Business Sectors

Events

Contents

Register to read more articles.

A long road ahead for onboard carbon capture

Learnings from CIMAC Congress 2023 highlight the developments needed for onboard carbon capture to become a widely applicable decarbonisation solution

With expensive renewable fuels currently the most viable pathway to decarbonisation for operators of large merchant vessels, it is no surprise that onboard carbon capture has caught the imagination of many in the industry. It holds the potential to enable the use of existing, reasonably priced fuels and to give ship operators another sellable product, all while meeting their emissions reduction targets. But presentations at CIMAC Congress 2023 in June showed some of the challenges lying between that vision and a widely applicable reality.

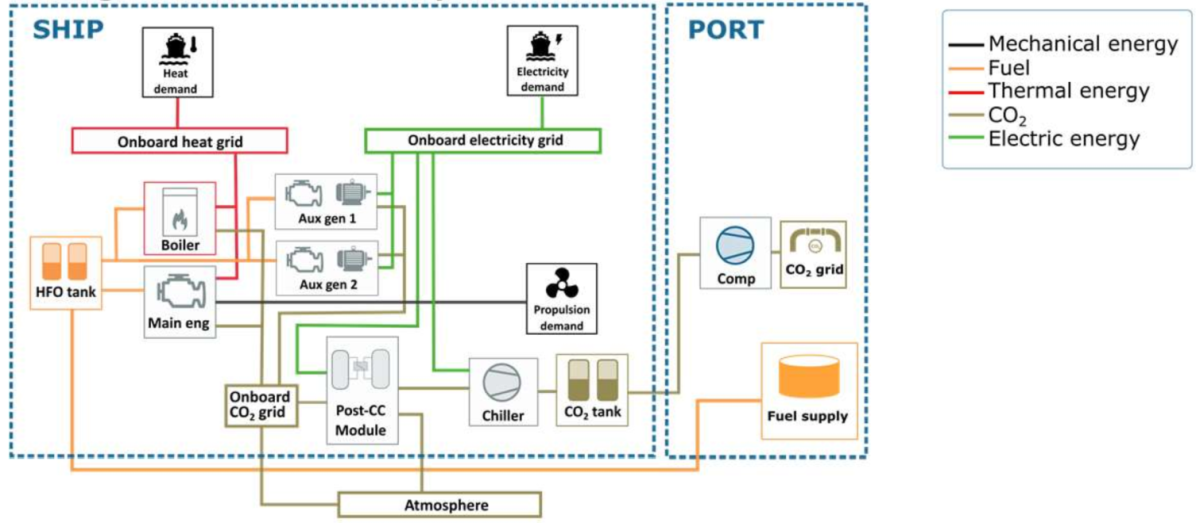

A study using the ENERsim modelling framework, developed by the Large Engine Competence Centre (LEC) in Graz, highlights some of the issues around deploying carbon capture technologies. Five different energy system configurations were studied for five vessel types. The results identify important considerations for ship operators planning to deploy alternative decarbonisation solutions.

When carbon capture is deployed on a 10,000-TEU container ship that burns heavy fuel oil, the first difference compared to a conventional HFO-fuelled vessel is the increased installed power requirement and fuel use. A main engine of 40.3 MW is proposed instead of 37.1 MW, with gensets adding a further 5.3 MW, compared to 4.2 MW. The boilers needed for the carbon capture configuration are also 10 times greater due to the increased thermal demand, up to 34.9 MW, from just 3.3MW.

The hypothetical carbon capture system, capable of removing 37 tonnes of CO2 an hour with an 85% capture efficiency, uses chemical absorption with an amine-based solvent. The extra energy is needed to produce steam to regenerate the amine solvent – hence the high boiler demand – as well as for electrical energy for auxiliary pumps and to keep stored CO2 in a liquefied state at -15°C.

The resulting fuel consumption compared to a conventionally fuelled vessel leads to 77% higher annualised costs (including capex, opex and fuel), at €34.7M (US$38.1M) a year, with HFO at a price of €48 (US$53)/MWh. Further, the large space needed for CO2 storage means that of all five system configurations, only the battery-electric option takes up more space. The 423 TEU needed for HFO and carbon tanks is more than twice the tank space needed for a similar vessel powered by methanol.

