Energy says: “[LNG] is subject to more favourable conditions under FuelEU Maritime yet encounters heavier penalties according to IMO guidelines. Despite being subject to the EU Emissions Trading System tax – which results in a higher total carbon tax under EU regulations compared to IMO – LNG is anticipated to remain the most cost-effective fuel choice under both regulatory frameworks through 2035.”

And, says the energy analyst, the production cost of e-ammonia struggles to compete with fossil fuels, with the current cost structure, even when regulatory penalties and production incentives are considered. “The price gap might be narrowed via selling surplus compliance units in pooling and incorporation with the ZNZ (zero- and net-zero fuels) rewarding policy after it gets determined,” it notes.

Rystad Energy says both IMO and EU regulations position “LNG in a cost-competitive stance for many years, until price parity with e-fuels is eventually achieved. This underscores the importance of establishing appropriate financial incentives for ZNZ fuels and technologies to accelerate the transition.”

Regulatory certainty is critical for shipowners, operators and technology providers to ensure there are no stranded assets. Given the draft regulation’s lack of clear guidance and incentives to use e-methanol and e-ammonia, Mr Schneiter says: “What this means for anyone who has invested in methanol and ammonia is that we may all have bet on the wrong horse. We invested heavily in methanol and ammonia. We fundamentally question the default emission factor within the GFI standard, because it stalls innovation.”

“The production cost of e-ammonia struggles to compete with fossil fuels”

Mr Schneiter explained his viewpoint: “With default emission factors you need to convince classification, flag states, etc, that you are better than that standard. And only when that is done, you have then uphill battles with the shipowners and operators to buy this equipment and get certified with a better standard than the regulation says.”

While WinGD is waging these battles to show its technology exceeds standards, others with lower default factors can “lean back on the sofa, saying, ‘Our technology is better, we don’t need to do anything’.”

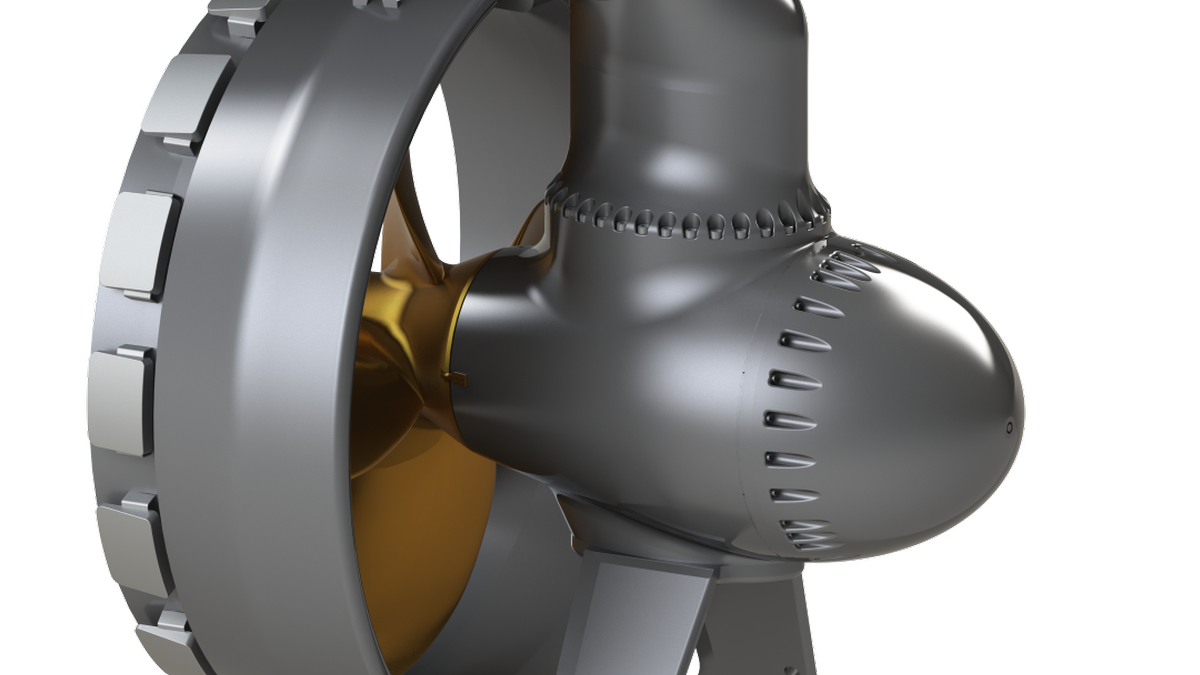

This is particularly galling for the Swiss two-stroke engine designer, which has checked off several milestones in the progress of the development of its ammonia and methanol dual-fuel technology. Speaking to Marine Propulsion at Nor-Shipping 2025 in Oslo, Mr Schneiter highlighted the success of WinGD’s two-stroke, slow-speed methanol, and ammonia dual-fuel engines, noting a 40% reduction in NOx emissions and over 90% in total GHG reduction.

