Business Sectors

Events

Offshore Wind Webinar Week

Contents

Register to read more articles.

Rigs report: south Asia and Middle East continue to drive rig utilisation

Westwood Global Energy analysts expect drillship day rates to improve further and are seeing more rig activity in the Asia Pacific region in 2022

In southeast Asia, however, not all of the activity is due to increasing rig demand from operators. Westwood analysis showed that several cold-stacked and stranded newbuild jack-ups that are being reactivated in the region are intended for contracts in other regions, primarily the Middle East.

Jack-up utilisation in Asia Pacific stands at 90% in 2022 but Westwood said a significant portion of that demand is driven by Saudi Aramco. Of the 45 contracted/committed rigs in southeast Asia, six are destined for Saudi Arabia and four forthcoming newbuilds are also slated to move there. By the end of 2022 or early 2023, 15 jack-up rigs will have departed the region to work for Aramco.

There are only three available drillships in southeast Asia and two of those are currently contracted. The largest number of jack-up requirements are in Malaysia, followed by Indonesia and Vietnam. Transocean’s Dhirubhai Deepwater KG2 is the lone stacked unit, and analysts think the rig may secure a contract soon.

Westwood expects upcoming rig day rates to hover around the US$270,000 mark, a significant increase on the US$220,000 range seen for most of 2022.

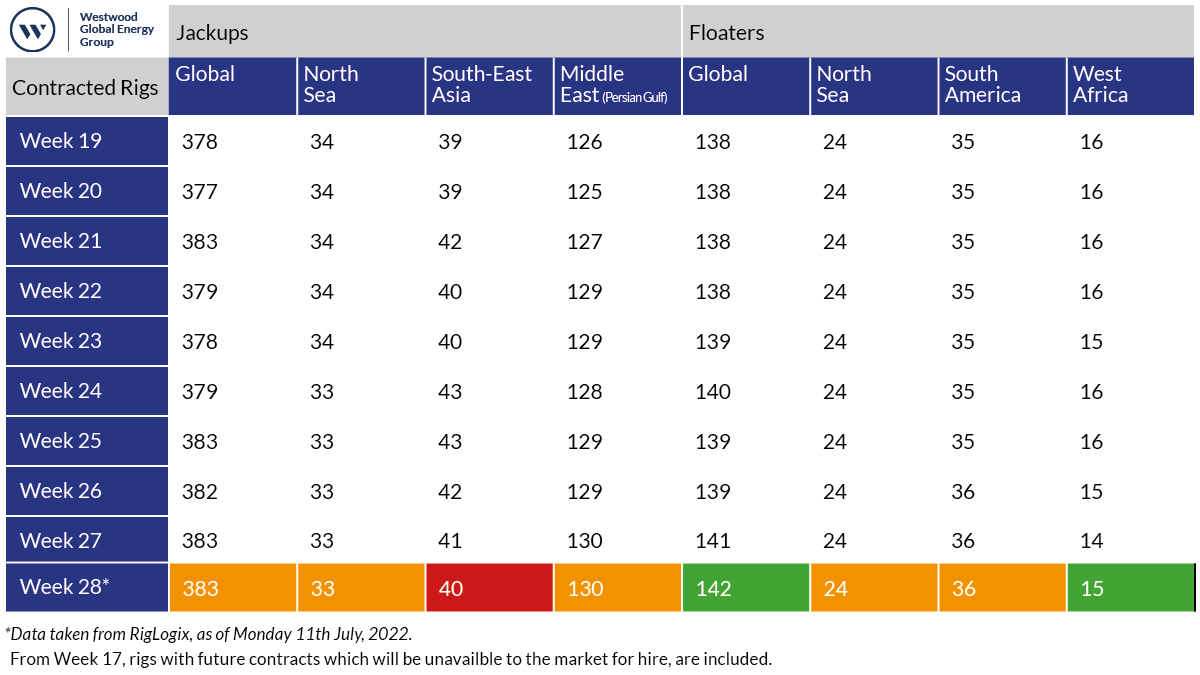

In week 28, 2022 the number of total active jack-up rigs remained unchanged week-on-week, while floaters gained by one unit.