“Carbon capture does not compete with electricity or methanol on emissions reductions”

The costs of carbon capture on the container vessel are dwarfed by the costs of methanol or battery-electric alternatives (US$83.4M and US$382.8M a year respectively), with cost of abatement per tonne of CO2 also significantly lower. However, far less CO2 is abated. The carbon capture-equipped vessel emits 23,100 tonnes of CO2 a year; a 78% reduction against the baseline, but still high compared to zero emissions for the renewable methanol vessel and 4,900 tonnes for the battery-electric variation.

Increased consumption

LEC senior engineer, Bernhard Thaler, observed: “The carbon capture configuration requires the second lowest abatement costs of all decarbonisation options. The assumed maximal capture rate lies at 85%; however, the actual reduction is lower, since the energy demand of carbon capture increases fuel consumption.”

From the LEC analysis it is clear that carbon capture does not compete with electricity or methanol on emissions reductions, due to the efficiency of the system and the extra fuel needed to run it. Those limitations will need to be addressed for carbon capture to become a long-term solution for shipping. But lower relative costs may still make carbon capture an important step that is more affordable, and therefore more appealing, to ship operators than immediately opting for renewable fuels or fully electric-power arrangements.

That appeal may explain why, for the last two years, exhaust gas cleaning system developers have been promoting the evolution of their technologies to remove carbon dioxide as well as sulphur oxides. The advance would be welcomed by the many ship operators that deployed scrubbers after the introduction of IMO’s global sulphur cap, potentially allowing them to continue using high-sulphur fuel oil, even amid tightening carbon intensity and efficiency requirements.

According to Harbinger Engineering University researcher, Jianjun Ren, there are both advantages and challenges to a combined carbon- and sulphur-abatement approach.

“For ships that have installed fuel gas desulphurisation systems, it is difficult to install a carbon dioxide capture device behind the scrubber, due to insufficient space location,” he noted. “It is more meaningful to use a carbon dioxide capture system to replace the desulphurisation scrubber, to achieve the integrated removal of carbon dioxide and sulphur dioxide.”

Given the particular application of carbon capture in maritime, there is further grounds for cross-over between sulphur and carbon removal. Mr Ren explains that the most common post-combustion capture technologies – adsorption, membrane separation and physical absorption – are not suitable for occasions where the gas flow is large and the partial pressure of CO2 is low, such as marine engine exhaust gas. That leaves the chemical absorption method, which delivers strong gas selectivity and mature technology, as well as being suitable for scenarios with low partial pressure. It is also the concept on which many scrubbers operate.

Sulphur compromise

However, combining the two processes in a single system can raise issues. In research presented at CIMAC Congress 2023, Mr Ren highlighted the impact that sulphur can have on two chemical absorbents’ ability to absorb carbon dioxide.

“After absorbing sulphur dioxide, the absorbents will reduce the absorption performance of CO2, which is reflected in the reduction of the absorption rate and maximum loading. Moreover, the absorption of more sulphur dioxide will lead to the stronger acidity of the absorbent as a whole, which will reduce the maximum loading of CO2 on the absorbent again,” he said.

The presence of sulphur dioxide also hindered the circulation performance of the two absorbents, meaning that the chemicals would need to be refreshed more frequently. That would add to the operating costs of the system and potentially require greater chemical storage onboard. Those issues, affecting the cost and efficacy of dual abatement, will be key questions for ship operators to ask technology providers touting carbon-removing scrubbers.

