Business Sectors

Contents

VSAT goes global with new small-scale products

Satellite communications companies are introducing more small-scale VSAT products for the maritime sector to provide faster broadband to a greater number of seafarers at a time when ship operators are being urged to offer better Internet and social connections. Shipowners and fleet managers are increasingly turning to VSAT suppliers to provide a reliable service for officers and ratings to stay in touch with family and friends through networking sites, while expanding their entertainment options and offering e-banking, e-commerce and real-time news.

The challenges are to provide a reliable and always available low-cost VSAT service on Ku-band with the largest global coverage, and to reduce the size of antennae and terminals so that operators can install them without a crane, while continuing to reduce the costs to owners. Satcoms companies that are already able to offer communications through Inmarsat and Iridium networks have moved into the growing mini-VSAT market, while also developing more value added services to increase communications security, reduce data transfer sizes and improve connection reliability.

The latest to bring a smaller VSAT solution is Vizada, which launched a service, based on iDirect technology, at the Seatrade Middle East Maritime conference in Dubai during October. Vizada offers a standard IP service with data speeds of at least 1 Mbps for Internet, e-mail and voice over IP (VoIP) with unlimited data transfer almost worldwide plus the added advantage of its value-added services, including extra security and firewalls.

The VSAT service will be “near-global” using a variety of satellites from a series of owners including Telesat, Intelsat and SES, explains Vizada’s executive vice president of product management and marketing, Anders Kallerud. “We integrate this with a combination of earth teleports run by iDirect, including two in Norway and one in the US, and an arrangement of satellites over the Far East.” Any service over the polar regions comes from Iridium’s low earth orbit satellites and is not VSAT quality.

Users of Vizada’s service will gain bandwidth double that of Inmarsat’s FleetBroadband but Vizada recommends that owners also install a FB500 terminal as a back-up and independent system. For these two services, ship operators could pay a fixed fee of around US$2,500/month for an “always on and unlimited service”.

Mr Kallerud says Vizada’s broadband is delivered via the Sea Tel 4009 tri-axis antenna, which is around 1m diameter and weighs 135kg; this means it needs to be installed using a crane when a ship is in port. Vizada also offers VoIP via iDirect’s Infinity 5100 series of equipment, which has a download rate of 256 Kbps and upload rate of 128 Kbps. Sea Tel’s 09 uses a DAC 2202 antenna control unit featuring three RS-232/422 serial ports and two ports for heading references, plus GPS input and modem compatible, reformatted GPS output.

“We launched our new offering to provide a standard and simplified service so we are able to reach the low price markets,” explains Mr Kallerud. “We are now waiting for our first user. What is unique is we are able to offer value added solutions with this and that makes us stand out from the crowd.”

Reinhold Lueppen, director of Vizada Solutions, says VSAT operators will need specialised services such as firewalls and antivirus software to restrict access and downloads from otherwise unlimited crew Internet use. Vizada offers its Skyfile suite of products, providing users with alternatives to Microsoft Outlook and Lotus Notes for e-mail and the added Internet solutions.

“There should especially be a need for Skyfile and its antivirus software as networks on ships would be vulnerable to what crews bring aboard,” says Mr Lueppen. “They may have their own memory sticks, CDs and DVDs, and download material, so there is a higher risk from viruses. Worms can also be found within software but not in SkyFile, and ships would receive the latest antivirus update once a day. Ships connected to broadband need firewalls and control of access to the Internet.

“Operators need to restrict access to what is coming into the network as some applications, such as Skype, can eat up bandwidth,” continues Mr Lueppen. “The firewall would allow operators to restrict traffic and there are also character filters that close access to different types of websites, such as You Tube, which consume a lot of airtime. It bars usage of all video and audio sites,” he explains.

Vizada also has a tool for compressing web data by 75 per cent to increase the speed of web page uploading, accelerating web browsing and reducing the size of data. “It reduces traffic over the VSAT terminal, optimising the throughput.” Vizada intends to continue developing its solutions and plans to bring out new versions by the middle of next year.

Another satellite communications provider, Marlink, was quicker off the mark with its near-global Ku-band VSAT offering as this was officially launched at SMM in Hamburg. Contracts have already been secured from three shipping companies, including car carrier owner, Wallenius Lines of Sweden.

The @SEAdirect is Marlink’s entry level VSAT service, which has data download rates of 1,024 Kbps and upload of 256 Kbps, offering Internet, e-mail and VoIP service. At present, access is through Sea Tel’s 4009 series antenna, which can be installed in less than a day but as with Vizada, Marlink will be working with other antenna suppliers in the future.

Marlink has two other VSAT services:WaveCall in the middle and Sealink the highest level; both guarantee an always-on service with higher bandwidths. Ships already using @SEAdirect can easily upgrade to WaveCall as they use the same hardware, says Marlink’s chief executive officer, Tore Morten Olsen.

