Business Sectors

Contents

Register to read more articles.

Rigs report: oil hits three-year high, with global drilling rising

Brent crude oil continued its upward trajectory, rising to as high as US$84.60 per barrel on 11 October – a level not reached in three years – before settling at US$83.65

Rising oil prices are the result surging demand outstripping supply as countries emerge from the effects of the global pandemic. As we reported last week, OPEC+ countries (which includes Russia) agreed to raise their monthly production output by a total of 400,000 barrels a day starting in November as part of their plan to meet post-Covid-19 recovery energy demand. Traders had expected oil-producing countries to open up their spigots more to meet surging demand.

Exacerbating the situation, a global natural gas shortage and record high prices have pushed electrical power plants to switch from gas to oil or even coal. With winter coming, expectations are that demand will push oil prices even higher in 2022.

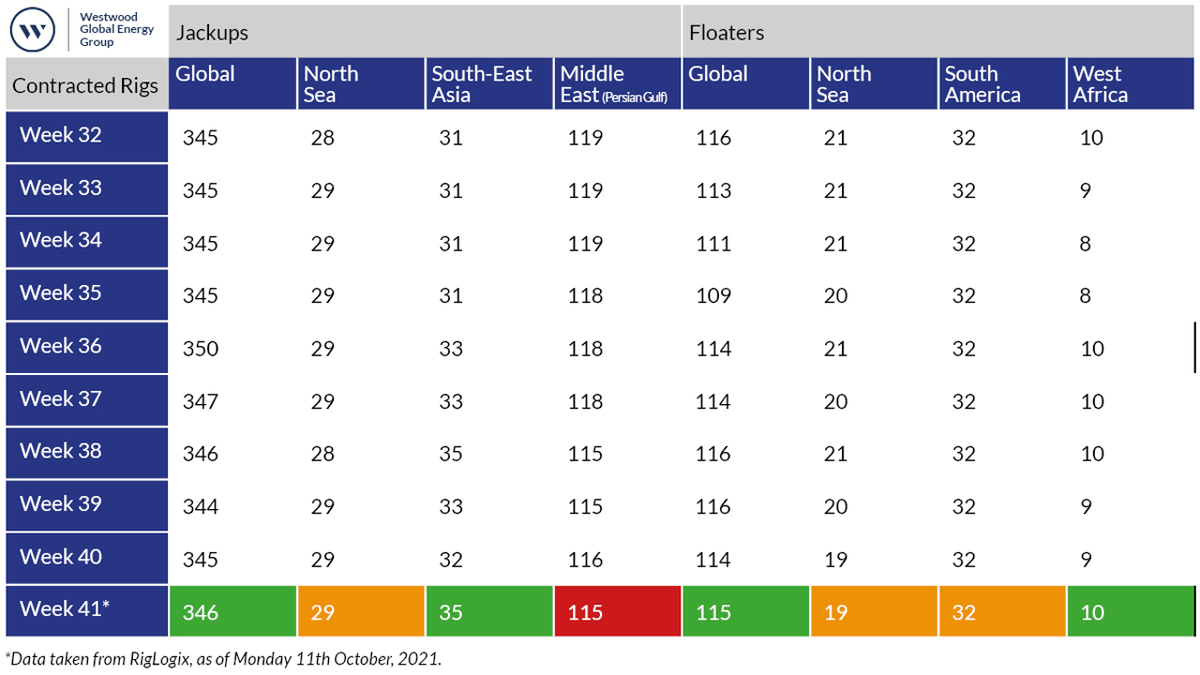

Meanwhile, increased jack-up drilling activity contracted in southeast Asia and floater activity in West Africa led to a positive week for global offshore drilling. Westwood Global Energy’s RigLogix reported on 11 October a total of 346 jack-ups and 115 floaters were contracted during week 41 2021. Jack-up drilling in southeast Asia jumped three units week-on-week to 35, while floater activity in West Africa rose one unit to 10.

North Sea drilling remained steady at 29 jack-ups and 19 floaters contracted, unchanged for the week.

In the Norwegian sector of the North Sea, independent E&P company Okea has decided to halt further development of the Vette discovery, citing the project’s insufficient financial robustness. Okea has a 40% interest in the project, taking over the operatorship of the licence earlier this year.

