Business Sectors

Contents

Register to read more articles.

Mediterranean carbon capture and storage close to start of operations

Prinos, APOLLOCO2 and Callisto initiatives highlight maritime terminals’ role in delivering captured CO2 across borders to stockage facilities

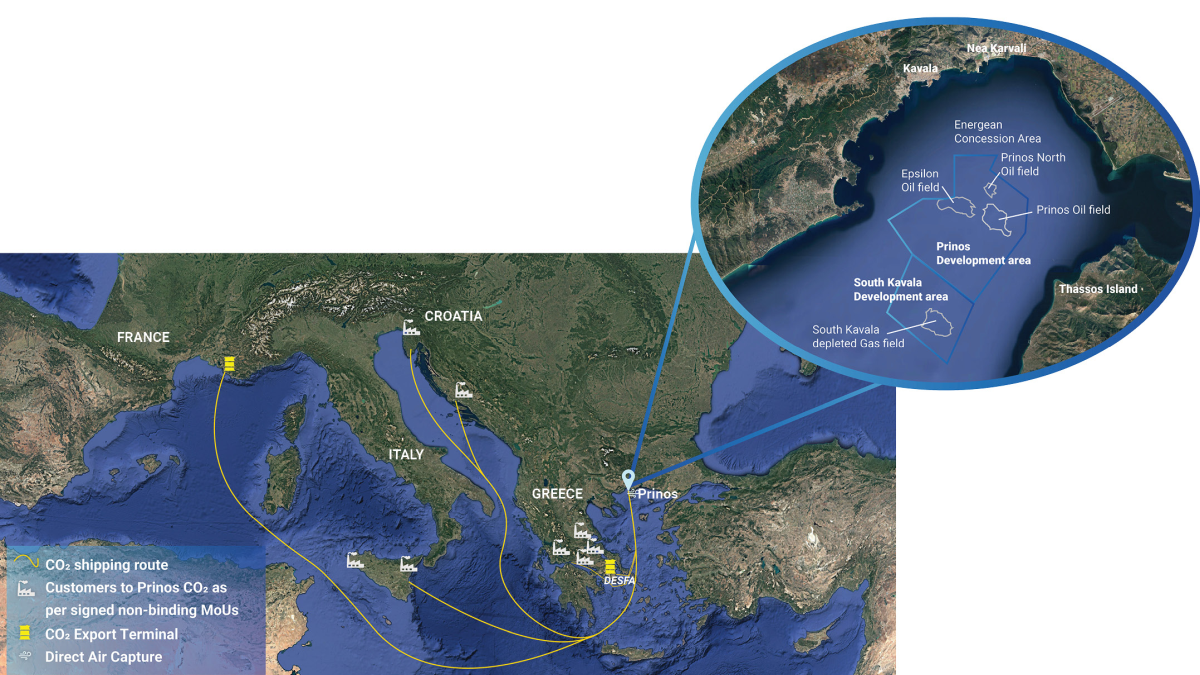

The eastern Mediterranean is emerging as a focal point for carbon capture and storage (CCS) development as projects connect dispersed capture sites and limited storage locations. In Greece, the Prinos CO2 Storage Project, led by EnEarth (an Energean subsidiary), is positioning itself as the region’s first full-scale storage hub. To the west, Italy’s Ravenna CCS facility anchors the Callisto Mediterranean CO2 network, while ECOLOG’s APOLLOCO2 concept offers a complementary hub model centred on Attica. Combined, these ventures underline the importance of EU-backed infrastructure, regulatory harmonisation and port connectivity to overcome pipeline constraints. These developments follow the pioneering Northern Lights JV, which has begun storing CO2 beneath the Norwegian North Sea.

Prinos CO2 Storage exploits a depleted oil field in northern Greece for permanent sequestration. Dr Pantelis Vogiatzis, project director, speaking at Riviera’s CO2 Shipping, Terminals & CCS Conference in Milan, which took place on 8 September 2025, said: “Prinos represents the only known CO2 storage in Greece; it is one of just two storage options in southern Europe, alongside Ravenna.” This highlights the facility’s unique status.

A Competent Person Report by the National Standards Authority of Ireland, an independent third-party assessment, confirmed a contingent storage capacity of 66.4MT CO2, providing confidence in long-term volume requirements. The project is included in both the first and second European Union lists of Projects of Common Interest (PCI), and 15 non-binding memoranda of understanding with emitters represent over 6M tonnes per annum (mtpa) of potential supply.

