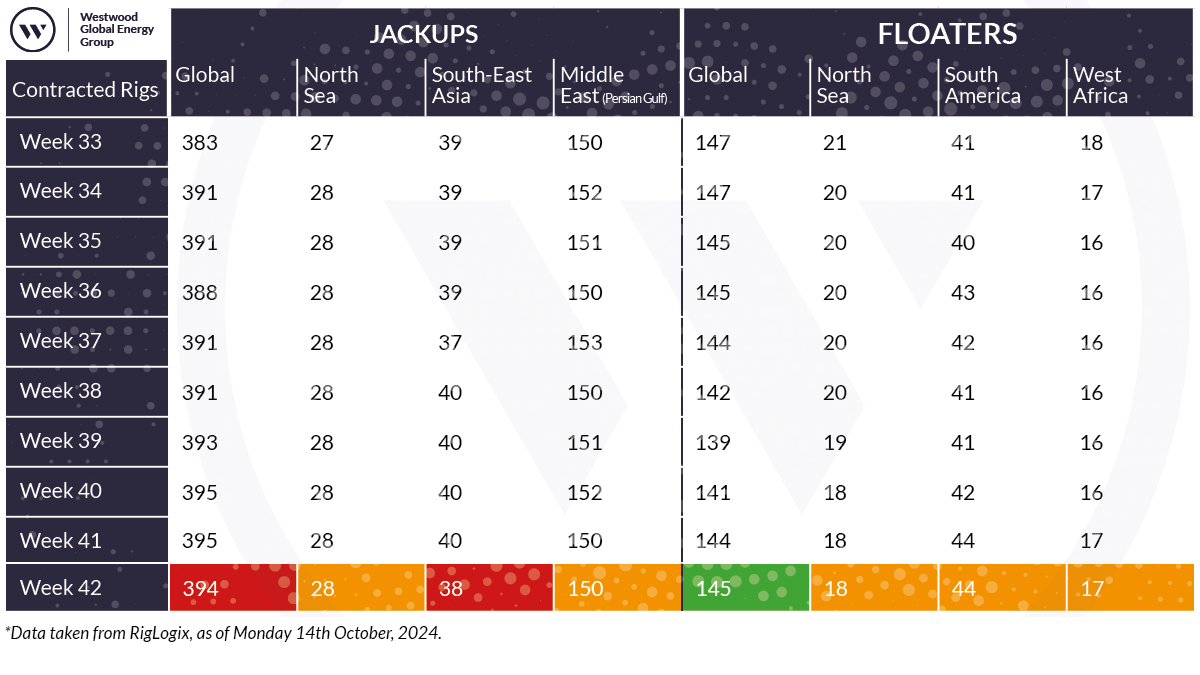

North Sea semisub awarded days in 2024 to-date has totalled a mere 1,468 days, with Norway accounting for 1,195 days, and the UK 273 days. The second lowest period of awarded days was 10 years ago when 2,930 days were awarded, with the best year in the last decade being 2023, when Norway awarded 7,158 days and the UK 3,524 days (totalling 10,682 days equating to 29.1 rig years).

Awarded North Sea Semisub Contract Days (2014-2024 YTD)

Source Westwood RigLogix

There are no outstanding semisub requirements in the North Sea with a 2024 start date, however RigLogix currently records four rig tenders (three in UK waters and one in Norwegian waters) pending award for work anticipated to commence in 2025 and 2026, totalling 910 days. Additionally, there is tentative demand totalling 13,803 days across the UK, Norway and Ireland.