“We have received a lot of interest from the commercial market, especially from dry cargo carriers and tankers,” says Mr Olsen. “Operators of large fishing trawlers are also interested as these ships spend long periods at sea, so there is demand for communication with head offices and for crew welfare and access to social sites.

“We have put together satellite coverage from three or four major vendors, the biggest being Intelsat and SES Astra, to have the most complete VSAT coverage. Our reach is 80° north and 80° south, with service over the polar areas limited to Iridium’s satellites.” Along with Wallenius, which operates almost 30 car carriers, Saudi Arabian company Bakri Navigation has also started to install @SEAdirect on its fleet of tankers.

Marlink also offers value added services, with Access Controller and @SEAweb Control enabling ship operators to manage onboard connections to available networks. It also has protective firewalls and a service to allocate bandwidth to different users. Access Controller also displays which data services are being used and how long a ship has been online. There are also programs for remote user control to allow technical support to a ship’s network and electrical systems.

Marlink’s @SEAwebControl increases bandwidth availability for critical tasks and protection from malicious sites and inappropriate content. “@SEAwebControl enhances network safety and efficiency. Access to potentially harmful websites is blocked, protecting from attacks and malware, such as spyware, or other objectionable content,” says Mr Olsen. “Maritime communications are now heavily relied upon for both business critical and crew applications, so it is imperative to protect a network as well as ensure that bandwidth is used appropriately.”

Another broadband communications supplier, US-based KVH Industries, has started distribution of a mini-VSAT service through Furuno Electric, which will market the airtime and supporting equipment worldwide along with its 1m diameter antenna. This network can be delivered through a global spread spectrum satellite network of 12 transponders and nine secure earth stations. It offers voice service and Internet access as fast as 512 Kbps uploading and 2 Mbps downloading.

Furuno’s director of marine electric products says the agreement means owners will benefit from a seamless global network, broadband connections and affordable airtime, adding: “Vessel operators, their crews and passengers are faced with a growing need for reliable and affordable broadband communications.” KVH’s vice president of satellite sales and business development, Brent Bruun, says mini-VSAT broadband is the fastest growing maritime network.

His company doubled its mini-VSAT broadband capacity over Europe when a business partner, US-based ViaSat, deployed another satellite, NSS-6, in October. “The addition of a new satellite, and the rollout of a powerful new high-density waveform, dramatically enhances the ability of our mini-VSAT network,” explains Mr Bruun.

“The network is built upon a robust, flexible architecture and ViaSat’s ArcLight spread spectrum technology, permitting us to expand the service quickly and easily,” he says. “Mariners who rely on mini-VSAT broadband for their Internet and voice connections will benefit from these enhancements via their existing TracPhone V7 hardware.” The mini-VSAT broadband network was designed to be the first next-generation maritime solution with the first approved 60cm diameter VSAT antenna.

Another supplier with a new VSAT service is GE-Satcom, which launched at SMM its Satlynx Maritime product based on the iDirect Evolution platform. German ship operator, Peter Döhle Schiffahrts-KG, piloted GE’s service on one of its container ships that operates in Asia, Africa and Europe, to demonstrate the versatility of VSAT, and has decided to install it on 14 more vessels.

The service provides telephone, Internet and TV content for daily news and sport reports, which can be beamed into cabins and recreational rooms. It primarily uses Ku-band, but can switch to L-band for Inmarsat and Iridium networks. “GE-Satcom has been extremely flexible in overcoming customers’ primary challenges and adapting to specific needs.” says Falk Bethke, Peter Döhle’s chief superintendent.

On the hardware side, recently developed smaller antennae will help alleviate one of the issues shipowners have with deploying VSAT services – the time it takes to install terminals. Another issue is reliability of network connections from the three-axis antenna but companies such as C2Sat are supplying four-axis mini VSAT models which weigh only 100kg and are 1.2m diameter. These alleviate the high elevation problems encountered with three-axis antennae in equatorial regions when a vessel is rolling and the satellite is close to its zenith.

Equipment can maintain its optimal position, facing the satellite without sudden movements even during heavy seas, which means large volumes of data can be transferred without interruption. C2Sat says the Ku-4M antenna has higher tracking accuracy because of the gradient tracking method, a predetermination tracking parameter and the four-axis design, where the fourth axis refers to the cross-level elevation. Antennae suppliers, Sea Tel, Intellian Technologies, Jotron and Navisystem have implemented iDirect’s OpenAMIP protocol; this allows the antenna controller and satellite router to exchange data and to switch beams automatically, which means broadband connections can pass between satellites without disconnection from the network.

Another issue is switching between bands to improve connection performance. Orbit Communications has launched a tri-band feed technology to enable switching between L, S and C bands. It has also developed the AL-4000 antenna control unit to monitor and operate antenna tracking. The front panel enables the operator to activate the operational modes, while monitoring data from the tracking unit.

