Business Sectors

Contents

Register to read more articles.

Methanol fuel: preparing ships for a green-fuels future

Stringent environmental regulations are required from IMO to encourage investment in newbuild ships to run on green methanol

Despite the rising number of ships being built ready to use methanol fuel, there still needs to be a collaborative drive by industry and regulators to support maritime through the transition to alternative fuels.

Methanol is seen widely as a transition fuel, enabling owners to reduce greenhouse gases (GHG) and other emissions such as particulates and NOx, in ports without increasing methane slippage levels, but its wide adoption needs stringent environmental regulations.

An expert panel considered what is required from regulators and shipowners for methanol to become a fuel of choice during Riviera Maritime Media’s Methanol’s moment: navigating shipping’s fuel shift webinar, which was held on 9 April 2025 during Riveria’s

Methanol Institute senior advisor on marine affairs Kjeld Aabo, UMAS International senior consultant Deniz Aymer and Royal IHC senior specialist for research and development, Benny Mestemaker.

They discussed methanol’s adoption, future fuel options, challenges in designing, building and owning methanol-ready vessels and future retrofit issues.

Mr Aabo said there is a lot of interest in producing biomethanol and e-methanol, with around 170 production projects being considered or in development with significant volumes starting to be produced from 2026-27 onwards. These projects are based in North America, Europe, India and East Asia.

“Not all will happen, but it is becoming more acceptable to use bio or e-methanol,” said Mr Aabo.

More than 50 green corridors are also being implemented where bunkering options are planned for ships operating on alternative fuels, linking nations along Pacific coasts, Scandinavia and within the Silk Alliance and in Singapore.

Mr Aabo also said new technology is enabling hundreds of vessels to use methanol now.

According to Clarkson Research data, 54 vessels in the global fleet are prepared to use methanol fuel, or burn this low-carbon fuel, and 304 ships on the global newbuilding orderbook are being built to run on methanol fuel. These include most ship types, such as container ships, bulk carriers, product tankers, vehicle carriers and a few offshore support vessels, tugboats and other workboats.

The top five shipowners investing in methanol-ready ships are Evergreen Marine, ONE, Maersk Line, CMA CGM, COSCO Shipping Lines.

When looking at ships being built ready to be converted to use methanol fuels, there were 121 ships in the current fleet and 586 on order in March 2025, according to Clarksons.

“The transition will take a long time, but there are over 150 vessels with methanol engines and many more to come and many green and biomethanol projects planned,” said Mr Aabo.

Ms Aymer analysed how regulations impact maritime fuel choices, with IMO and the European Union the main drivers of shipping’s transition.

Regulations broadly work on two levels, with legislation influencing fuel standards and the price of greenhouse gas emissions. These include the EU’s FuelEU Maritime and emissions trading scheme (EU ETS) and similar planned regulations from IMO, which are all expected to encourage shipowners to adopt low-carbon or zero-carbon fuels in the long term.

As Ms Aymer said the idea is to enable the fuels “with the lowest abatement costs to become the cheapest.” She said, “Carbon pricing and fuel standards are being phased in” which would enable ships to use different fuels if available, or owners to trade credits, or borrow against a future surplus.

“Owners can use large volumes of low-cost fuels with marginal emissions savings, such as LNG, use small volumes of high-cost fuels with much lower emissions, or pay to pollute,” said Ms Aymer. She spoke about total cost of ownership to compare fuels and the corresponding FuelEU and EU ETS penalties.

Reward factors could also be introduced by the EU and IMO, to make e-fuels more commercially viable and competitive.

“The EU provides introductory pathways for IMO regulations, so people get used to compliance and paying,” said Ms Aymer. “IMO’s decisions will be critical, but carbon tax is not a panacea. The fuel standard will drive the adoption of alternative fuels.”

