Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

UPDATED: US offshore wind auction blows oil and gas lease sales out of the water

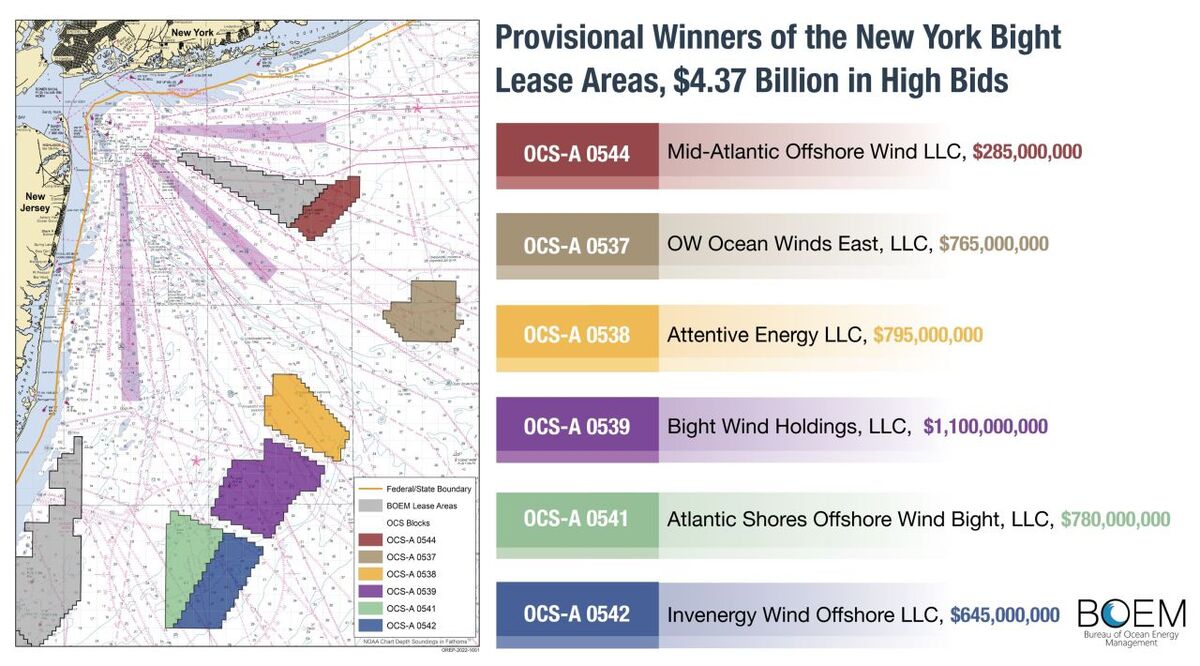

The US Department of the Interior has announced the results of the New York Bight lease sale, a process that became by far the highest-grossing offshore energy lease sale in its history, with sums bid far exceeding any oil and gas lease sale or previous offshore wind sale

The lease sale offered six areas totalling more than 488,000 acres in the New York Bight for potential wind energy development. Under the auction format, bidders were limited to winning one lease area. A winning bid provides the rights to develop the lease area and to participate in upcoming New York state offtake auctions, the first of which is expected later this year.

The auction drew competitive winning bids from six companies for an unprecdented total of US$4.37Bn, a result that is a major milestone towards achieving the Biden-Harris administration’s goal of reaching 30 GW of offshore wind energy by 2030.

To place the total and sums bid in perspective, US$4.37Bn is more than three times the revenue received from all US offshore oil and gas lease auctions in the last five years.

“This week’s offshore wind sale makes one thing clear: the enthusiasm for the clean energy economy is undeniable and it’s here to stay,” said US Secretary of Interior Deb Haaland. “The investments we are seeing today will play an important role in delivering on the Biden-Harris administration’s commitment to tackle the climate crisis and create thousands of good-paying, union jobs across the nation.”

As highlighted previously by OWJ, one particular lease area, the largest on offer, attracted especially high bids. That area, OCS-A 0539 (see map) attracted a winning bid of US$1.1Bn from Bight Wind Holdings LLC, which is led by RWE Renewables. RWE says the area has the potential to host approximately 3 GW of offshore wind generating capacity.

The next highest bid, US$795M, was from Attentive Energy, a joint venture between EnBW and TotalEnergies, for lease area OCS-A 0538.

Next came a bid of US$780M from Atlantic Shores Offshore Wind Bight LLC, an entity owned by Shell New Energies and EDF Renewables, for OCS-A 0541. Shell said that, subject to a future investment decision, the area could support approximately 1.5 GW of wind generation.

OW Ocean Winds East LLC bid US$765M for OCS-A 0547. OW East is a partnership between Ocean Winds, which was created by EDP Renewables and ENGIE, and New York-based Global Infrastructure Partners (GIP), a fund manager. OW Ocean Winds East said the area it has been awarded has the capacity to generate 868 MW.

Invenergy Wind Offshore LLC, a privately-owned renewable energy developer owned by Invenergy, which until now has specialised in developing solar and onshore wind, bid US$645M for OCS-A 0542.

Mid Atlantic Offshore Wind LLC bid US$285M for OSC-A 0544. The company is owned by a Copenhagen Infrastructure Partners fund, CI IV, the latest of CIP’s flagship funds.

Before the leases are finalized, the Department of Justice and Federal Trade Commission will conduct an anti-competitiveness review of the auction, and the provisional winners will be required to pay the winning bids and provide financial assurance to Interior’s Bureau of Ocean Energy Management (BOEM).

The New York Bight offshore wind leases also include stipulations designed to promote the development of a robust domestic US supply chain for offshore wind, and stipulations designed to advance flexibility in transmission planning. These stipulations include incentives to source major components domestically – such as blades, turbines and foundations – and to enter into project labour agreements to ensure projects are union-built.

BOEM director Amanda Lefton said, “We must have a robust and resilient domestic offshore wind supply chain to deliver good-paying, union jobs and the economic benefits to residents in the region. We are requiring lessees to report their engagement activities to BOEM, specifically noting how they’re incorporating any feedback into their future plans.”

Responding to the announcement, National Ocean Industries Association president Erik Milito said, “The record-shattering interest in the New York Bight lease sale is testament to how bright the American offshore wind outlook is and how confident developers are in the strength of the US offshore wind industry as a whole.

“Companies continue to invest and innovate, and the regulatory regime has a firm foundation. The New York Bight is a watershed moment for American offshore wind.”

Mr Milito continued, “In many ways, the New York Bight lease sale is just the kick-off for a busy 2022 for American offshore wind. We applaud the work done thus far by Interior and BOEM. We can clearly see the demand for more leasing, and we encourage the Biden administration to sustain progress through continued lease sales and project approvals.”

American Clean Power chief executive Heather Zichal said, “The scale of this lease sale is historic and shows the strong demand for clean energy. We support BOEM’s path forward to conduct six more lease sales through 2024.”

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.