Ammonia-fuelled gas carriers

Illustrative of its progress is a recent order from one of the world’s largest vessel charterers and a major commodities group, Trafigura. It selected ammonia dual-fuel engine technology from WinGD for a series of four medium-sized multi-gas carriers (MGCs) under construction at South Korea’s HD Hyundai Mipo Dockyard.

Each of the 45,000-m3 MGCs will have a six-cylinder, 52-bore 6X52DF-A engine with high-pressure selective catalytic reduction.

As a member of the Global Maritime Forum’s Getting to Zero coalition and a founding member of the First Movers Coalition, Trafigura has committed to reducing the carbon intensity of its own shipping fleet by 25% by 2030.

This order is one of several WinGD has received for its ammonia dual-fuel technology, with some of the first ships entering service this year.

WinGD vice president, market development, Benny Hilström, said: “Trafigura selected our technology based on our demonstration of X-DF-A’s development and strong performance indicators to date. With the first X-DF-A engine deliveries due in mid-2025, we will already have gathered significant construction and commissioning experience by the time these engines are delivered.”

In full-load, running with 5% pilot fuel on its testbed X-DF-A engine, WinGD has achieved thermal efficiency results like diesel engines with significantly lower NOx and ammonia emissions, at less than 10 parts per million (ppm) and nitrous oxide emissions at less than 3 ppm.

Safety critical

When using ammonia as fuel, safety will be critical. Alfa Laval will deliver marine boiler systems designed to function as an ammonia release mitigation system (ARMS) for the safe incineration of ammonia waste. The system will be installed on four MGCs designed to transport LPG and ammonia.

“Alfa Laval’s innovative boiler technology, designed to operate as ARMS, tackles one of the critical technical hurdles impeding the wider adoption of ammonia, while prioritising the safety of the environment and crew,” said Trafigura global head of shipping, Andrea Olivi.

This boiler technology will not just generate steam but also efficiently incinerate gaseous ammonia and ammonia-nitrogen mixtures produced by ammonia dual-fuel engines, fuel supply systems and other equipment on board. This multi-functionality allows shipowners to reduce costs and save valuable space by minimising the need for additional equipment, while effectively managing waste and byproducts.

“LNG is anticipated to remain the most cost-effective fuel choice”

“The first commercial deployment of the ammonia-incinerating boiler system will serve as a model for future vessels, demonstrating ammonia can be used safely, while optimising vessel design and operational efficiency,” said HD Hyundai Mipo Initial Design Division and Detailed Design Division head, Dong-jin Lee.

Lloyd’s Register worked in a joint development project designing ammonia dual-fuel systems on Trafigura’s MGCs, completing an extensive design evaluation and safety assessment to approve the designs, in line with its rules and international regulations.

The two-stroke ammonia dual-fuel engines for Trafigura’s MGCs will be delivered to the South Korean shipbuilder between early 2027 to early 2028.

Technology-agnostic regulations

While WinGD is pleased that IMO has developed regulations that “give some boundaries”, Mr Schneiter says they need to be technology-agnostic, allowing for innovation and rapid development, and offered a straightforward solution.

“There is a dilemma in the regulation, and the solution would be very simple. Measure the performance on a drop-test parent engine, like NOx, with the same measurement cycle to measure greenhouse gas emissions, including CH4, methane slip, and N2O - laughing gas - from ammonia engines.”

IMO meets in October for MEPC’s extraordinary meeting, to formally adopt amendments to Marpol Annex VI that will enact the GFI standard and the global pricing mechanism. If approved, the IMO Net-Zero Framework would come into force by March 2027.

But Mr Schneiter would like to see the regulation refined before it is rolled out. “It will need iterations. I hope I speak for any innovative company that provides energy converted to ships, like engine designers or manufacturers. We really need to see what comes out of the funnel and not what’s written in a regulation book. IMO managed very well with NOx more than 10 years back. So why do we make it so complicated now? It could be so simple,” he concludes.

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.