Business Sectors

Contents

Register to read more articles.

Is shipping prepared for the ammonia transition?

If the toxicity can be tamed, ammonia could become a front runner as a source of energy for fuel cells and greener internal combustion engines

If the toxicity can be tamed, ammonia could become a front runner as a source of energy for fuel cells and greener internal combustion engines

Due to its high energy density and storage benefits over liquid hydrogen, ammonia is a potentially useful hydrogen carrier. Liquid hydrogen must be stored at -253˚C, compared to -33˚C for liquid ammonia.

In addition, ammonia is less flammable than hydrogen, making it a safer storage and transport medium for hydrogen, for subsequent use in fuel cells. The downside of ammonia is toxicity and the threat it poses to human health – a fundamental safety issue that all current and future projects must satisfy.

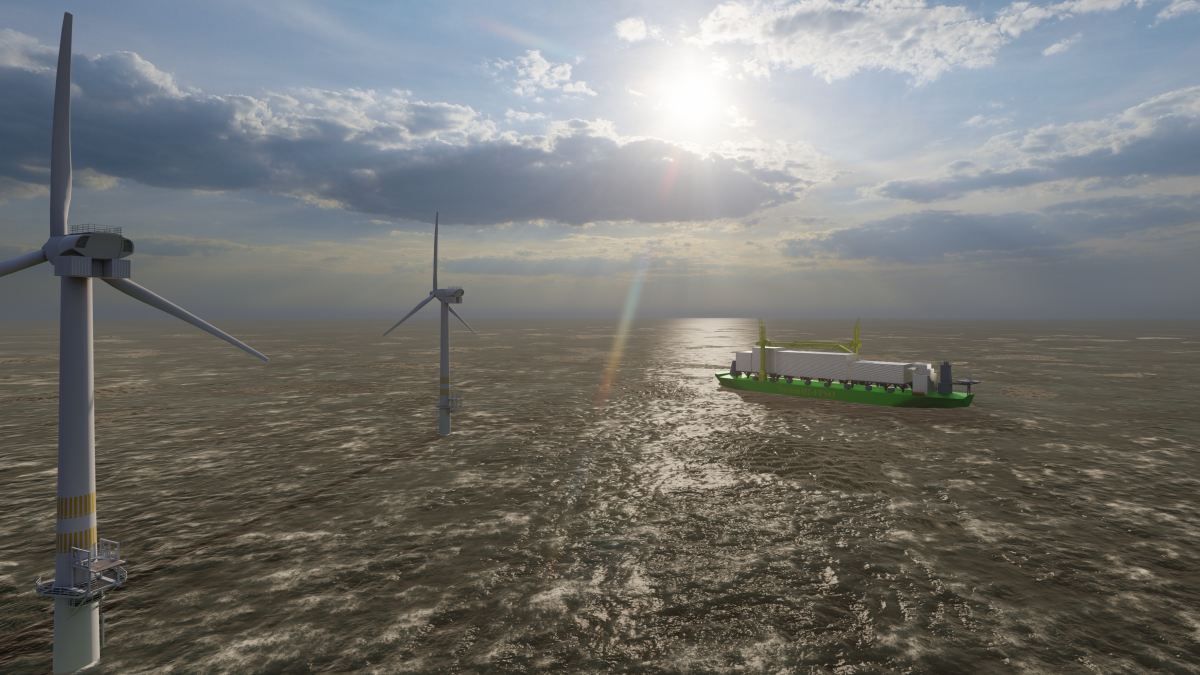

The number of shipping projects involving ammonia will continue to grow, in both number and variety, be that in internal combustion engines, as an energy source for fuel cells, or via sustainable production using wind power. An example of the latter is an industrial-scale concept for a floating production unit to produce green ammonia, which has secured Approval-in-Principle (AiP) from DNV, affirming the technical feasibility of the design.

The NH3 FPSO concept is being developed by Netherland-based SwitchH2 BV and Norway-based BW Offshore and will be built through the conversion of an existing VLCC, or a dedicated newbuild vessel. Receiving power primarily from a windfarm, the unit will produce hydrogen by the electrolysis of seawater and nitrogen, through the use of an air separation unit, combining these in an ammonia synthesis unit.

