Business Sectors

Events

Offshore Wind Webinar Week

Contents

Rigs report: Latin American market growth and future rig reactivations

With E&P spending and utilisation on the rise and another ’step change’ in activity coming in 2023, reactivation of cold-stacked rigs is looking likely, according to Westwood Global Energy Group’s calculations

Westwood head of offshore energy services Thom Payne told a crowded house at Riviera Maritime Media’s Annual Offshore Support Journal Conference, Exhibition and Awards 2023 event in London that "we believe that there is potential demand in the [offshore drilling] market to reach around 100 rigs by 2026".

Mr Payne said Latin America is the ’growth story’ for drilling, with expectations high for ongoing activity offshore Brazil and Guyana, and "hopefully the growth story will be Suriname, as well, as we look forward".

Saying there is a net increase in the total marketed fleet ongoing, and that Westwood is expecting a "pretty significant increase in the number of rigs [required] in 2023," Mr Payne discussed the likelihood of reactivation of cold-stacked rigs.

"In order to [meet] that we are going to have to not only deliver all of the orphans that are in the yards but we will have to reactivate cold-stacked rigs, as well" Mr Payne said.

"The story here is, realising current plans will mean reactivation."

Westwood’s analysis referred to a handful of high-profile acquisitions of what has been called an ’orphan fleet’ of stranded rigs at Asian shipyards.

Among the 15-17 cold-stacked rigs Westwood are tracking, the average laid-up drillship is 10.4 years old and has been stacked for 4.5 years, according to the group’s figures.

"So it is no simple feat to just click your fingers and bring these drillships back into the market. There is a huge amount of cost and investment required to bring these drillships in to keep up with demand, but what this allows the drilling contractors to do, of course, is to retain the pricing power on their side. These guys are in no real rush to bring these rigs back and to make that investment while they are enjoying the day rates in that US$400,000-500,000 a day mark," Mr Payne said.

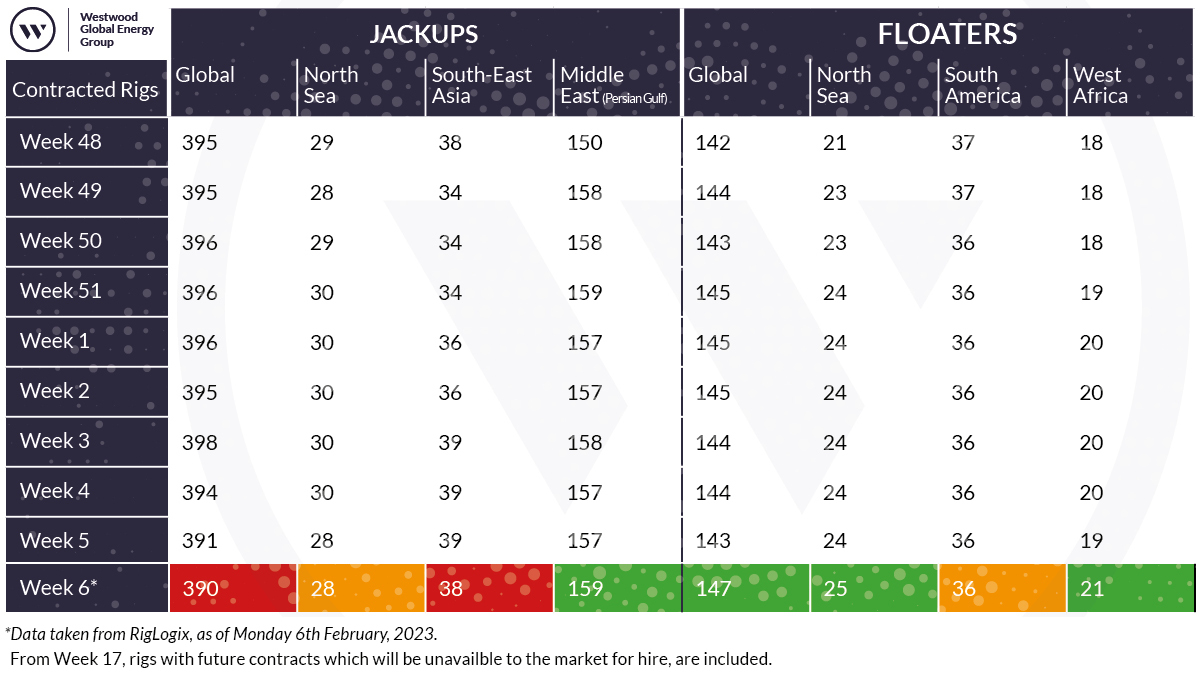

Noting that Westwood’s assessment metric for ’committed’ rig utilisation, or the number of rigs contracted, as well as those that are inactive but effectively off the market due to future near-term commitments, sets drillship utilisation at 95% already and committed utilisation in the other rig sectors at between 80-90%, Mr Payne said the group expects a "step change in rig utilisation in 2023".

"What this means is that you cannot secure new tonnage in the market today for the first time in many, many years," Mr Payne said.

Westwood Global Energy director for the RigLogix platform Teresa Wilkie expanded on Westwood’s figures, noting the ’golden triangle’ of Brazil, the US Gulf of Mexico and West Africa are the biggest drivers of demand for drilling, generally.

For shallow-water vessels, jack-ups and floaters, there is limited ready drill supply left, as well, resulting in more reactivation and the potential for more newbuilds coming into yards.

The Middle East and Americas were the largest growth areas for rig demand last year, mainly driven by National Oil Companies’ (NOCs) plans to increase domestic supplies and production.

Discussing the rig demand outlook for 2023, Ms Wilkie said the majority of demand for 2023 will also come from NOCs, but some newer areas will have an increased rig presence following large discoveries over the past few years.

The top five regions with the highest demand all include countries that have an NOC presence (China, India, Brazil, Mexico and Saudi Arabia – not in that order), she said.

In contracts news, Stena Drilling’s Stena IceMAX vessel has won a contract extension from BP. The extension is in direct continuation of the initial one-well programme offshore Newfoundland, but will reposition the vessel to the US Gulf of Mexico for two years. In a LinkedIn post, Stena said drilling operations will commence later in 2023.

UK-based Stena also won a new semisub rig contract for the Stena Spey rig from Ithaca Energy for a one-well campaign on the UK Continental Shelf. The warm-stacked rig is expected to begin operations Q3 2023.

Malaysia’s Velesto Energy’s offshore drilling unit has secured a new contract with Roc Oil of US$14M for the Naga 2 premium jack-up rig. The rig will be used to drill three wells.

Sign up for Riviera’s series of technical and operational webinars and conferences in 2023:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.