Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

US proposal could lead to US$50Bn annual fees, changing the map of global shipping

Shipping analysts believe the proposed US port fee on Chinese-built and owned vessels could exert significant pressure on the domestic economy while reshaping global maritime operations, affecting trade flows, freight rates and even fleet renewal strategies

“This proposal reaffirms the US-China adversarial relationship is structural and is only expected to intensify in the coming years. The Trump administration will continue to take bold actions – some of which may succeed, others may not – but they remain unwavering in their approach,” said market sources shortly after the proposal was announced.

“All in all, this will only reinforce the shipping industry’s reputation as one that requires boldness and resilience,” the sources added.

Optima Shipping Services head of market analysis and decarbonisation strategies Angelica Kemene told Riviera President Trump often employs a “businessman’s approach,” starting with maximalist demands before moving toward a middle ground. “Whether this turns out to be a strategic realignment or a bargaining tactic remains to be seen, but market uncertainty is already taking hold,” she noted.

Broader economic implications

Turning to the broader market implications, Ms Kemene pointed out that with up to US$50Bn in potential annual fees, the risk of inflationary pressure on US imports and disruptions to global trade flows is significant.

“While these measures are intended to counter China’s dominance in shipbuilding, they could inadvertently constrain fleet renewal, drive up freight rates, and create ripple effects beyond shipping,” she added.

The policy could have wider economic repercussions, from inflationary pressures to shifts in global trade patterns. “The intent is to curb China’s influence, but the knock-on effects could challenge US shippers and exporters,” Ms Kemene warned.

Could these measures backfire?

One sector particularly vulnerable to these proposed port fees is container shipping. Ms Kemene explained operators might attempt to reroute vessels, but with 83% of US container port calls falling within scope, avoidance strategies will be limited.

Drewry also commented that more than 80% of container ships calling at US ports would be impacted by these tariff fees as they are currently envisioned, either because the operator is based in China, the ships are built in China, or the operator has ordered ships from China.

Benesch Law vice chair, Transportation & Logistics Practice Group, Jonathan Todd told Riviera a major concern is these charges will increase the cost of US import and export trade. “In particular, the resulting increases in inbound container freight charges are likely to yield elevated retail costs for those containerised cargoes. Those potentially higher retail costs are ultimately payable by the US consumer,” Mr Todd highlighted.

Soaring costs

Drewry has already estimated the potential elevated costs. For a typical container ship operating on the three main US trade routes, the proposed US tariff fees (US$1M per US port of call) would add about US$222 to US$500 per TEU of ship capacity, and between US$2M and US$3M per sailing. For context, these costs are estimated to be between seven and 16 times higher than Europe’s new Emission Trading Scheme carbon taxes.

Xeneta chief analyst Peter Sand predicted similar increases in freight rates, comparing the current situation to the Red Sea crisis, when carriers reduced port calls in Asia and handled more containers per call at Singapore to offset the impact. “The intentions were good, but the severe congestion in Singapore rippled across global supply chains and saw average spot rates from the Far East to US East Coast spike more than 300%,” he noted.

“The threat of even higher costs to import goods into the US should be taken very seriously, but it remains to be seen whether it becomes a reality due to the impact it will have for US businesses and, ultimately, consumers,” Mr Sand added.

A blow for US agricultural exporters?