On the software side, satcom suppliers have developed value added programs creating more efficient methods of using the Internet and other applications over satellite services that cannot offer the bandwidth of VSAT, such as over Iridium’s OpenPort and Inmarsat’s FleetBroadband. Iridium’s vice president of Europe, Middle East, Africa and Russia, Dan Mercer, says several service providers offer OpenPort deals which include supplying the terminals free of charge on a long-term fixed month payment deal. They have also developed value added services to make up for the slower speed of just 128 Kbps on OpenPort.

“Some have news and e-mail software that optimises transmission to a narrower bandwidth and control on the timing of data download, preventing large data movements and protecting with a firewall,” says Mr Mercer. “For example, IP Signature has e-mail and an area for crew welfare, messaging and optimised Internet. We transmit on L-band and charge by the megabyte on data, so an owner could run up a massive bill on open Internet.

“In general, crew look for four things: e-banking, social networking sites such as Facebook, sports news and general news. We ran a web browsing trial for six months and found IP Signature trims the quality of images so users do not bring back large files such as advertisements.”

Service provider Telaurus Communications has developed a suite of useful software in its se@Comm series to manage data, allowing operators to control broadband costs and sends images to and from the ship when required, and to fix network problems remotely. In September it launched se@Remote, a remote monitoring program to provide access to the ships’ IT system from the shore offices, says Trevor Whitworth, Telaurus’ senior vice president for sales and marketing: “Shore-based IT managers can solve problems without dispatching an engineer, so shipowners can control their costs. Any IP-enabled device can be linked up so that PC faults and those on other ship bridge electronics can be diagnosed and repaired. This will be happening more and more as shipowners set up their vessels to be offices at sea.

“We also have se@Image, which sends high resolution camera images from ship to shore without the normal expense. It allows people to look at an image, crop it, then compress it. Perhaps a 10MB image was taken but all of this is not needed – maybe just the identification number of a part, or the shape of it, so only what is needed can be sent. It is a question of working smarter,” explains Mr Whitworth.

Telaurus also has its se@Shield antivirus product, developed for ships connected to the Internet on narrow bandwidths such as Inmarsat B or Fleet series, which minimises the size of update files to just 10Kb. It also has software to ensure e-mails are delivered in almost real-time, instead of being stored until the ship is ready to perform batch sending and collecting of stored messages.

“Ships should operate not much differently to offices, with messages sent from ships or received without delays. If a message is sent by Telaurus, it should arrive within 10 minutes,” says Mr Whitworth. Telaurus is developing a new VSAT service with sister companies in the GlobeComm Group.

So where is VSAT heading in the future? Antennae are becoming smaller, although Mr Whitworth thinks the optimal size is 1m-1.2m diameter. VSAT service suppliers have cut their prices and launched fixed monthly fees for users that do not need high bandwidths. Bandwidth on C-band is much higher than the Ku-band VSAT, and George Best, director of Orbcomm’s eastern hemisphere sales, thinks suppliers will be offering even higher bandwidths for video streaming purposes.

“The sector should consider how high bandwidth communications will affect shipping,” says Mr Best. “Pressure will be coming from crew to give them the communications they have on land. Some suppliers offer up to 10Mb bandwidth and it will not be long before we will see 20Mb but as graphics become more complex and high definition video arrives, then 20Mb will not seen that much. Cruise ships will lead the way; passengers will demand better communications and this will set the standard for the rest of shipping.” MEC

Related to this Story

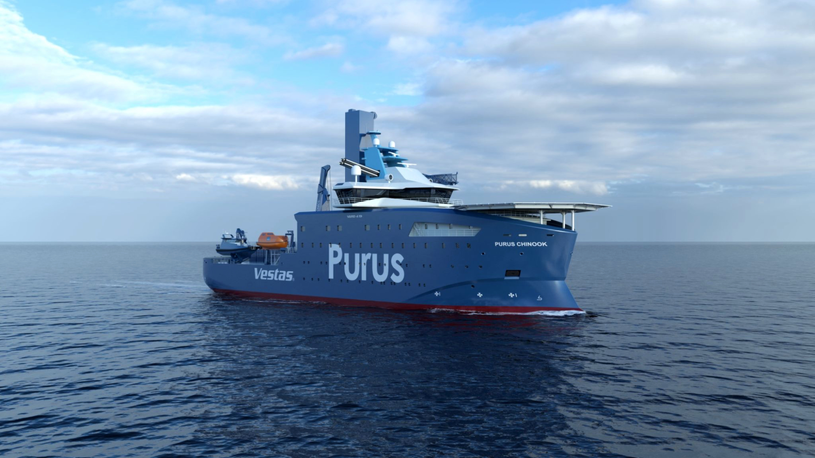

AI, digital twins help design cyber-secure, green SOVs

Events

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

Marine Coatings Webinar Week

© 2024 Riviera Maritime Media Ltd.