The ammonia gas produced by the unit will be condensed, and the liquid ammonia will be stored in the hull, to be subsequently offloaded to an ammonia carrier. The NH3 FPSO will be permanently moored, but can be relocated as necessary through a planned disconnect. The offloading will be done through a floating hose, reeled from the aft ship to the ammonia carrier shuttle midship manifold.

The largest collaborative project involving ammonia in the shipping space is the Castor Initiative, established in 2020. This is a global coalition which includes MISC Berhad, Lloyd’s Register, Samsung Heavy Industries, MAN Energy Solutions, the Maritime and Port Authority of Singapore, Yara Clean Ammonia and Jurong Port.

In December 2022, TotalEnergies joined the project and its senior vice president shipping, Jérôme Cousin, said: “Among various decarbonised marine fuel alternatives, ammonia could rapidly become a viable solution in the maritime sector. Challenges remain to be addressed, in particular on the safety aspects. We are therefore enthusiastic to join the Castor initiative, one of the most comprehensive and ambitious projects dealing with ammonia as a fuel today.”

Yara Clean Ammonia director for bunkering port relationships and regulations, Tessa Major, said that legislation will drive the adoption of ammonia: “Towards 2050, the majority of the clean ammonia will go to the shipping industry because of the IMO legislation and EU taxation.”

| A selection of ammonia-as-a-cargo or fuel projects | ||||

| No | Project | Participants | Technology | Vessel Type |

| 1 | NH3 FPSO | SwitchH2 BV, BW Offshore (Norway), DNV | Ammonia production at sea | FPSO |

| 2 | Castor Initiative | TotalEnergies, MISC, LR, Samsung HI, MAN ES, MPA, Yara Clean Ammonia, Jurong Port | Fuell cell and ICE | Tankers |

| 3 | Yara Clean Ammonia | Yara Marine | Fuel cell | All |

| 4 | MPA | Singapore MPA and Energy Market Authority | Production, bunkering | All |

| 5 | IRA initiatives | US IRA Act, First Ammonia, Topsoe, Air Products, Mabanaft | Green ammonia | All |

| 6 | Hamburg terminal | Air Products, Mabanaft (Oiltanking) | Ammonia import terminal | All |

| 7 | Pilot-E programme | Amon Maritime, Viridis Bulk Carriers | Ammonia as a fuel | Bulk carriers |

| 8 | ABGC DMCC | Energy trader BGN and Abu Dhabi-listed Al Seer Marine | Ammonia as a cargo | Gas carrier |

| 9 | Amore Mio | Capital Ship Management Corp: two VLCCs | Ammonia-ready | VLCC |

| 10 | ONE | Ocean Network Express (ONE) order for 10 ammonia-ready vessels | Ammonia as a fuel | Container ships |

| 11 | Bunker project | Yara International and Azane Fuel Solutions | Ammonia as a fuel | Bunkering |

| 12 | ONE | One Network Express (ONE) ten 13,700 TEU container ships | Ammonia-ready | Container ships |

| 13 | Aurora | Höegh Autoliners | Ammonia-ready | PCTC |

| 14 | Tennor Ocean | Flensburger shipyard, IVP Ship Invest (owner) | Ammonia-ready | RoRo |

| 15 | PIL | Pacific International Line, Yangzijiang Shipbuilding: four 8,000-TEU, four 14,000-TEU | Ammonia-ready | Container ships |

| 16 | CALM buoy | Imodco (SBM Offshore Group), dnv | Ammonia infrastructure | All |

| 17 | WinGD CMB.Tech | WinGD and CMB.Tech devoping ammonia version of 2-stroke WinGD X72DF engine | Ammonia-ready ICE | Bulk carriers |

| 18 | MAN ES engine | MAN ES ammonia fuel engine being tested | Ammonia-ready ICE | All |

| 19 | Hong Lam Marine | Hong Lam Marine, PaxOcean Engineering, Bureau Veritas | Bunkering | All |

| 20 | Wärtsilä 25 | New Wärtsilä 25 is will be ammonia-ready | Ammonia-ready ICE | All |

| Source: Various. March 2023 | ||||

Logistics

Ammonia as a marine fuel will require a new infrastructure, demanding national-level involvement. In Singapore, the Energy Market Authority and MPA issued an expression-of-interest (EOI) to build, own and operate low- or zero-carbon power generation and bunkering solutions in Jurong Island.