“Although significant reductions in break-even cost have been achieved, it is deemed insufficient to warrant a stand-alone field development,” said Okea in a press statement. “As Okea was targeting a joint serial development of the Vette discovery together with the Grevling/Storskrymten discoveries, the decision to halt further development of Vette also implies that Okea is likely to halt further development of Grevling/Storskrymten.”

Okea’s partners in the Vette development are ONE-Dyas Norge and M Vest Energy, each with a 30% interest.

Equinor highlights projects

By contrast, Equinor is crowing about the progress of its offshore energy projects in Norway. Despite the challenges posed by Covid-19 to the offshore industry over the last 18 months, Equinor noted several of its projects came on stream in the past year. Among these was the Nkr18.3Bn (US$2.1Bn) Snorre Expansion Project, which started up in December 2020. The project started up ahead of Equinor’s original timeline and Nkr2.65Bn (US$311M) below its original cost estimate. The cost reduction is mainly related to drilling operations and the subsea scope, as well as topside modifications.

Additionally, Troll phase 3, Martin Linge and Vigdis Boosting Project all came on stream in 2021.

“Troll phase 3 has a break-even price below US$10, making it one of the most profitable projects in Equinor’s history,” said Equinor projects, drilling and procurements executive vice president Arne Sigve Nylund.

Mr Nylund also noted the attractive environmental profile of Troll phase 3, which will have CO2 emissions below 0.1 kg per barrel.

Equinor reported Johan Sverdrup phase 2, Breidablikk and Hywind Tampen “are on schedule” and its partners have taken FID for Kristin South and Askeladd West, in addition to Troll C electrification and partial electrification of Troll B.

Equinor provided an update on its work on the Njord Future project, with an anticipated start up in Q4 2022. “Both the platform and the storage vessel have been towed to shore for upgrading and preparations for another 20 years on the field. This extensive work also enables the development of the Bauge and Fenja fields, which will be tied in to the Njord A platform.”

However, Covid-19-related delays at shipyards in Singapore and Norway impacting the construction of the production vessel will push the start-up of the Johan Castberg field until Q4 2024.

More efficient drill ship

E&P companies such as Equinor have been strongly focused on reducing their carbon footprint. This is being supported by drillers, which are making investments in lowering emissions from the drilling rigs.

Reducing emissions and increasing energy efficiency is at the heart of upgrades to the Valaris ultra-deepwater drill ship Valaris DS-12. Valaris reported that as a result of the upgrades, the drill ship has become the first vessel in the world to receive the ABS Enhanced Electrical System Notation EHS-E.

To secure the notation, Valaris upgraded the vessel’s electrical system, allowing the drill ship to optimise powerplant performance, enabling operations on fewer generators and reducing emissions.

Valaris senior vice president and chief operating officer Gilles Luca said the upgrade “paves the way to more sustainable deepwater drilling.”

ABS global offshore vice president Matt Tremblay said the notation recognises the driller’s “commitment to sustainable operations and investment in advanced electrical systems to increase efficiency.”

ABS has surveyed the upgraded system and tested it to ensure it can operate on reduced generator power. The short circuit and fault ride-through capability was demonstrated on board the vessel with ABS in attendance.

The EHS-E notation was introduced in the ABS Guide for Dynamic Positioning Systems in October 2021.

Valaris DS-12 has been actively drilling in Africa. It was awarded a one-well contract with TotalEnergies for offshore Ivory Coast from July to August and will go on a four-well contract with BP offshore Mauritania and Senegal starting in Q1 2022 that will keep it busy for about 285 days. As of its most recent fleet status report, the Big Board-listed driller had secured US$1.1Bn in backlog for its drill ships and another US$294M for its semi-submersibles through 2024. Total backlog, including jack-up rigs, other floaters and ARO Drilling rigs totals US$2.63Bn.

Riviera Maritime Media will be hosting Offshore Support Journal conferences in Asia, the Middle East and Europe during 2021 - use this link to our events site for more details and to register for these conferences

Related to this Story

Events

Reefer container market outlook: Trade disruption, demand shifts & the role of technology

Asia Maritime & Offshore Webinar Week 2025

Marine Lubricants Webinar Week 2025

CO2 Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.