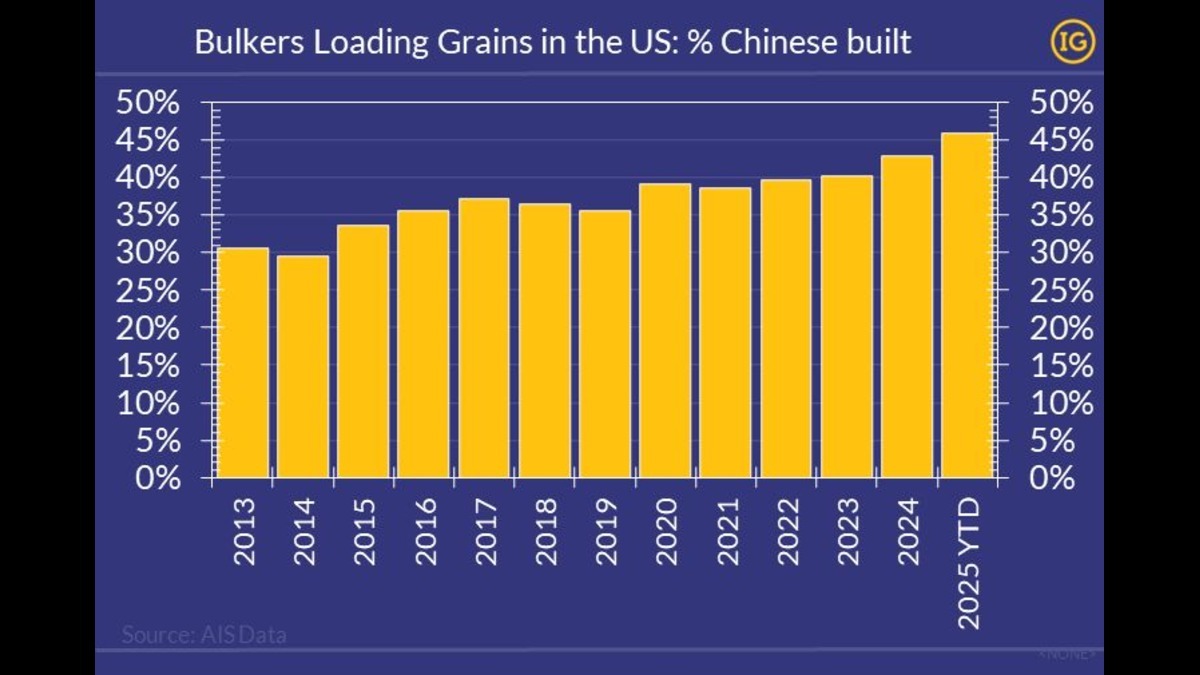

Shipbroker Ifchor Galbraiths highlighted another potential consequence of the port fees – US agricultural exports. According to an analysis, 43% of port calls for US agricultural exports in 2024 were made by vessels built in China.

If the proposals are implemented, analysts believe the fees could push freight rates higher. Vessels built in Japan and South Korea would demand premiums to load cargoes from the US Gulf and North Pacific.

Another consequence could be the shift of Chinese-built Panamaxes to the East Coast South America - Asia route, which would increase vessel supply on that route and ultimately push freight rates down. This shift could reduce costs for South American agricultural exports to China while raising costs for US exports. “The goal? Weaken China. The potential outcome? A competitive edge for China and a blow to US exporters,” Ifchor Galbraiths noted.

Shifting to Canada and Mexico?

According to MarineTraffic, a potential shift in Chinese-linked shipping could see vessels rerouted to Mexican and Canadian ports to bypass US restrictions, with goods then transhipped to US ports.

Xeneta’s Peter Sand also pointed out this possibility, noting shippers might seek to avoid the port fees by importing goods into the US via Mexico and Canada.

“Shippers have long used Mexico and Canada as backdoors to avoid tariffs on imports from China,” said Mr Sand. In response, “Trump has vowed to stop this trend by imposing tariffs of 25% on imports from Mexico and Canada, making using these nations as a backdoor less attractive.”

“If shippers now face new port fees on top of the tariffs when importing directly into the US, it could change the situation again and fuel further growth in imports from China to Mexico and Canada,” he noted. “Ironically, Trump may be indirectly driving one of the very things he’s trying to guard against”, Mr Sand concluded.

Tanker market facing possible disruptions

Regarding potential implications for the tanker market, Gibson Shipbrokers highlighted in its recent weekly report that the most disruptive measure would be the one linking penalties to the share of Chinese-built vessels in an operator’s fleet. “If implemented, this measure would have profound implications for US-linked freight rates, arbitrage economics, and even domestic oil and refined product prices,” analysts noted.

