Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

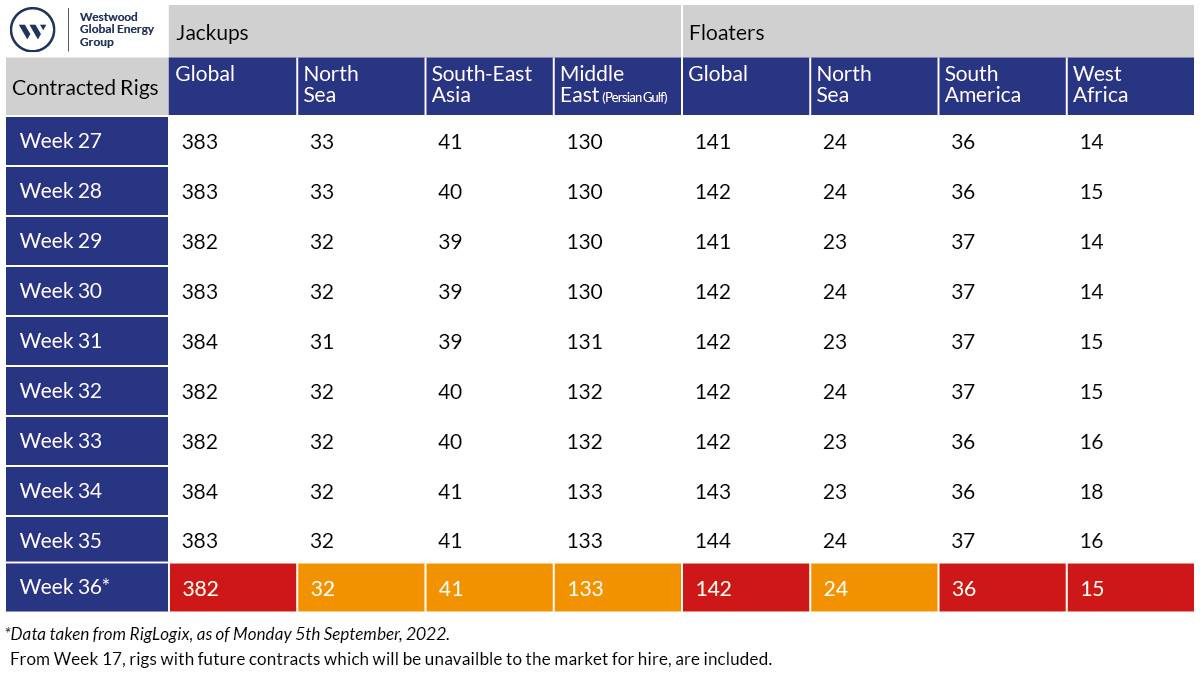

Rigs report: exploration predicted to slow worldwide

In week 36 2022, the offshore market continues to hold firm with jack-ups at 382 units while active floaters stand at 142 units

Analyst Rystad Energy predicted “the effects of the Covid-19 pandemic and the ensuing oil market crash” is causing global oil and gas exploration to falter this year, with the number of licensed blocks and total acreage falling to near all-time lows.

Rystad reports 21 lease rounds were completed globally from January through August 2022, half the number of the same time period in 2021, with the acreage awarded in 2022 shrinking to a 20-year low of 320,000 km2.

Rystad said offshore leased acreage has plateaued since hitting a high point in 2019. Global lease rounds are expected to total 44 in 2022, 14 less than in 2021 and the lowest level since 2000.

Concluded lease rounds in 2022 have dropped significantly in Russia, the US and Australia, falling to a combined five lease rounds in total, compared with 17 rounds in the same countries through the first eight months of 2021.

Among the few bright spots, however, Brazil has awarded the most blocks of any country this year with eight offshore blocks split between European majors Shell (six blocks) and TotalEnergies (two blocks). Asian licensing, too, has bucked the downward trend with increased activity and blocks awarded in Malaysia, India, Indonesia and Pakistan.

Rystad’s analysis cited a difficult geopolitical landscape as a contributing factor to the decrease in licence awards globally, with many governments pausing leases and

encouraging companies to wrap up exploration activity within already awarded blocks. Rystad expects this trend will continue as governments look to move away from fossil fuel production and toward renewables in the push to decarbonise.

“Global exploration activity has been on a downward trend in recent years, even before the Covid-19 pandemic and oil market crash, and that looks set to continue this year and beyond. It is clear oil and gas companies are unwilling to take on the increased risk associated with new exploration or exploration in environmentally or politically sensitive areas” said Rystad vice president of analysis, Aatisha Mahajan.

In rigs contracts news, Odjfell Drilling’s Deepsea Nordkapp was assigned a two-well extension from Aker BP. The US$60M deal has a duration of six months and will commence in direct continuation of the rig’s current firm contract period, keeping Deepsea Nordkapp occupied into late Q3 2024.

The semi-submersible Deepsea Yantai rig will complete a one-well firm deal for DNO Norge in PL 984 in the North Sea. The 50-day contract will commence Q2 or Q3 2023.

In addition, Odfjell awarded KBR a study to develop a carbon-neutral, green ammonia-based power system for an Odfjell semi-submersible unit, working with Equinor and Wärtsilä to assess converting the diesel generators on drilling units to ammonia-fuelled generators.

Transocean’s ultra-deepwater drillship Deepwater Asgard received two contract awards in the US Gulf of Mexico for 14 months of work, adding another US$181M in firm backlog for the company.

The first award is a one-well contract with Houston-based Murphy Oil Corp at US$395,000 per day and is expected to commence late this year after the rig completes its current contract and a planned out-of-service period. The contract includes an option for a second well at the same day-rate. The backlog for the firm contract is approximately US$20M.

The second award, a year-long contract with another (unnamed) operator at US$440,000 per day (plus up to US$40,000 per day for additional products and services), is expected to commence in the first half of 2023 and includes three one-year option periods at mutually agreed day rates. Transocean pegged the firm backlog associated with the contract at US$161M.

Last month, Petrobras extended the operator’s Petrobras 1000 rig by another 5.5 years into 2029.

Norwegian contractor Island Drilling will mobilise the Island Innovator rig and associated services for Trident Energy’s drilling campaign offshore Equatorial Guinea. Work on the two firm wells is planned to start September or October 2023. There are five optional wells associated and the campaign is estimated to be 250 days if all the options are exercised. This will be the third project for Island Drilling in Africa since the rig was warm stacked at the beginning of 2020.

Shell has exercised an option to extend the provisioning of the 7th-generation drillship Maersk Voyager for drilling services offshore Mexico. Valued at US$77M, the contract extension will commence April 2023 in direct continuation of the rig’s current contract, with a firm duration of six months. The parties have further amended the options included in the contract, so that it now contains options to add up to 18 months of additional drilling work.

Maersk Drilling’s proposed merger with Noble Corp is inching towards conclusion following approval from the UK antitrust regulator.

And Eni’s Australian subsidiary has submitted an environmental plan to Australia’s offshore regulator NOPSEMA for development drilling on a gas field off the coast of Western Australia. The environmental plan, submitted in July, is related to development on an offshore drilling programme in the Blacktip field offshore Darwin.

The plan includes drilling up to two additional wells and completing work on an existing well to boost production from the field.

Eni’s scope of work includes geophysical site survey at the wellhead platform of the Blacktip field and drilling two development wells (P3 and P4) using a jack-up rig and the workover of the exisiting P1 development well.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.