Business Sectors

Events

Contents

Register to read more articles.

Middle East keeps rolling, despite Saudi Aramco jack-up suspensions

Middle East offshore oil and gas market is still growing, despite Saudi Aramco’s decision to suspend contracts for 22 offshore jack-up rigs, just not as quickly, said leading analyst

Offshore drilling contracting activity remains strong in the Middle East Gulf despite Saudi Aramco’s decision to suspend contracts for almost two dozen jack-ups earlier this year. The suspensions came in the wake of the Kingdom of Saudi Arabia’s decision to cap the country’s production at 12M bbl per day.

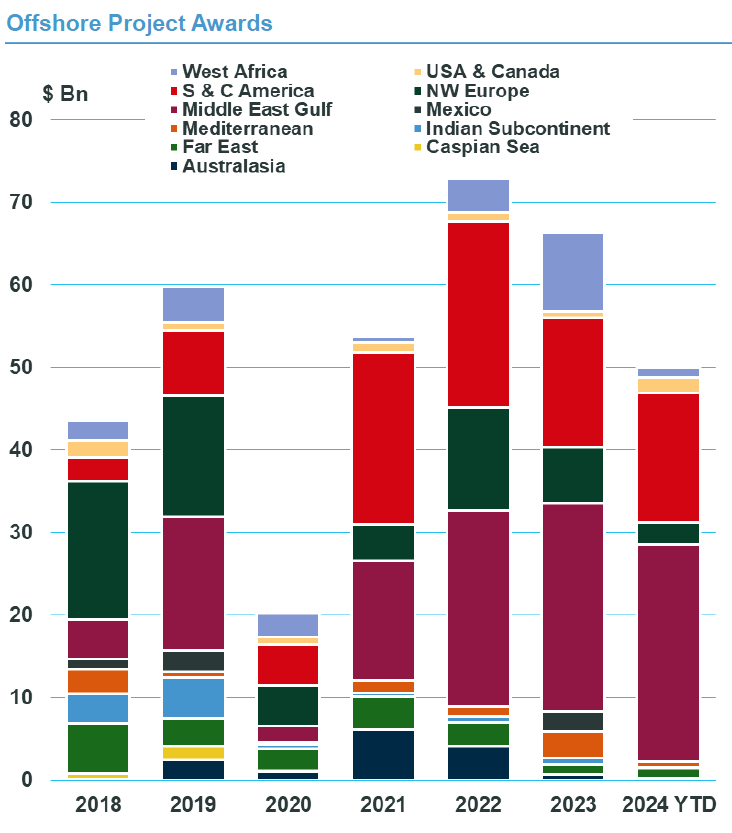

Market analysts MSI said the Gulf region continues to contribute strongly to contract volumes with US$50Bn in awards during H1 2024. The energy analysts said that if the current rate continues, 2024 capex spend will outstrip levels seen in 2022 and 2023.

The Middle East Gulf and South and Central America dominated awards accounting for about 55% and 30% shares, respectively, according to MSI’s Q2 MODU Report.

While Saudi Arabia’s announcement to curtail its oil production plans initially sent a chill through the mobile offshore drilling unit (MODU) market, a number of jack-up rigs were marketed elsewhere or have scheduled in maintenance while the rigs aren’t working. This extra supply is expected to have a knock-on effect in the Asian and African markets where opportunities have already presented themselves for some of the suspended units.

In the wake of Saudi Aramco’s decision, MSI revised its projections for jack-up demand down for Q2 2024 in the Middle East Gulf. Growth for demand in the region has been revised down from 4% to 1%, with Qatar and the UAE among the area’s big drivers.

MSI has also revised down its charter rate growth projection by around 3% for standard jack-ups. Some of the rigs will also be stacked in Saudi Arabia to save running costs and in anticipation of continued work once suspensions are over.

Nonetheless, said MSI, activity in the Middle East Gulf remains strong as national oil companies continue with key projects. Italy’s Saipem won two contracts in Saudi Arabia to replace lateral lines at the Berri & Manifa oilfields and add a 49-km, 48-inch trunkline at the Abu Safah oilfield. The contracts have a combined value of US$700M. In the UAE, ADNOC awarded an engineering, procurement, construction and installation contract for water injection pipelines and topside modifications on four existing wellhead platforms in the Lower Zakum development to NMDC Energies.

Strong global demand allowed ADES, which had five jack-ups temporarily suspended by Saudi Aramco, to quickly lock up contracts for three of the rigs.

It inked a charter for a jack-up worth a potential US$93.3M with TotalEnergies for drilling work in Qatar. The initial contract is for one year, with options for three additional six-month extensions. Another jack-up was fixed with SUCO in Egypt’s Gulf of Suez for 21 months, while another was secured by PTTEP for drilling in Thailand.

Iran’s Oil Ministry highlighted its ambition to increase output from its South Pars gas field, awarding US$20Bn worth of contracts to erect 28 platforms and install 56 compressors. The contracts were awarded to domestic companies including Petropars, OIEC, Khatam Al Anbiya Construction and Mapna Group.

Riviera’s Offshore Support Journal Conference, Middle East will be held in Dubai, UAE, 11 December 2024. Click here to register your interest in this industry-leading event.

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.