Business Sectors

Events

Contents

Register to read more articles.

Medium-range tankers for the longer term

DNV’s latest Maritime Forecast to 2050 report aims to answer the alternative fuel usage question, while ABS’s Beyond the Horizon offers views on the future composition of the tanker fleet

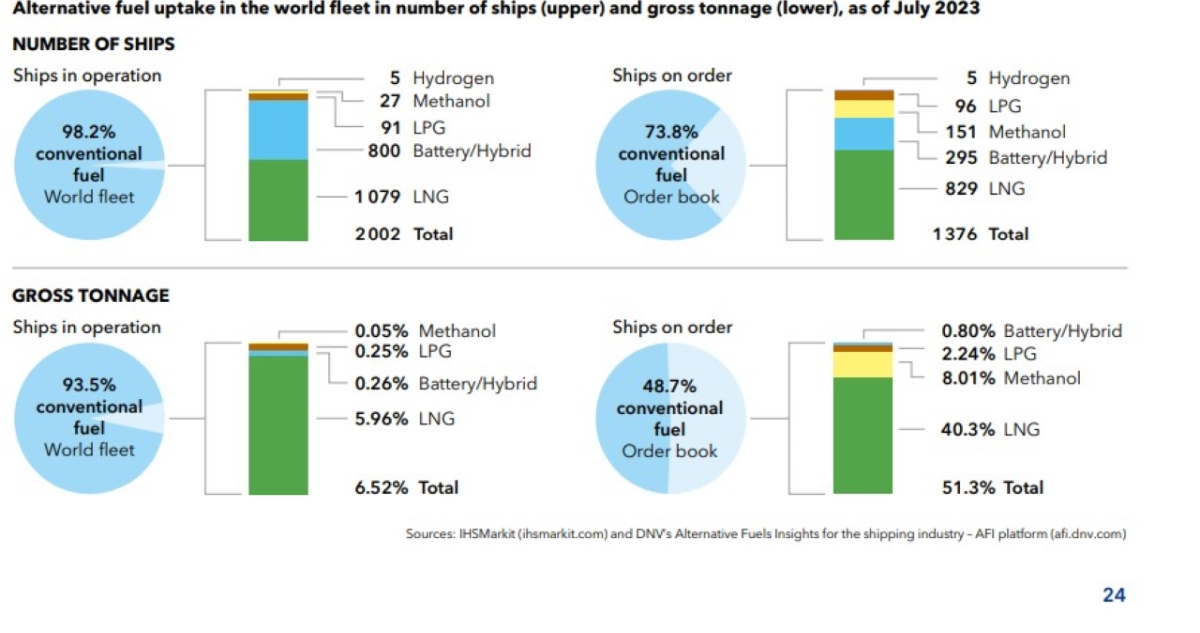

DNV’s Energy Transition Outlook 2023 Maritime Forecast to 2050 presents a comprehensive analysis of the global shipping industry, focusing on the adoption of alternative fuel technologies. The report examines the current status of the world fleet and order book, shedding light on the increasing implementation of LNG as the preferred alternative fuel choice.

LNG stands out as the most prominent alternative fuel technology, frequently utilised in dual-fuel solutions alongside traditional fuel oil. Notably, there has been a significant rise in the number of ships capable of utilising methanol as fuel in dual-fuel systems. In fact, the gross tonnage of LNG-fuelled ships on order, excluding LNG carriers, is more than twice the amount present in the existing fleet. Furthermore, the order book for ships equipped with methanol fuel amounts to 20 times the gross tonnage of currently operating methanol-fuelled vessels. These figures indicate a persistent trend observed in last year’s DNV Maritime Forecast, wherein larger ships with alternative fuel propulsion are increasingly favoured.

The demand for LNG as a fuel is particularly noteworthy in the car carrier and containership segments, with 133 and 196 ships on order respectively. Additionally, there has been a noteworthy surge in the utilisation of LNG for tankers and bulk carriers, with 83 and 39 ships, respectively. Out of the total 1,376 ships currently on order with alternative fuel capability, 306 are LNG-fuelled LNG carriers, 523 are other types of LNG-fuelled ships, and 295 employ battery/hybrid propulsion.