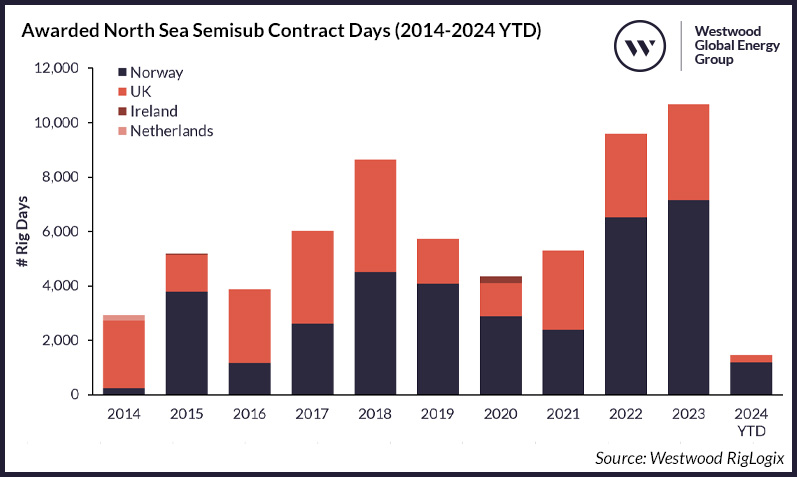

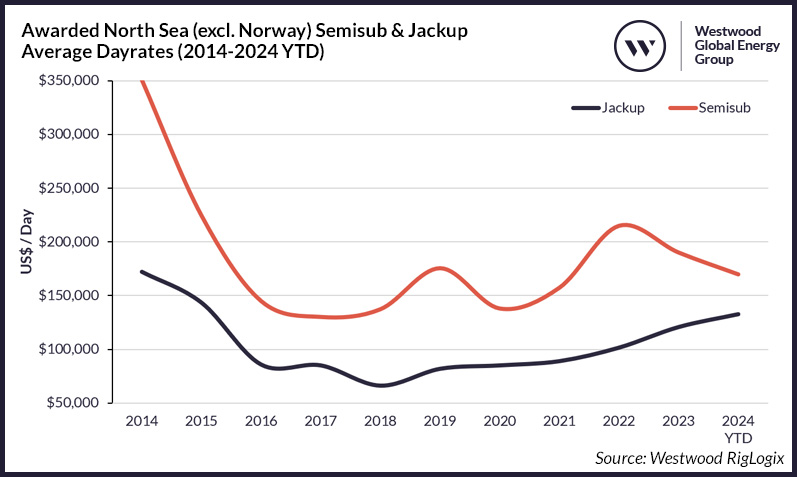

Excluding Norway (a niche market, commanding a premium compared with its British, Dutch and Danish counterparts), North Sea semisub dayrates are some of the least compelling globally and have been on a downward trajectory since 2022. In comparison, North Sea jackup dayrates have been on a slow and steady incline since 2018, currently sitting at an average of just over $132,000. Albeit – unlike North Sea rates fixed before the downturn in 2014 – they have not been market leading by any means.

Awarded North Sea (excl. Norway) Semisub & Jackup Average Dayrates (2014-2024 YTD)

Source Westwood RigLogix

Uncertainty continues to circle future demand

Demand for the UK North Sea is looking especially precarious due to the new Labour government and its stance on the issuing of new licences, as well as its revised tax regimes due to come into force from 1st November 2024, which includes the removal of the 29% investment allowance for qualifying expenditure incurred. There is also uncertainty in the short-term, pending the UK Autumn budget on 30th October 2024, on whether the capital allowance claims (tax relief) will continue and if so, to what extent. Several UK North Sea operators such as NEO Energy, Serica Energy, EnQuest, Jersey Oil & Gas and Hartshead Resources have been vocal about limiting or slowing down further investment in the region due to the new changes from government.

Additionally, environmentalist groups have been protesting new developments – Jackdaw and Rosebank – and recently the UK government did not challenge the judicial reviews on these. Although the licences have not been withdrawn, a cloud is now hanging over these projects, which if cancelled could see further rig contracts disappear.

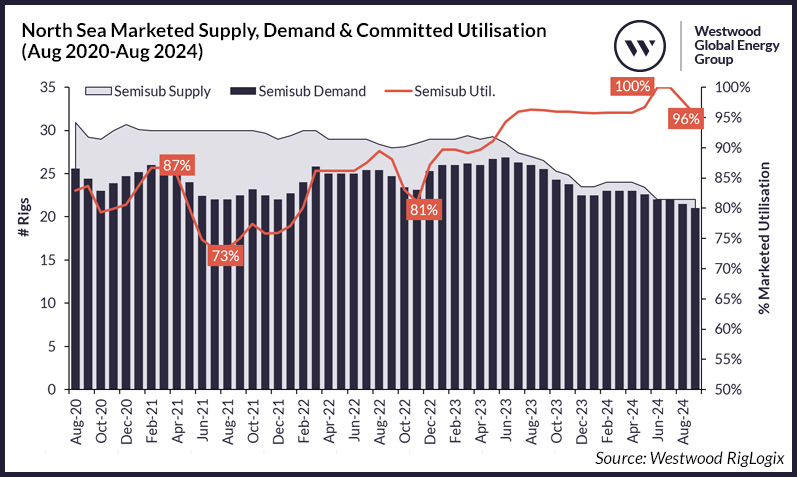

With no real or meaningful semisub demand, coupled with seven units potentially rolling off contract between 4Q 2024 and mid-2025, more units may be moved to cold stack, retired or relocated if the right opportunity presents itself. Westwood is aware of several drilling contractors with rigs currently located in Norway and the UK, that are bidding their assets into areas such as Southeast Asia, the Mediterranean, Africa and the Falkland Islands due to the limited outlook offshore Norway and the UK.

The UK North Sea has over 2,200 wells estimated to be plugged and abandoned (P&A) between 2024 and 2033, with 39% of these being subsea wells. Although this sounds like a great opportunity for drilling contractors, operators have been using every excuse in the book for years to defer – citing high rig dayrates as just one reason. Currently, only three harsh-environment third generation semisubs remain in the North Sea – Ocean Patriot, Well-Safe Guardian and Well-Safe Defender. This lower specification-design, along with fourth generation units, have long been seen as the “cheap and cheerful” brand of unit perfect for P&A work in UK Central North Sea waters. However, with little supply or competition we could very well see a spike in dayrates for these in the coming years.

North Sea Marketed Supply, Demand & Committed Utilisation (Aug 2020-Aug 2024)

Source Westwood RigLogix