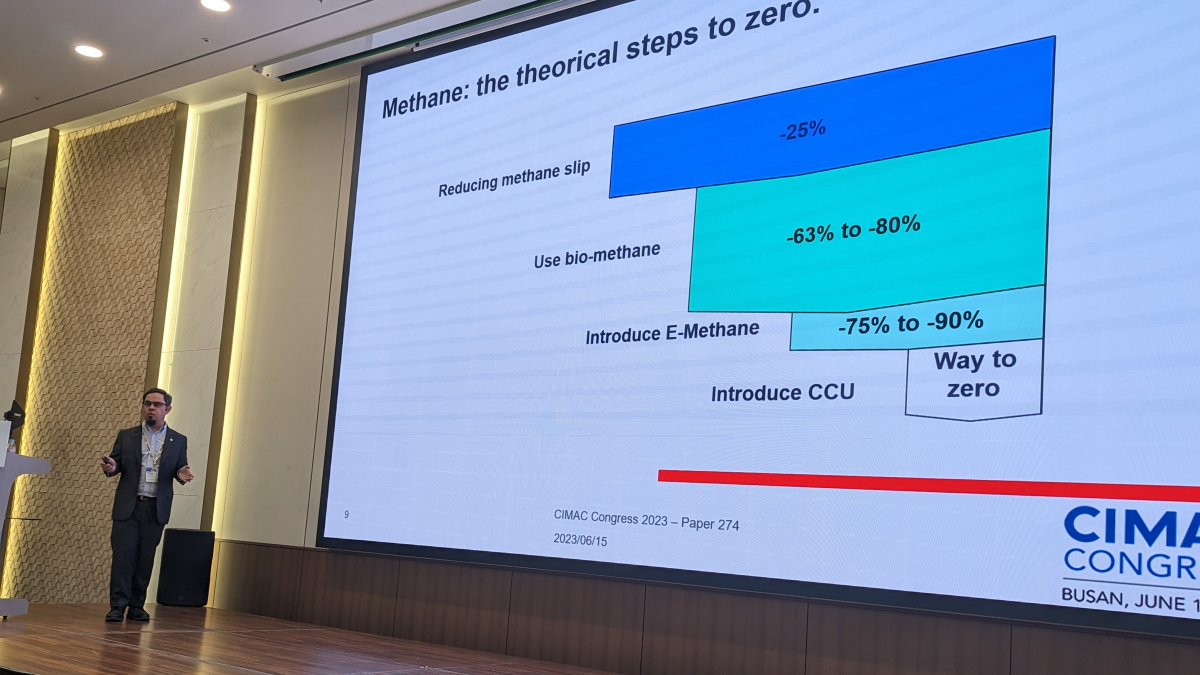

For vessels that do not also require sulphur abatement, carbon capture could be a more straightforward prospect. One example is LNG-fuelled vessels, where sulphur emissions are within IMO limits without aftertreatment. However, greenhouse gas emissions from LNG-fuelled engines will need to be limited for vessels to comply much beyond IMO’s 2030 indicative checkpoint, which demands a 20%-30% reduction on 2008 levels.

For operators that have already invested in such engines, carbon capture could hold even more potential than just reducing emissions from fossil LNG. In his presentation at CIMAC Congress 2023, Philippe Renaud, manager of energy R&D at container line CMA CGM, showed how a ship operator could participate in a ‘carbon loop’, where synthetic methane is produced from captured carbon.

Carbon loop

As well as contributing to the supply of the carbon-neutral LNG substitute, Mr Renaud argued that the properties of methane and liquid carbon dioxide can improve the efficiency of producing and supplying the fuel. The loop takes advantage of the fact that methane needs to be liquefied before export, for loading onto LNG carriers, while CO2 needs to be vaporised after it is imported, for use in industrial processes.

“The cooling capacity of liquid CO2 can be used to reduce the energy demand of the methane liquefaction, while methane’s thermal energy is used to vaporise the CO2,” he explained.

Another opportunity for efficiencies in the LNG-CO2 cycle could come from coupling the methanation process, which generates methane from carbon dioxide and hydrogen, with the production of hydrogen through high-temperature electrolysis (HTE). Using high-temperature vapour to separate water molecules can significantly reduce the amount of electricity needed in the process, explained Mr Renaud. If this vapour can be generated from the methanation process, which creates a lot of waste heat, the production of methane can be made more energy efficient.

With these processes in place, LNG-fuelled vessels can contribute to an efficient fuel production cycle, bunkering LNG, capturing carbon dioxide and offloading it to be fed back into the synthetic methane plant. The carbon loop could therefore offer a way for gas-fuelled vessels to both reach zero (or potentially negative) emissions, while reducing fuel costs by supplying a key feedstock.

“The energy demands of carbon capture increase fuel consumption”

The innovative approach driven by onboard carbon capture could be one pathway for shipping, particularly LNG-fuelled shipping, to reach emissions reduction targets. But it has challenges, Mr Renaud noted, particularly in technology maturity.

“HTE may have potential, but pilot projects are not expected to be launched before 2025,” he explained. “Large factories may not be operational before 2035. Capturing CO2 from exhausts in an efficient manner will also require significant technical developments and associated logistics.”

The presentations at CIMAC Congress gave a similar impression across onboard carbon capture technology, its potential for integration with sulphur abatement and the establishment of a circular economy based on captured carbon and carbon-based fuels. Given their early stages of maturity, the maritime industry is unlikely to see widescale deployment until just a handful of years before IMO’s 2040 indicative checkpoint, demanding emissions reductions of at least 70%.

Related to this Story

Women in Maritime Today: Elin Saltkjel says no day working in maritime is dull

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.