“The orderbook for ships equipped with methanol fuel amounts to 20 times the gross tonnage of currently operating methanol-fuelled vessels”

While methanol was historically selected exclusively for tankers engaged in the methanol trade, this year’s report showcases a significant shift. The containership segment emerges as the dominant sector, with a remarkable 142 ships on order possessing the capacity to utilize methanol as fuel. Presently, 72 LPG carriers are using LPG as fuel, while an additional 93 LPG carriers and four ethane carriers have been ordered with LPG-burning capability.

In terms of fuel profiles, alternative fuels (including LNG carriers) can power 6.5% of the ships in operation, a notable increase from last year’s figure of 5.5%. Furthermore, 51% of ships on order have the capability to operate on alternative fuels, compared to the previous year’s statistic of 33%. By analysing the number of ships, this year’s figures stand at 1.8% in operation and 26% on order, with 1,376 out of 5,258 ships ordered possessing alternative fuel capability.

When examining the number of ships, it becomes evident that the uptake of alternative fuel technologies is predominantly driven by battery/hybrid and LNG-fuelled vessels. However, when considering gross tonnage, LNG fuel emerges as the dominant choice, indicating that battery/hybrid solutions are commonly implemented on smaller vessels. Out of the 1,079 ships currently operating on LNG fuel, 659 are LNG carriers, while the remaining 420 comprise other ship types, as highlighted by DNV in the report.

ABS, a leading authority in maritime and offshore classification services, presents a compelling view of the emerging energy value chains that are reshaping the industry.

The global demand for oil has seen remarkable growth, with a 2.3% year-on-year increase in 2022, and an anticipated further growth of 2.4% in 2023. However, this surge will be short-lived as alternative energy solutions steadily gain traction. The transportation sector, in particular, is witnessing a rapid transition towards electrification and hybrid technologies, resulting in a significant decline in the demand for oil. Additionally, the power sector is under pressure to shift towards renewable energy sources, straining oil demand from this domain.

Looking ahead, ABS forecasts that crude oil seaborne trade will reach its peak, followed by a swifter decline compared to seaborne trade for oil-based products. This divergence is a consequence of the disparity between supply and demand in refining points. Refining capacity in North America and Europe is projected to dwindle by 2050, while oil-producing regions seek to diversify and increase capacity for refined products and petrochemicals. This strategic move up the value chain empowers refiners to capture a substantial share of refining margins.

“The year 2025 is projected to witness the highest HFO equivalent level, before steadily decreasing towards 2050”

Moving forward to 2050, ABS anticipates that oil-based marine fuels, equivalent to heavy fuel oil (HFO), will account for approximately 10% of the oil and chemical tanker market fuel mix. The year 2025 is projected to witness the highest HFO equivalent level before steadily decreasing towards 2050. From 2040 onwards, fuel consumption is expected to be predominantly driven by ammonia, methanol, and hydrogen. The transition towards these alternative fuels is fuelled by the growing availability of sustainable energy options.

With respect to the tanker fleet, ABS predicts a decline due to the peak and subsequent decrease in global oil demand, the rise of alternative energy sources, and the associated geopolitical risks linked to oil production. The aggregate share of oil and chemical tankers, as well as dry bulk carriers, is forecasted to decrease from 64% of the fleet in 2022 to 45% in 2050; a demand shift that entails a greater focus on smaller vessels, such as medium-range tankers. However, it is worth noting that the adoption of alternative fuels has been relatively slower in sectors that employ small tankers and bulkers.

| ABS: Impact of Energy Efficient Technology on Tankers | ||

| Energy Saving Devices | Existing Fleet | Orderbook |

| Air lubrication system | 0.04% | |

| Hull Fin | 0.50% | 0.50% |

| Bow Enhancement | 0.40% | 1.90% |

| Propeller Boss Cap Fin (PBCF) | 0.90% | 3.90% |

| Propeller Duct | 4.30% | 3.20% |

| Wake Equalizing Duct | 0.70% | 0.70% |

| Stator Fin — Pre Swirl | 0.90% | 1.50% |

| Rubber Bulb | 2.00% | 10.50% |

| Rudder Fin | 0.20% | |

| Solar Panel | 0.01% | |

| Wind, Flettner Rotor | 0.01% | |

| Wind, Rigid Sail | 0.01% | |

| Exhaust Gas Economiser | 5.00% | 2.40% |

| Waste Heat Recovery System | 0.02% | 1.00% |

| Data Source: Clarkson’s Research — World Fleet Register — August 2, 2023 | ||

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.