Critically, Prinos CO2 will receive both compressed and liquefied streams. This reflects a flexible approach to maritime delivery. A new jetty and six spherical buffer tanks will accommodate vessels carrying up to 30,000-m³ of liquid CO2, before onshore heating and pumping inject the supercritical fluid more than 4,000 m below the seabed. In outlining the commercial model, Dr Vogiatzis noted that the facility will use a cost-plus tariff model, offering firm capacity contracts for up to 15 years and allowing emitters to choose between direct shipment or aggregator services.

While Prinos leads in the east, southern Europe’s broader CCS ambitions coalesce around the Callisto Mediterranean CO2 network, which designates Ravenna as its reference storage hub. At the same conference, Eni’s head of CCS business development, Luca Rossi, described Ravenna CCS as “an infrastructure for gathering multimodal transport offshore and permanently storing CO2 in the depleted gas reservoirs operated by Eni in the Adriatic Sea,” emphasising its role in a region where saline aquifers and hydrocarbon fields are scarce.

Phase 1 of Ravenna began injecting CO2 in August 2024, repurposing existing offshore installations to accelerate delivery. With an overall potential of 500M tonnes and more than 30 non-binding agreements. Totaling 31 mtpa of interest, Ravenna is developing a logistics hub in the industrial area of Ravenna to receive shipments by ship, train and truck, and will vaporise the liquid CO2, and pump it onshore to compression and pipeline facilities.

The Callisto network’s inclusion in the EU’s PCI list makes it eligible for Connecting Europe Facility funding, while Italy’s reforms to permit large-scale storage authorisations and define CO2 transport rules provide a clearer regulatory framework. By 2030, Ravenna CCS phase 2 plans to ramp up to 4 mtpa with future expansions targeting at least 16 mtpa, contributing to the Net‑Zero Industry Act target of 50 mtpa of EU storage capacity.

Between these anchors, ECOLOG’s APOLLOCO2 hub in Greece offers an integrated aggregation model. Jasper Heikens, chief commercial officer, noted in Milan that in Attica — extending from the Saronic Gulf islands to the Parnitha and Pentelicus mountains — “the industrial cluster sits south in Attica, with roughly 10–15 million tonnes of CO2 in that region,” suggesting benefits from a shared terminal.

APOLLOCO2 plans a floating liquefaction and export terminal adjacent to the Revithoussa LNG import site, leveraging existing port infrastructure. A 230 km pipeline network would collect CO2, deliver it to a 30,000 m³ floating liquefier and storage vessel, then dispatch larger carriers to offshore storage sites such as Ravenna or Prinos. The unit’s onboard redundancy and modular liquefaction trains would allow staged expansion without dry-dock delays, while studies into pressure-interface compatibility aim to lower market-entry barriers.

Despite differing national geographies, these projects share common hurdles. The limited number of Mediterranean storage sites forces emitters to choose between distant sinks, potentially creating inequities in allocation and cost. APOLLOCO2 and Prinos both call for EU funding mechanisms to underpin commercial viability. Meanwhile, Callisto’s cross-border mandate demands regulatory alignment across member states to permit CO2 export and maintain emissions accounting within the EEA. Ports must also upgrade facilities — such as jetties capable of handling liquid CO2 carriers and onshore buffer storage tanks — to link capture clusters with maritime routes.

The Northern Lights JV offers a valuable precedent. It announced that the first CO2 volumes have been transported through its 100 km pipeline and injected into the Aurora reservoir, 2,600 m beneath the seabed of the Norwegian North Sea, showing that shipping-led models can synchronise national facilities and deliver reliable sequestration. The venture, owned by Equinor, TotalEnergies and Shell, is expanding from 1.5 mtpa to at least 5 mtpa under a Connecting Europe Facility grant, with planned volumes from Denmark and the Netherlands in 2026.

As the Mediterranean strives to emulate this blueprint, co-ordination among EU institutions, national regulators and port authorities will be paramount. The emerging network of Prinos, APOLLOCO2 and Ravenna, supported by Northern Lights’ proven operations, could form the maritime backbone linking hard-to-abate industries with long-term storage solutions. With first injections under way in Norway, followed by Greece and Italy, 2025 may be remembered as the year maritime shipping underpinned regional-scale carbon management.

Riviera’s Tankers 2030 Conference, Singapore will be held 19-20 November 2025. Use this link to register your interest and attend the event.

Related to this Story

Orderbook tilts to alternative fuels as deliveries rise

Events

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

Marine Coatings Webinar Week

© 2024 Riviera Maritime Media Ltd.