Business Sectors

Events

Offshore Wind Webinar Week

Contents

Register to read more articles.

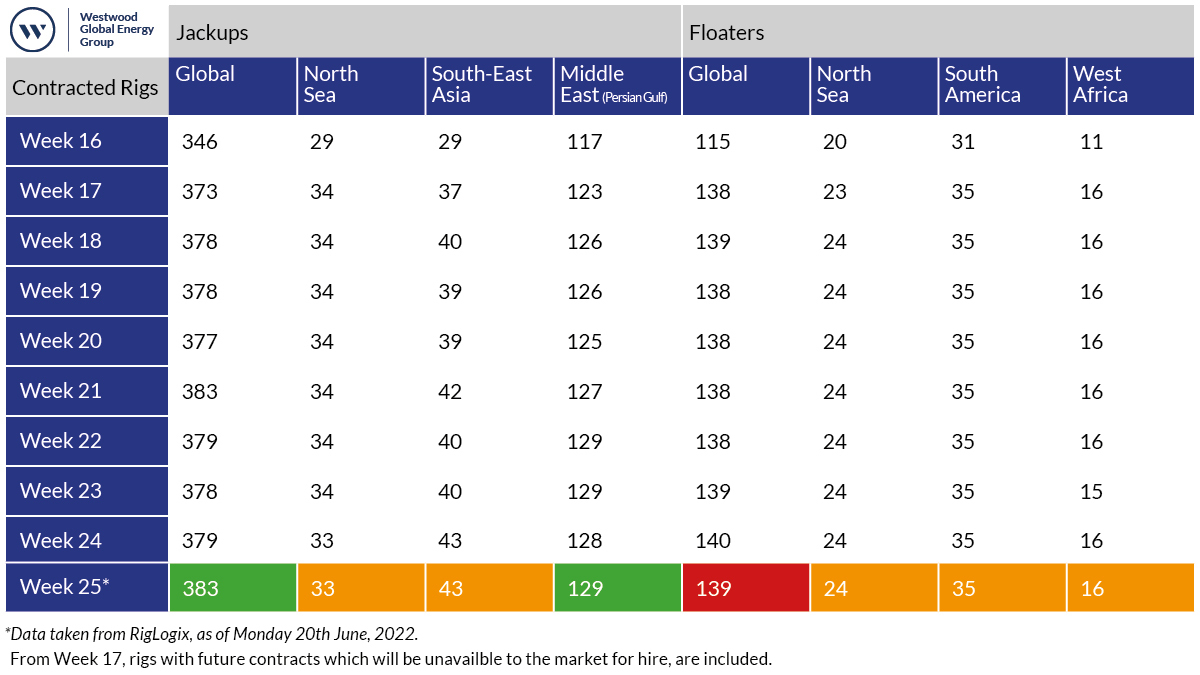

Rigs report: jack-up market surges with Middle East driving growth

Data from Westwood Global Energy pegs active jack-ups at 383 units and floaters at 139 active units for week 25, 2022

The jack-up market is booming, according to industry analysis from Esgian Rig Analytics.

The analysis shows contractors have secured 100 jack-up charters between January and March 2022, with the Middle East accounting for most of the growth. Of the 23 jack-up sales recorded by Esgian since January 2022, at least 18 are Middle East buyers, and three of the remaining five rigs are understood to have been sold into the Middle East market.

Ocean Challenger, the asset management company of China’s EPC contractor CIMC Raffles, has entered into a charter contract with Italian oilfield firm Saipem for the jack-up Gulf Driller VII. The rig will be renamed Perro Negro 11 and is scheduled to be deployed to the Middle East by August for modifications, before beginning a campaign for Saudi Aramco by the end of the year.

Aramco is in the middle of a massive contracting spree, with Westwood Global projecting them to have 78 jack-ups under contract by the end of this contracting round. Seven of those ships belong to rig operator Shelf Drilling, which has agreed to buy the Deep Driller 7 jack-up rig from Indian offshore drilling company Aban Offshore for US$30M. The 2008-built rig is based on a Baker Marine Pacific Class 375 design, and is currently in the UAE, expected to be delivered in July 2022, according to Shelf Drilling.

The Indian subcontinent takes a distant second spot behind the Middle East region, with Esgian counting 13 chartered rigs there. Several multi-year jack-up tenders are open in the region. Earlier this year, India’s state-owned Oil and Natural Gas Corporation issued tenders for two deepwater drillships.

Elsewhere, more vessels are scheduled to roll off charter by the end of June, including five with Mexican state firm Pemex.

In May, Transocean disclosed its Q1 results for 2022 and gave an update on the status of its fleet amid rising day rates for both its ultra-deepwater and harsh-environment semi-submersible fleets.

As OSJ noted, utilisation rates have improved considerably of late: Transocean projects average contract day rates for its ultra-deepwater fleet to rise to US$355,000 per day in Q1 2023, up from US$312,000 per day for Q2 2022. Likewise, it projects rates for its fleet of harsh environment semi-submersibles to climb from US$386,000 in Q2 2022 to US$439,000 in Q1 2023.

Since May, the Deepwater Skyros unit has clinched a new 10-well contract from French major TotalEnergies for work offshore Angola. The 18-month contract has an average day rate of US$310,000/day.

Equinor awarded the Transocean Spitsbergen semi-submersible rig a firm nine-well drilling programme with options for a further two wells. The 18-month contract is valued at Nkr2.4Bn (US$253M).

In the North Sea, Scottish decommissioning specialist Well-Safe Solutions announced it has been contracted by Ithaca Energy to plug and abandon six wells on the Anglia Platform in the southern North Sea.

The Aberdeen-based outfit will provide project management, well engineering and all managed delivery services for the project. An option to plug and abandon an additional three subsea wells is also available during 2023. The contract sum remains undisclosed.

An NGO, the Australian Conservation Foundation, has sought an injunction in the Federal Court of Australia related to project activities in Woodside Energy’s Scarborough development. In 2021, Woodside approved the development of the US$12Bn project – the biggest to be built in Australia in a decade.

Located approximately 375 km off the coast of Western Australia, the Scarborough field is estimated to contain 11.1Tn cubic feet of dry gas with first LNG cargo from the project targeted for 2026.

In a public statement, ACF called the project “a massive carbon bomb” and said “it should not proceed.”

“This is absolutely not the time to be approving new gas or coal projects – it is completely at odds with effective climate action”, the NGO said.

Woodside chief executive Meg O’Neill said the project is underway, having received primary environmental approvals. Ms O’Neill said, “Woodside will vigorously defend its position in these proceedings.”

And finally, a senior official in Russia-occupied Crimea has reported an attack on three Russian-controlled oil rigs in the Black Sea. One of the rigs, Chernomorneftegaz, is on fire 24 hours after the alleged strike. The rigs are located 71 km off Odessa.

Writing on social media on 20 June, Sergey Aksyonov, the governor of the Crimean Peninsula, commented “This morning the enemy struck the drilling platforms of Chernomorneftegaz... I am in touch with colleagues from the Defense Ministry and the FSB. We are working to rescue people.”

The incident has not been confirmed by Ukrainian officials.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

Related to this Story

Events

Offshore Wind Webinar Week

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

© 2024 Riviera Maritime Media Ltd.