Business Sectors

Contents

OSV owners: redefine business models to survive

Experts agreed offshore support vessel owners need to redefine their business strategies to survive the longest and deepest downturn in living memory at Riviera’s Offshore Support Journal, Middle East virtual conference

Synergy Offshore chief executive Fazel Fazelbhoy, P&O Maritime Logistics chief executive Martin Helweg, V.Ships crewing and offshore chief executive Allan Falkenberg and Zakher Marine International managing director Ali El Ali discussed strategies, sustainability, contracting and seafarer welfare on 10 November.

They debated the ways OSV owners could react to the slump in vessel demand at a time of severe oversupply and asset lay-ups worldwide. Demand has crashed this year after the global coronavirus pandemic caused a huge drop in energy prices and offshore activity, which have yet to recover.

This came as the industry was starting to rebound after a five-year downturn caused by a considerable oversupply in vessels with more than 1,000 ships laid up worldwide.

Mr Fazelbhoy opened the session by calling on OSV owners to change their business models and strategies to counter the impact of industry recession.

He explained how owners are competing on tenders from energy companies that are only looking for minimal requirements “and stopped giving extra kudos to those players that excelled in terms of expertise”.

Mr Fazelbhoy said as long as owners had prequalified then “all that mattered was price, hence establishing the principle of the lowest common denominator as a primary criteria.”

This is not sustainable for owners or the OSV sector. He said owners “should not just be taxis of the offshore industry”. Owners should consider bundling augmented services and offer contractor solutions to replace third-party service providers.

“In logistics, an operator could put forward a combined planning and execution strategy, offering a supply base, equipment storage and a fleet of vessels,” said Mr Fazelbhoy.

Owners could also collaborate with energy companies to find a more sustainable method of contracting for “a win-win basis for commercial enterprise”. “This will move the sector away from the realm of the lowest common denominator to the highest common multiple,” said Mr Fazelbhoy.

Mr Helweg explained how P&O Maritime changed its business strategy to become an integrated logistics provider. “We reinvented our business model, as we saw conventional models struggling to cope with Covid-19,” he said, adding the industry is in a new normal “where businesses need to do more with less and OSV owners cannot rely on energy companies returning to indiscriminate spending”.

He said OSV owners should create partnership models and share information and incentives with competitors to “solve problems and unlock value” for clients and owners, but it will be a learning curve for all. “We should pursue collaboration across our industry, with shared data for maintenance, operations and safety,” Mr Helweg said.

This would enable vessel operators to “push back” on the downward pressure on charter rates and “benefit from the operational gains by sharing data and standards,” said Mr Helweg. “We should be masters of our own destiny,” he said.

P&O Maritime has created Maritimestats.com, a platform for marine data storage and sharing. It is an open-source platform for vessel operators to share data and collaborate on solutions that actively improve safety, sustainability, technical reliability and the operations of vessels and seafarers.

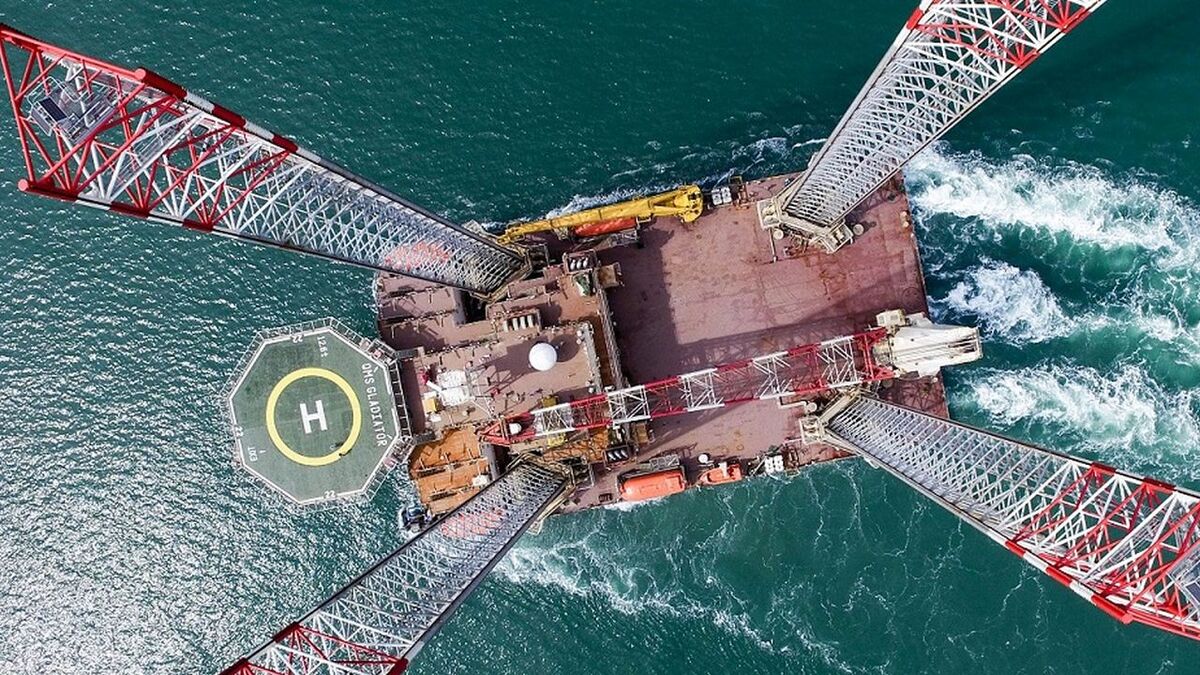

Mr Ali said Zakher Marine had found a strategic solution by offering a variety of services and vessels, including subsea construction and maintenance solutions and Quality Marine Services’ jack-ups, offshore work support vessels, anchor handlers, multipurpose supply and maintenance ships, utility vessels and diving support units.

“We have become a second-tier engineering procurement and construction player as we have seen international oil companies take a more holistic view of contracting,” said Mr Ali.

He said OSV owners need to diversify their fleets and consider other services. “There are too many operators, the market is fragmented and has become a commoditised service,” said Mr Ali.

“Owners need to shift their business models to understand the changing requirements of clients, to manage their logistics and make crew welfare a high priority,” he continued.

Mr Falkenberg agreed crew welfare needs to be improved in a fluctuating market and uncertain times where seafarers are unable to travel due to coronavirus restrictions. “It is a conundrum that we have never seen so challenging,” he said.

He said the biggest challenges were crew retention, career development, training and improving seafarer competences.

OSV owners are not only competing for talent among themselves, but also with other shipping sectors. “Seafarers can get much more from working on tankers and may see less attraction in joining an OSV crew,” said Mr Falkenberg.

Sessions earlier in the Offshore Support Journal, Middle East virtual conference on 9-10 November covered the impact from Covid-19 on the offshore oil and gas sector; a regional round-up of the key challenges and project delays and a session on potential opportunities from offshore renewables and decommissioning oilfield infrastructure in the Middle East.

Riviera will be holding a follow-up virtual conference Offshore Support Journal, Asia on 2-3 December 2020 where there will be further discussion on the commercial opportunities and threats, vessel design and construction and technical challenges - use this link to access more details and to register for that event

Related to this Story

Events

Maritime & Offshore Community Golf Day 2025

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.