According to Gibson, more than 60% of the global tanker fleet is currently owned by companies with at least one China-built vessel, while 40% of owners have at least 25% of their fleet built in China.

Conversely, Gibson believes that measures targeting only Chinese operators and/or just Chinese-built ships – without considering an operator’s entire fleet – would likely be less disruptive. “Given that US crude exports and imports account for 9% and 7% of global trade, respectively, and clean exports for 13%, the tanker market has enough flexibility to reallocate Chinese-built or Chinese-owned tonnage away from US ports,” analysts stated.

Nonetheless, any such measures would likely lead to inefficiencies, initial disruptions, and missed trading opportunities, while freight rates for US-bound voyages may rise due to reduced vessel availability.

Shipyards: already sold out

As Ms Kemene mentioned above, the proposed port fee could disrupt fleet renewal strategies. Market sources explain that while non-Chinese shipyards could theoretically benefit, in practice, this is not straightforward. South Korean and Japanese shipyards are already fully booked for the next few years.

“Enforcing these tariffs would not only disrupt supply chains but also expose a significant vulnerability: the US lacks shipbuilding capacity to replace Chinese-built vessels. Alternatives in South Korea and Japan cannot quickly fill the gap,” noted shipbroker Intermodal in a recent social media post.

Riviera has reported that Chinese-built vessels make up 26% of the global fleet by vessel count, while Chinese shipyards account for 58% of the world’s under-construction tonnage.

Market sources suggest replacing China’s shipbuilding industry is a significant challenge. After years of growth, Chinese shipbuilders have solidified their market leadership, constructing ships across all major segments, while key competitors tend to focus on high-value sectors.

Impact on investment decisions

Shipping analysts have also discussed potential implications for investments in the secondhand vessel market.

“We may start seeing a divergence in demand for vessels based on their shipbuilding origin,” said Allied Shipbroking in its latest weekly report.

Analysts believe Chinese-built bulk carriers may face liquidity constraints and discounted pricing, while their Japanese-built and Korean-built counterparts could attract stronger buying interest.

“The impact on S&P (sale and purchase) transaction volumes and asset values will depend on how these regulatory shifts interact with freight market fundamentals,” Allied concluded.

Market sources speculate Japanese and South Korean-built ships may earn a “policy premium” in the time charter market due to greater trading flexibility.

Shipowners on the sidelines

Following the proposal of the US port fee, Riviera reached out to multiple shipowning sources, the majority of whom noted it’s too early to estimate the full impact. They are waiting for the March public consultation before making any definitive decisions.

One of the owners who publicly spoke about the proposal was Aristides Pittas, during Euroseas’ Q4 earnings report. “While we believe it will be difficult for these measures to pass, at least in their currently envisaged form, if implemented, they could fundamentally change trade in terms of both volume and pattern”, Mr Pittas emphasised, adding “shipping thrives on uncertainty and inefficiency.”

Public consultation

Liner shipping lobby, the World Shipping Council, which says the proposed fees are ’unworkable’ in their current form, is encouraging public comment on the proposal.

The WSC claims the USTR proposal would add between US$600-800 per container, "which would double the cost of US shipping exports".

"USTR’s proposed fees apply to vessels already built and serving the U.S. trade or under construction, which would not disincentivize current shipbuilding practices," WSC said, noting that 98% of ships that call at US ports could be affected by USTR’s proposals.

"Policymakers must reconsider these damaging proposals and seek alternative solutions that support American industries," WSC President & CEO Joe Kramek said.

The USTR outlines three deadlines to formally respond to its proposal:

March 10, 2025: Submit requests to appear at a hearing, along with a summary of the testimony.

March 24, 2025: To be assured of consideration, submit written comments by this date.

March 24, 2025: Hearing.

Submit documents in response to the USTRs proposals, including written comments, and requests to appear through USTR’s electronic portal: comments.ustr.gov/s/.

The docket number for written comments and rebuttal comments is USTR–2025–0002. The docket number for requests to appear is USTR–2025–0003.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.