Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

On-demand manufacturing – solving the dilemma of legacy parts

OEMs can produce their own legacy marine components faster, cut downtime, and prevent grey-market spares with Pelagus’s global network of vetted suppliers

With global shipping fleets and offshore assets aging, owners increasingly face machinery breakdowns and longer downtimes due to the shortage of legacy OEM spares.

When 20-plus-year-old equipment breaks down, operators can face limited availability of parts, increased downtimes, and higher costs, explained Pelagus chief executive, Haakon Ellekjaer.

“Equipment manufacturers struggle to supply legacy parts and the end user struggles to get those parts. But it’s our sweet spot; where we can add value,” said Mr Ellekjaer.

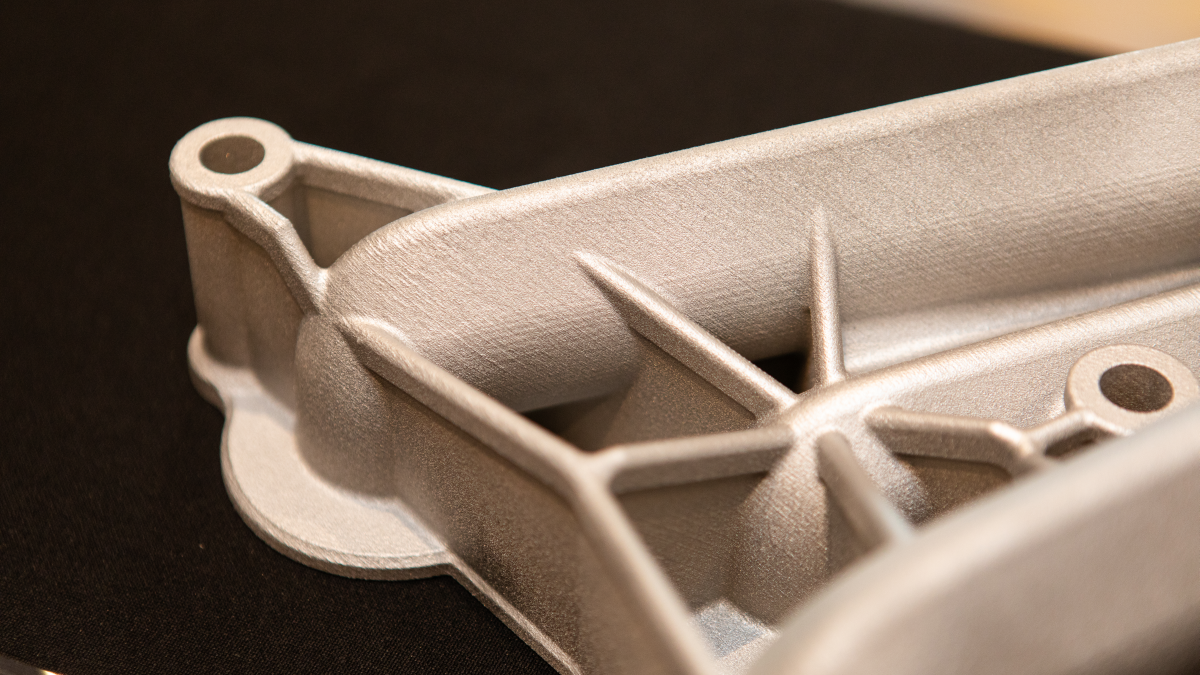

Singapore-based Pelagus, a joint venture between thyssenkrupp and Wilhelmsen, helps solve this dilemma with a digital platform, enabling on-demand manufacturing of critical components through a network of certified global manufacturers. These manufacturers use a wide range of manufacturing technologies, including conventional and additive manufacturing, to produce components to the exact specifications and materials required by genuine makers.

“After 15 years, many OEMs typically phase out production to free up capacity for new equipment and meet lower required spares volumes,” said Mr Ellekjaer. “You can address this in two ways: one, you can produce inventory to maintain parts in stock, which is expensive – its cash sitting on the shelf; two, you can produce parts on demand yourself using conventional technologies.

“But if you go for the latter, typically your lead time increases, and service becomes poor,” he explained. Additionally, this creates an opening for grey-market parts suppliers, noted Mr Ellekjaer.

“On-demand manufacturing allows production when and where it is needed”

But Pelagus’s on-demand manufacturing model transforms legacy parts into protected digital assets. A ship or asset operator places an order for a part with the OEM or genuine maker. Using the Pelagus platform, the OEM coordinates the manufacturing of the parts with Pelagus. The order will be matched with a Pelagus-approved supplier depending on factors including the production methods, materials, and location. The part will be shipped to either the OEM or the ship or asset operator after completion. This streamlines supply chains and simplifies procurement and maintenance schedules, minimising delay and reducing costs.

Critically, Pelagus safeguards OEM intellectual property at every stage of the manufacturing process. OEMs retain full ownership of their designs, data, and specifications, while sensitive part files are securely stored, encrypted, and access-controlled within the Pelagus platform. This ensures proprietary designs remain confidential and prevents unauthorised replication, eliminating grey-market risk. Through Pelagus’s global network of vetted suppliers, OEMs can produce certified parts up to 90% faster, reducing supply chain delivery times.

In one example, a return oil standpipe was manufactured for Kawasaki Heavy Industries. Additively manufactured in 316L stainless steel, the component’s weight was reduced from 75 kg to 8 kg through design optimisation. The standpipe’s reduced weight allowed the crew to install the part without the use of a crane, saving installation time. The manufacturing lead time was also slashed, from 135 days to 15 days.

“On-demand manufacturing allows production when and where it is needed,” said Mr Ellekjaer.

He noted Singapore is “a huge maritime innovation hub, with strong support from the government in terms of maritime innovation and funding joint industry programmes to increase adoption around new areas. But another element is that it’s one of the world’s largest advanced manufacturing hubs. We have access to very competent and skilled engineers, from design engineering to quality engineering to manufacturing engineering.”

Outsourcing production to a partner is nothing new to OEMs, observed Mr Ellekjaer. “But we do it globally, and we do it distributed, and we do it across all various on-demand manufacturing technologies, everything from 11-m propeller shafts to complex critical engine components. Bringing that end-user perspective into the dialogue with the equipment manufacturers is crucial in driving supply chain optimisation in the maritime and energy sector,” he said.

Related to this Story

CIC finds ballast water systems driving detentions

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.