Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Rigs report: Noble-Maersk Drilling merger concludes; Middle East drives jack-up use

After a year-long wait, the Noble and Maersk Drilling merger is final, while ADNOC Drilling has purchased two more jack-ups for a combined US$140M

Drilling contractors Noble Corp and Maersk Drilling have completed their anticipated multi-billion dollar merger, nearly a year on from the initial announcement

The merger creates an industry powerhouse with one of the youngest and highest specification fleets in the industry, with a contract backlog of over US$4Bn. The transaction concluded through the completion of Noble’s recommended voluntary public share exchange offer to the shareholders of Maersk Drilling.

Noble Corp said it has received preliminary commitments from a group of banks to enter into a US$350M, three-year term loan to replace the existing Maersk Drilling syndicated facilities and another commitment for a US$150M, three-year term loan to replace the existing Maersk Drilling loan with Danish Ship Finance.

Both loans have an initial interest rate of Term SOFR plus 3.5% with margin increases beginning in year two. The loans remain subject to final documentation and customary closing conditions, which the company anticipates will be completed in Q4.

And Noble expects to close the previously announced sale of five jack-up rigs, worth a combined US$375M, to Shelf Drilling later this week after the UK Government’s Competition and Markets authority gave final clearance for the proposed merger plans in September.

The British Government is also looking to speed up new energy projects, targeting five oil and gas fields for accelerated development as part of its well-publicised ’mini-budget’.

The UK Treasury’s Growth Plan 2022 earmarked the BP-operated Murlach oil field, Harbour Energy-operated Talbot field, NEO Energy’s Affleck redevelopment, the Victory field and Ithaca Energy’s controversial Cambo Phase 1 field for accelerated development by the end of 2023.

Last week, OSJ reported the UK has lifted its moratorium on shale gas and will consider applications for fracking, with a licensing round expected to commence this month.

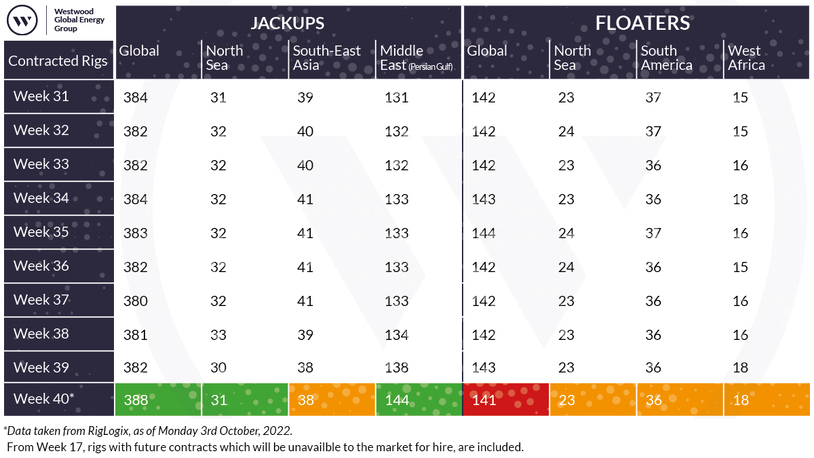

As we enter week 40, the active number of jack-ups rose to a high of 388 units driven by activity in the Middle East; while floaters slipped marginally to 141 active units.

In the Middle East, ADNOC Drilling purchased two more jack-ups for a combined US$140M as part of an accelerated growth strategy. The state-owned firm aims to raise its crude oil production capacity to 5M barrels per day (b/d) by 2030.

ADNOC previously signed purchase agreements in May for two rigs, in June for one rig and in late August for a further rig.

The two new rigs will join the ADNOC Drilling fleet and commence operations by the end of 2022. Since listing on the Abu Dhabi Securities Exchange last October, ADNOC Drilling has expanded its fleet from 96 to 105 owned rigs, as of 31 July 2022.

Three Valaris jack-ups, Valaris 76, Valaris 54 and Valaris 108, employed by Saudi Aramco, have also had their contracts extended by 292, 204 and 142 days respectively, in contract updates totalling US$95M.

In the North Sea, jack-up Maersk Invincible recommenced operations in Norway after a four-month drydock in Denmark involving upgrades to the vessel aimed at lowering its emissions. The rig is employed by Aker BP after Norway’s Petroleum Safety Authority Norway consented to using Maersk Invincible rig on the Norwegian Ivar Aasen field. Aker plans to drill 50 wells next year and invest US$15Bn over the next five years.

Other assets on the Norwegian Continental Shelf have changed hands. Norwegian firm Sval Energi has acquired a 19% stake in the Martin Linge unit and full participating interests in Greater Ekofisk Area from Equinor. The company noted these transactions add “around 34,000 barrels of oil equivalent per day to Sval’s production.” In August, Sval acquired the Norwegian arm of Canada’s Suncor Energy, adding around 19M barrels of oil equivalent in reserves to its portfolio.

Equinor has exercised a further well for the Deepsea Stavanger semi-submersible. In August, Norway’s state-owned producer received regulatory consent to use the rig in the Othello North prospect.

The extension adds 120 days to Deepsea Stavanger’s firm backlog, which now reaches into Q4 2023 at a day rate similar to the current contract up to 1 May 2023. Equinor also has the opportunity to exercise further wells.

Solstad Offshore’s platform supply vessel Normand Titus has been fixed to Trident Energy’s Brazilian subsidiary for a year-long firm contract with a one-year option. The contract commences early Q4 2022.

TotalEnergies EP Brasil exercised an option for the drillship Valaris DS-15, adding another 100 days to its existing firm term. And BP exercised a four-well option, valued at approximately US$24M, for the heavy-duty modern jack-up Valaris 118. The option has an estimated duration of 200 days and will be in direct continuation of the existing firm programme offshore Trinidad.

Finally, Shell awarded Maersk Drilling a contract for semi-submersible Maersk Developer commencing in March 2023 for 90-day period. The rig will drill one exploration well and perform subsea well interventions at the BC-10 field in the Campos basin, offshore Brazil.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.