Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Nakilat lifted 2025 profit, advanced fleet programme

Nakilat reported a full year 2025 net profit of US$464M and set out dividend and shipbuilding updates tied to its 2026 delivery schedule

Nakilat reported a full year 2025 net profit of US$464M, up 3% year-on-year, in results for the year ended 31 December 2025.

The figure corresponded to QAR1.7Bn (US$460M), compared with QAR 1.6Bn in 2024. The board recommended a second-half 2025 cash dividend of 7.2 Qatari dirhams per share, in addition to an interim 7.2 dirhams per share already distributed for the first half, taking the full-year total to about US$0.04 per share.

Nakilat chief executive officer Abdullah Al-Sulaiti said, “We sustained dependable performance across our fleet and upheld the highest standards of safety.”

The full year 2025 financial figures release reported an operational reliability rate of 99.6% and a customer satisfaction rate of 95.3%.

The announcement also said construction continued in South Korea on two LNG carriers and four LPG/ammonia carriers at HD Hyundai Samho Heavy Industries, and that all six vessels would be owned by Nakilat.

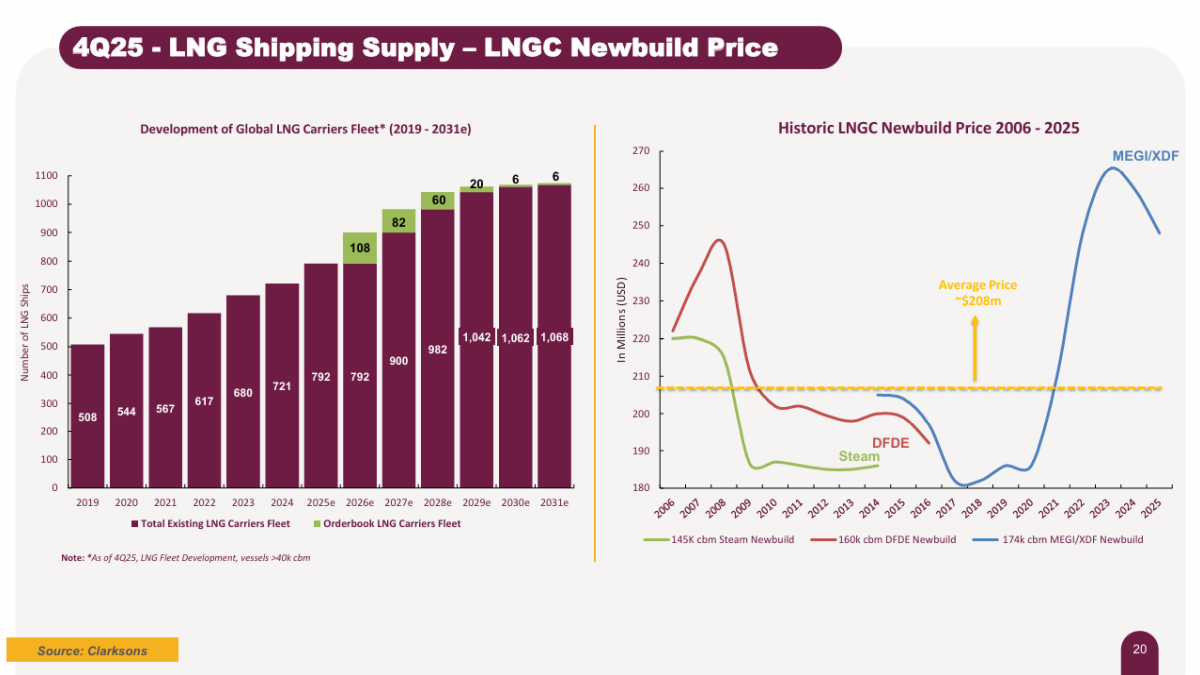

The company noted its existing modern fleet comprises 69 LNG carriers, two very large LPG carriers, one FSRU, and an orderbook of 36 LNG carriers and four LPG/ammonia carriers.

Nakilat said that, upon completion of delivery of all vessels currently under construction, its fleet would expand to 112 vessels, and it expects the first vessel from the programme by the end of 2026.

