Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Dry bulk spot markets soften on seasonality

Clarksons’ data showed weaker Capesize and overall bulker spot earnings, while Panamax routes remained mixed across Atlantic and Pacific basins

“Bulker markets continue to soften seasonally”, noted Clarksons in its latest Shipping Intelligence Weekly.

Average Capesize earnings dropped a further 13% to US$19,769 per day after activity dried up in the Pacific, while average bulker earnings fell to US$12,867 per day – “a 6-month low”, it noted.

In its weekly trip charter assessment, Clarksons’ Capesize average earnings line showed US$26,096 per day for the latest week, down 13% week-on-week, with weakness most acute on Far East-Continent, where the quoted daily rate fell 50% to US$7,500.

Transpacific returns also eased, with Clarksons’ table showing US$19,140 per day, down 15% week-on-week, while Transatlantic round voyages softened to US$28,340 per day, down 18%.

Panamax indicators were mixed, with Clarksons’ estimates showing Continent-Far East at US$18,000 per day, up 3% week-on-week, while Transpacific round voyages fell 9% to US$10,500 per day and Transatlantic round voyages fell 9% to US$11,400 per day. Indonesia-South China round voyages, in contrast, were the only quoted Panamax lane to strengthen, rising 6% to US$9,000 per day.

FFA indications also pointed to a paper market that, at the time of publication, priced a higher Panamax time charter average for Q2 2026 than for January 2026, while Cape time charter average indications for the same periods remained below the 2024 reference figure shown on the page.

On the contracting side, BRL noted that “deliveries … are growing into 2032” and “this week, we uncovered another 45 orders”.

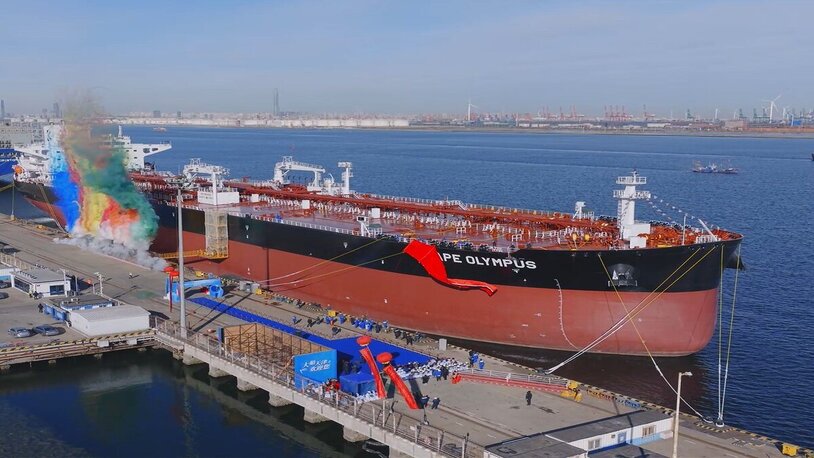

Within its listings, BRL also wrote that Mercuria Energy had “committed” four Newcastlemax bulk carriers, and recorded options retained by Mercuria Energy Trading at Nantong Xiangyang Shipbuilding for two 211,000-dwt Capesize bulk carriers, stating two had already been ordered and the ships will use conventional fuel.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

NZF delay: what next for IMO’s headline policy?

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.