Business Sectors

Events

Marine Coatings Webinar Week

Contents

Register to read more articles.

Greek owner Polembros tied to LR2 resale trio with early deliveries in China

Greek traditional shipowner Polembros Shipping has reportedly secured early delivery slots in China for the construction of three LR2 tankers

Shipbrokers reported in early May that Chinese shipbuilder Zhoushan Changhong had offered for sale three LR2 tankers, originally ordered by one of its own holding companies, with delivery scheduled for the second half of 2026.

Now, shipbrokers and market sources are linking Polembros Shipping to these resales, estimating the price per vessel at around US$66.5M. The company has been contacted for comment. Some sources also note that the deal has not yet been finalised, but suggest that its conclusion may be imminent.

Shipbroking sources suggest this pricing is highly competitive for LR2 newbuildings. In its latest weekly report, Xclusiv Shipbrokers noted the construction cost of an Aframax tanker in South Korea stands at around US$73.3M, while resale deals are being concluded at roughly US$74.0M.

If confirmed, this deal would mark a notable shift in recent Greek tanker ordering trends, which have largely favoured South Korean shipyards. Xclusiv Shipbrokers data shows that in the first four months of 2025, Greek shipowners placed 17 tanker orders – every one of them with South Korean builders. This trend has been largely driven by proposed US port fees and the uncertainty they created around Chinese-built tonnage.

In late April, Riviera reported that Chinese shipyards are expected to respond to heightened competition by offering even more attractive pricing than their South Korean rivals. Additionally, the latest revisions to the US port fee proposal – perceived as more moderate than earlier plans – may help revive Greek interest in Chinese newbuildings.

Fleet renewal strategy

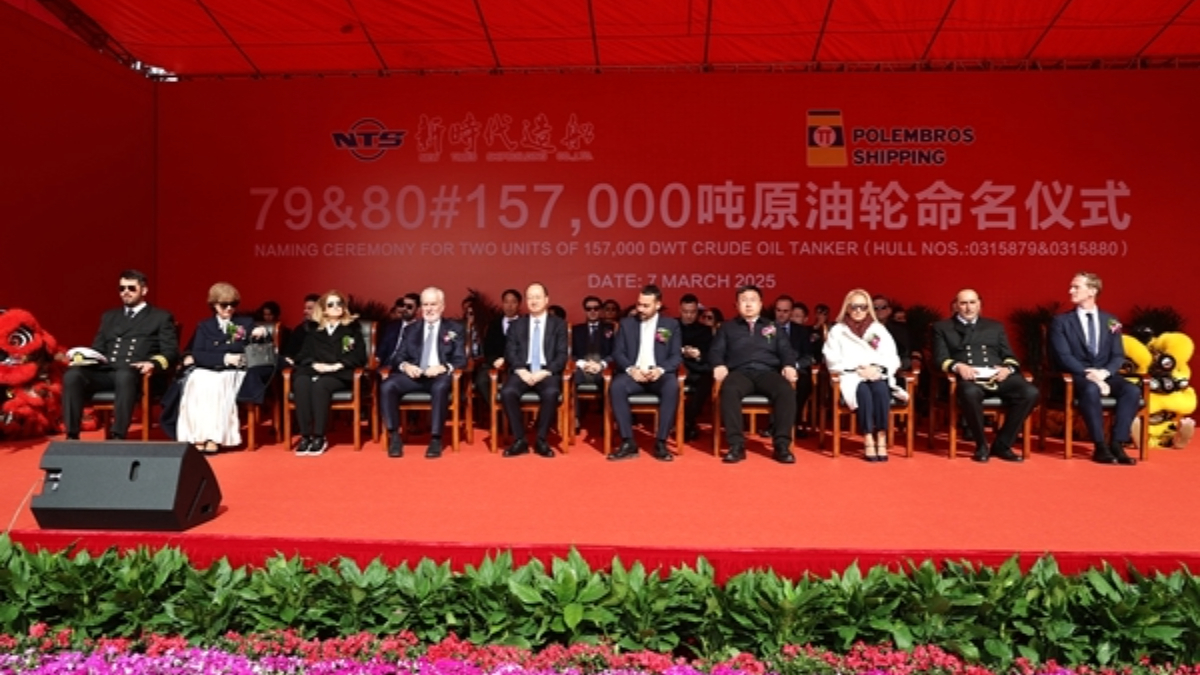

Polembros Shipping is actively renewing its fleet and has managed to secure early delivery slots amid tight shipyard capacity. The company is wrapping up a three-ship Suezmax newbuilding programme at China’s New Times Shipbuilding (NTS), based on an order placed in mid-2023. Two of the tankers have already been delivered, with the third expected to join the fleet by September.

NTS has emphasised the use of advanced energy-saving and emissions-reduction technologies in these tankers. Although conventionally fuelled, the ships are optimised for enhanced energy efficiency.

In parallel, Polembros is gradually modernising its dry bulk fleet through strategic secondhand acquisitions. Polembros Shipping currently manages a fleet of 14 tankers, including under-construction tonnage, while its bulk division, Polembros Bulkers, operates 13 vessels.

Riviera’s Tanker Shipping & Trade Webinar Week will be held from 30 June 2025. Click here to register for this free-to-attend event.

Related to this Story

Events

Marine Coatings Webinar Week

Maritime Environmental Protection Webinar Week

Ship Recycling Webinar Week

© 2024 Riviera Maritime Media Ltd.