Business Sectors

Events

Offshore Wind Webinar Week

Contents

Register to read more articles.

Rigs report: Saipem share price sinks on failed capital-raising bid; Equinor restarts Peregrino production

Saipem stock was cut by nearly half after an attempt to raise about €2Bn (US$2Bn) in shareholder capital failed, and Equinor reported production in Brazil’s Peregrino field had resumed after more than two years of a major maintenance and repair programme on the FPSO stationed there

Saipem stock was cut by nearly half after an attempt to raise about €2Bn (US$2Bn) in shareholder capital. The attempt failed to achieve the full investment, with the company only raising 70% of its intended capital, and Saipem’s stock dropped by 49% to €1.95 (US$1.99) on 12 July. The stock has dropped further, and is currently at €0.77(US$0.78) as of 20 July, prompting fears the company could be delisted. A group of major banks – BNP Paribas, HSBC, Citigroup, Deutsche Bank, Intesa Sanpaolo, UniCredit ABN AMRO, Banca Akros/BPM, Santander, Barclays, BPER, Goldman Sachs, Société Générale and Stifel – agreed to take on any unsubscribed shares to cover the outstanding capital needed for the €2Bn capital increase. In total, there was an overhang of nearly €600M.

Saipem is controlled by Italian energy group Eni and Italy’s state lender CDP. In March, the company presented a new restructuring plan to cut costs and focus more on its offshore engineering and construction business. In late June, Saipem secured contracts in the Middle East worth US$1.25Bn. Last week, Saipem and Saudi Aramco signed an agreement to set up a new Saudi-based entity.

The company’s Scarebeao 8 rig has wrapped up its North Sea drilling campaign for German oil and gas firm Wintershall Dea. Drilling operations on the Nova field have been completed ahead of first oil, which is expected at the end of July, while the water injection system is due to be completed in September.

Saipem’s semi-submersibles Scarabeo 9 and Scarabeo 5 will continue operations offshore Angola with Eni into mid and early August, respectively. These are extensions to their existing contracts and Eni has options to extend employment into mid-2023 for Scarabeo 9 and November 2022 for Scarabeo 5.

Equinor reported production in Brazil’s Peregrino field resumed on 16 July after operational issues aboard a FPSO halted production from the Campos basin field in April 2020.

Equinor has since executed a major maintenance and repair programme on the FPSO and installed a new platform, Peregrino C. Production from the new platform is expected Q3 2022.

The new platform is part of the Peregrino Phase II project which will extend the lifetime and value of the field and add 250-300M barrels.

Peregrino is the largest field operated by Equinor outside of Norway and the first of a series of major field developments in Brazil. Remaining reserves from Peregrino Phase I are estimated at 180M barrels.

Equinor awarded further work for Odfjell Drilling’s Deepsea Stavanger semi-submersible rig in the North Sea offshore Norway. The two companies entered into a contract May 2021, and the deal was awarded under an optionality clause in the contract. Odfjell said the rig has eight remaining wells to drill and expects the rig to be employed until at least Q3 2023.

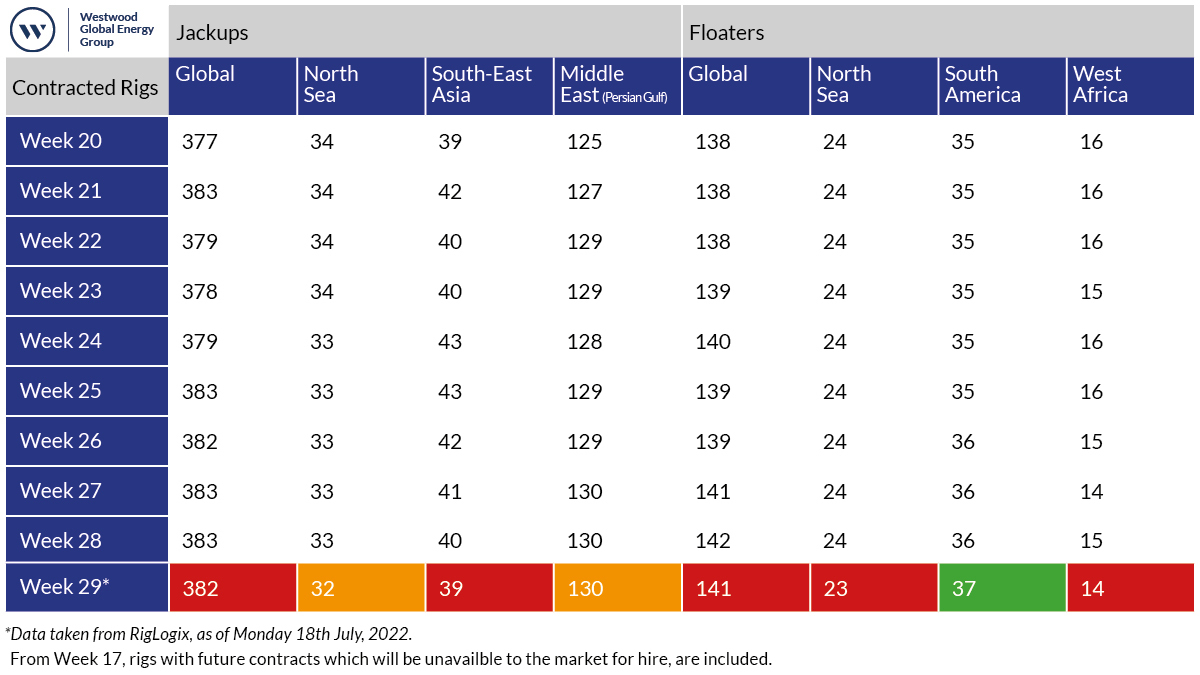

Active jack-up and floater units dipped slightly week-on-week across nearly all regions; South America saw an increase and overall numbers remain high. In all, active jack-ups stood at 382 units and floaters stood at 141, according to the latest data from Westwood Global Energy.

As OSJ reported last week, the Asia Pacific and Middle East regions continue to drive drilling activity. Borr Drilling has secured a binding letter of award for the Mist jack-up from Emirati firm Mubadala Petroleum in Thailand. The 210-day programme is expected to commence January 2023 and has an estimated total contract value of US$25M.

Heavy-lift vessel GPO Grace departed from Subic Bay, Philippines, 8 July and is currently transporting Admarine 690 (formerly Valaris 113) and Admarine 692 (formerly Valaris 114) rigs to the Middle East.

UK-based Harbour Energy announced it completed drilling the Timpan-1 exploration well, located 150 km offshore Indonesia, in a water depth of 1,294 m. The well was drilled using Vantage Drilling’s West Capella drillship, which is managed by the drilling contractor Vantage and owned by Aquadrill, formerly known as Seadrill Partners.

The well was drilled to a vertical depth of 4,211 m subsea. The well encountered a 118-m gas column in a high net-to-gross, fine-grained sandstone reservoir with associated permeability of 1-10 mD. A full data acquisition programme has been completed.

Vantage will also be reactivating its drillship Polaris for a campaign in India for state-owned Oil and Natural Gas Corporation. The campaign is worth US$67M and will begin Q4 2022. The rig is currently in Labaun, Malaysia.

Offshore contractor Shelf Drilling has completed the purchase of the Deep Driller 7 jack-up rig from India’s Aban Offshore Ltd for US$30M. The 2008-built rig has been renamed Shelf Drilling Victory and is a Baker Marine Pacific Class 375 design.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Events

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.