Through the EOI, the Singapore governmental agencies want to explore the use of hydrogen and ammonia for power generation, alongside other low-carbon alternatives, such as electricity imports and domestic renewable energy sources. Low- or zero-carbon ammonia may also have multiple end-use pathways for power generation and bunkering.

“Ammonia could rapidly become a viable solution in the maritime sector”

MPA chief executive Teo Eng Dih said: “MPA hopes to partner with those who are committed to building up the global supply chain for low- or zero-carbon fuels, including ammonia, with Singapore as a key bunkering hub.” Parties interested in responding to the EOI have until 30 April 2023 to submit their proposals.

In North America, the US Inflation Reduction Act (IRA), introduced in August 2022, set in motion the single largest investment in climate and energy in American history, with US$369Bn in tax incentives for green energy investments. Some companies, like New York-based First Ammonia, have seized the initiative. “The IRA now trumps all other places to invest,” said its global head of engineering, Ralf Schaaf.

“We are now pushing forward with our plants in the US, starting with one of the world’s largest green ammonia production facilities in Texas, with 300 MW capacity as a start, supported by the tax credit,” he said.

First Ammonia’s plants will be pioneering the use of solid oxide electrolyser cell (SOEC) technology, built by Danish manufacturer Topsoe, to produce green ammonia on a commercial scale.

In Europe, Air Products and Mabanaft are participating in a German state project to build the first green ammonia import terminal in Hamburg. From 2026, the terminal will import green ammonia from Saudi Arabia. Air Products will produce the ammonia and distribute it to end users in Germany, mostly for conversion into hydrogen. Mabanaft’s Oiltanking will run the terminal.

“In 2022, there were 90 newbuilding orders for ammonia-ready tonnage”

In another example of state collaboration, this time in Norway, Amon Maritime’s ammonia-powered shipping joint venture, Viridis Bulk Carriers, and its consortium partners, have been awarded development funding from the Norwegian Pilot-E programme to build ammonia-powered vessels.

Amon Maritime chief executive Andre Risholm described the company as the world’s first carbon-free shipping company. “We are working both on the infrastructure side, for building bunkering terminals, and on the ship side, as a consumer of ammonia fuel, where we will be an owner/operator ourselves,” he said.

A joint venture between energy trader BGN and Abu Dhabi-listed Al Seer Marine, has purchased two LPG newbuilds and a new LPG/ammonia gas carrier for transporting LPG globally. The Middle Eastern energy transport company joint venture, ABGC DMCC, purchased two 88,000-m3 carriers from South Korea’s Hyundai Samho Heavy Industry (HSHI) and an 86,700-m3 LPG/NH3 carrier from Japan’s Kawasaki Heavy Industries. These Very Large Gas Carriers will all be LPG dual-fuel-powered and are due for delivery in Q4 2025 and Q1 2026.

‘Ammonia-ready’ has become a popular term for newbuildings that have been constructed with a classification society notification of ‘ammonia-ready’. It means the vessel has been constructed with space and facilities in place to be converted to dual-fuel ammonia power. According to Clarksons Research Services, in 2022, there were 90 newbuilding orders across all vessel types for ammonia-ready tonnage, which is equivalent to around 10% of all new contracts placed (7.7M gt).

The tanker fleet is already receiving ammonia-ready vessels. In August 2022, Capital Ship Management Corp received the 300,000-dwt VLCC newbuilding Amore Mio from Hyundai Samho Heavy Industries. This is the first of two ammonia-/LNG-ready VLCCs for the group, with the second, Alterego, delivered in October 2022.

Related to this Story

Events

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.