Of the 12 semi-submersible rigs in the Asia Pacific, seven are in southeast Asia and five are being marketed. Four of the five units are currently working, but only two have contracts that extend beyond 2022. Only three new semi-submersible contracts have been signed this year, with day rates still below US$200,000.

In total, the Asia Pacific region has over 40 programmes in some stage of rig enquiry, including 13 in Australia alone, a significant number considering there are only two jack-ups. Noble Tom Prosser and Valaris 107 are the two rigs operating in Australia, while Valaris 249 recently began work offshore New Zealand and may enter the Australian market in February 2023 at the end of the current contract.

All five semi-submersibles in Australia are currently employed, with three staying employed into 2024. One of the rigs will go idle as of this month (July 2022). Of the three new semi-submersible contracts signed in 2022, the most recent fixture hit a rate of US$379,000 per day.

A labour dispute in Australia has led to the temporary suspension of LNG cargoes from Shell’s Prelude FLNG. The disruption will preclude cargo loading until at least 21 July according to reports. Prelude’s production has been intermittent since it discharged its first cargo in 2019. In 2020, Shell was forced to close the unit for 11 months after an electrical trip led to a series of extensive investigations and repairs and the unit only resumed operations in April 2022.

Another production disruption was reported this week, when a gas leak in a contained area related to a turbine on Equinor’s Sleipner A offshore platform caused the field to close. Norway’s gas operator Gassco said it received notification of “technical challenges” on the Sleipner field which has resulted in a full shutdown, including the Sleipner Riser Platform. Gassco estimates that operations will resume by the end of the week.

Last week, Equinor initiated a production shutdown at the Gudrun, Oseberg South and Oseberg East fields on the Norwegian continental shelf but restarted production shortly after, as industrial action eased.

The Norwegian Ministry of Petroleum and Energy approved the plan for development and operation for Aker BP’s Frosk oilfield development this week. Frosk is co-owned and operated by Aker BP with Vår Energi and Lundin Energy Norway (an Aker subsidiary) and is estimated to hold about 10M recoverable barrels of oil equivalent and ties back to the Alvheim FPSO via existing Bøyla and Alvheim subsea infrastructure.

The field is located 28 km south of the existing Alvheim field in the central North Sea on the Norwegian continental shelf. Total investment in the project is projected at around Nkr2Bn (US$197M), with first production targeted in Q1 2023.

In China this week, Italian firm Saipem christened its new CIMC-built jack-up, Perro Negro 11. The rig is now officially part of the Saipem offshore drilling fleet and will go on a five-year charter with an additional two-year option, to a charter party in the Middle East.

In North America, Stena Drilling announce a new one-well contract with Canadian oil sands operator BP Canada Energy Group ULC for the mobile offshore drilling unit Stena IceMAX. The programme is scheduled for 2023 off the coast of Newfoundland and has an estimated duration of 80 days.

Elsewhere in the Americas, Luxembourg-based Tenaris was awarded a four-year contract by Petrobras to supply casing for the Brazilian operator’s flagship Buzios deepwater project. The contract’s total volume exceeds 100,000 tonnes of seamless and welded casing in carbon, sour service and high collapse steel grades.

The pre-salt field is among the largest deepwater oil and gas fields in the world with production expected to reach 2M barrels per day (b/d) by 2030, up from a current 0.7M b/d. That would equal approximately 70% of today’s current production in Brazil.

Finally, the board of British oil and gas group Serica Energy rejected a merger proposal valued at £1.04Bn (US$1.23Bn) made by energy investment firm Kistos. Serica produces nearly 5% of the UK’s gas supplies and the Serica board noted there was “industrial logic in combining the portfolios of the two companies.”

Serica’s own proposal to merge was rejected by the Board of Kistos 8 July. Kistos’ board cited “the wrong price, with the wrong mix of stock and cash” as one reason. Kistos also acquired a 20% share in TotalEnergies’ Greater Laggan Area offshore gas fields in the west of Shetland, and assets in the Dutch North Sea.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

Related to this Story

Events

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.