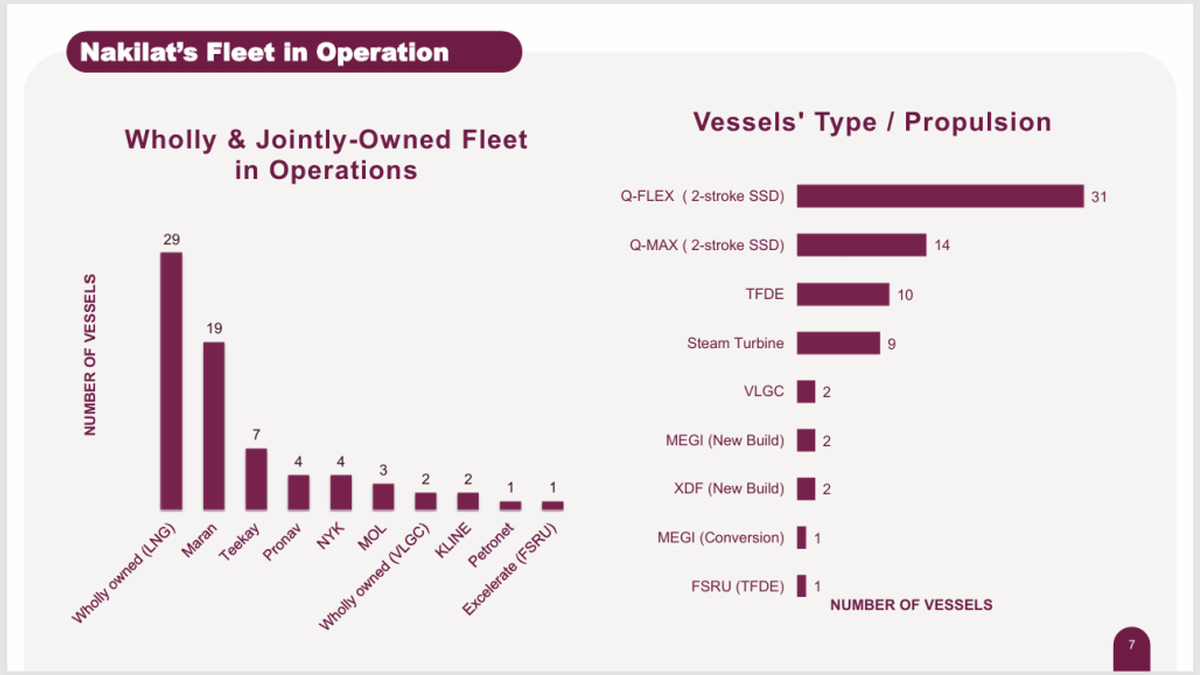

The investor presentation set out Nakilat’s view of fleet mix by vessel type and propulsion, listing 31 Q-Flex LNG carriers with two-stroke slow-speed diesel propulsion and 14 Q-Max LNG carriers with two-stroke slow-speed diesel propulsion, alongside 10 tri-fuel diesel-electric units and nine steam-turbine ships. It also listed two very large LPG carriers, two MEGI newbuilds, two XDF newbuilds, one MEGI conversion and one FSRU with tri-fuel diesel-electric propulsion.

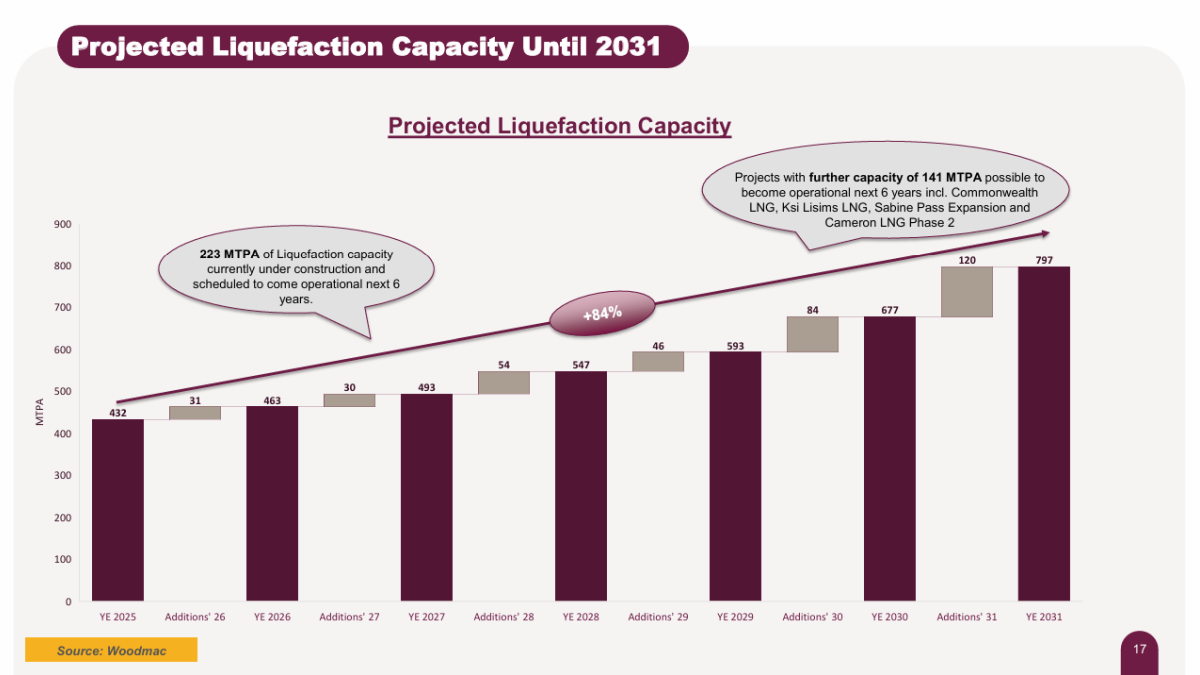

In its medium-term outlook slides, Nakilat cited Wood Mackenzie projections of global liquefaction capacity rising from 432M tonnes per annum (mta) in the year ending 2025 to 797 mta by the end of 2031, and linked the increase to higher LNG transport requirements.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.