Ship design and retrofits

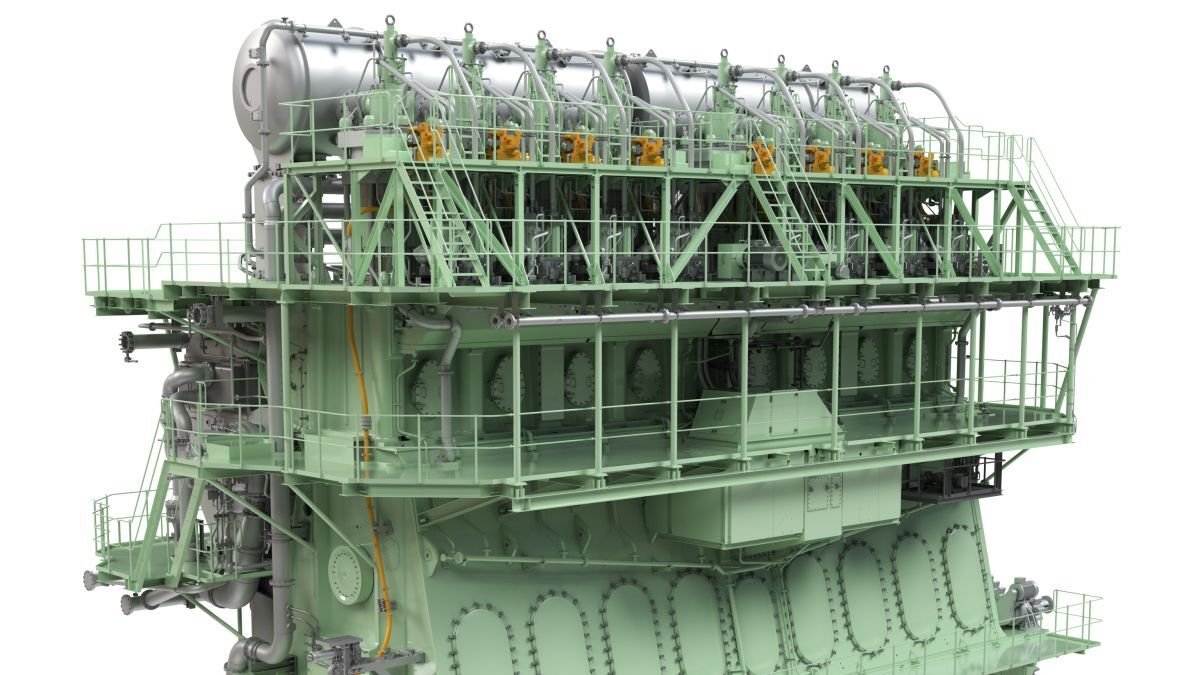

IHC’s Mr Mestemaker said vessel owners need to build vessels ready to use alternative fuels as this reduces the cost of a later conversion to methanol.

He sees methanol as a key future fuel for offshore support vessels, workboats, dredgers and naval ships due to their operating profiles, compact size, space limitations for fuel storage and operational flexibility.

A fuel’s energy density dictates how much needs to be stored on board vessels for operations between bunkering. “We are transitioning to fuels with less energy density that need more storage tank space, and we need to deal with low flashpoint fuels or gases, with various levels of toxicity,” said Mr Mestemaker.

Methanol has some advantages over other fuels, except diesel, such as its relatively high energy density, low toxicity and being able to dissolve in water.

“Owners need to decide in the design phase and prepare ships for the future,” said Mr Mestemaker. “As it is difficult and expensive to retrofit ships to methanol, so preparing vessel as they are built means less hassle in a drydock for the conversion.”

Ships have an operating life of 25-30 years, which means those built this decade could still be operating beyond 2050 when the shipping industry is aiming to be net zero.

“We need to prepare ships to run on a mixture of fuels. Investments now will mean less costly retrofits in the future,” said Mr Mestemaker.

Webinar poll results

Attendees were asked to vote on a series of poll questions during the webinar. Here is a summary of the results.

Which segment of the shipping industry will see the greatest uptake of methanol as a marine fuel by 2050?

Container ships: 58%

Tankers (chemical/product carriers): 20%

Cruise vessels: 18%

Dry bulk vessels: 4%

What do you see as the most likely future for the use of methanol (bio and e-methanol) as a bunker fuel?

Utilised in niche use cases with limited exposure across shipping sectors: 12%

Cross-sector adoption but use concentrated geographically: 33%

Broad global adoption from mid-2020s: 5%

Broad global adoption from mid-2030s: 40%

Broad global adoption from mid-2040s: 10%

What do you think will be the most important factor in encouraging low-emissions fuel uptake in Europe?

Demand from customers or cargo owners: 15%

FuelEU Maritime: 29%

EU ETS: 15%

IMO mid-term measures: 25%

Policies by national governments: 16%

When do you expect green methanol to be financially attractive as a fuel?

Now (2025): 1%

2030: 15%

2035: 25%

2040: 17%

2045: 15%

2050: 5%

Second half of this century: 11%

Never: 11%

Which two fuels do you believe will dominate the marine industry in 2050?

LNG (with methane slip mitigation) and e-methanol: 36%

E-ammonia and hydrogen: 3%

Biofuels and synthetic fuels (e-fuels): 7%

LNG (with methane slip mitigation) and e-ammonia: 16%

Biofuels and e-methanol: 7%

Hydrogen and synthetic fuels (e-fuels): 8%

E-methanol and e-ammonia: 23%

(source: Riviera Maritime Media)

On the panel of Riviera’s Methanol’s moment: navigating shipping’s fuel shift webinar were (left to right): Methanol Institute senior advisor on marine affairs Kjeld Aabo, Royal IHC senior specialist for research and development, Benny Mestemake and UMAS International senior consultant Deniz Aymer.

Related to this Story

Events

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.