Business Sectors

Events

Contents

Register to read more articles.

How Cat’s R&D is supporting industry’s decarbonisation goals

Caterpillar is collaborating with shipbuilders and government to advance new engine, energy-storage and shoreside-charging solutions to reduce emissions

At the IMO MEPC 80 meeting in July 2023, delegates adopted a revised strategy for reducing greenhouse gas (GHG) emissions from ships. Crafted to accelerate the decarbonisation of shipping, the revised strategy aims to cut the carbon intensity of ships by an average of at least 40% by 2030 compared to 2008 levels, while increasing the uptake of zero or near-zero GHG emissions technologies, fuels or energy sources to represent at least 5%, while striving for 10% of the energy in the same timeframe.

Within the strategy are ‘indicative checkpoints’ to track the progress of shipping in meeting GHG reduction goals, serving as signposts on the way to reaching net-zero ambitions by or near 2050. These indicative checkpoints call for a reduction of total annual GHG emissions from shipping compared to 2008 levels by at least 20%, striving for 30% by 2030, and at least 70%, striving for 80% by 2040.

These are lofty ambitions, particularly considering the lack of availability, supply, regulatory guidelines, training and technologies needed for the use of low- and zero-carbon fuels in shipping that will be required to reach these aggressive reductions in carbon intensity and GHG emissions.

Uptake of dual-fuel engines

Driven by international and regional environmental regulations, such as the EU Emissions Trading System and FuelEU Maritime, and their own net-zero targets, shipowners have begun to walk their decarbonisation pathways. The paths are being laid with investments in energy-saving devices, flexible dual-fuel engine technology and energy storage systems. A clear sign of this is the shift in the shipyard orderbook. By tonnage, some 45% of all newbuild orders placed in 2023 were for alternative fuel-capable ships, according to Clarksons Research.

“Burning methanol is an emissions reduction pathway”

Dual-fuel technology capable of burning methanol has gained traction among vessel owners, particularly following the successful maiden voyage of Laura Maersk, the world’s first methanol-powered container ship, in 2023. Of the 552 alternative-fuel-capable ships ordered in 2023, 135 are methanol dual-fuel propulsion, according to data shared by Clarksons Research. While container ships equipped with methanol-capable, two-stroke, slow-speed propulsion dominate the orders, there are a handful of offshore vessels that will be equipped with four-stroke, medium-speed engines, some paired in battery-hybrid applications.

Methanol, batteries and shore power

To meet the growing demands of owners for methanol dual-fuel-capable technology, engine designers and builders such as Caterpillar are conducting intensive R&D in new engine technology for newbuilds and vessel conversions, as well as the integration of batteries in hybrid marine applications paired with shoreside charging.

In 2022, Caterpillar announced it was making investments in the development of methanol engine technologies for the marine sector, and the engine builder has since expanded its collaborative efforts with shipbuilders to integrate alternative-fuel engine, battery-hybrid and electrification technologies.

“Burning methanol inside an internal combustion engine is an emissions reduction pathway that we see has potential,” says William Watson, marine product manager, Caterpillar.

One way Caterpillar is working to advance that potential is by partnering with the US Department of Energy’s Oak Ridge National Laboratory (ORNL) on testing methanol in a modified four-stroke, in-line, six-cylinder Cat marine engine. Methanol is an attractive alternative fuel because it reduces CO2 emissions, NOx and SOx compared to marine diesel on a tank-to-wake basis. Additionally, methanol is stored as a liquid, has a relatively high energy density, making it easier to store and handle, and can be more readily integrated into existing engine designs and operation.

The R&D is expected to yield new engine design concepts and engine combustion strategies, including dual-fuel, dimethyl ether reforming and spark-ignited prechambers.

Collaboration with shipbuilders

Caterpillar is also collaborating with international boatbuilders to advance its knowledge in alternative fuels and battery-hybrid technologies. In H2 2023, Caterpillar Marine inked two separate memoranda of understandings (MoU) with Singaporean shipbuilders to incorporate battery-hybrid and alternative fuel technologies in offshore vessels, workboats and ferries. One, announced in November with Penguin International, would facilitate collaboration between the Singapore-based aluminium boatbuilder and Cat engine distributor Tractors Singapore Limited (TSL) on employing emissions-reduction technologies, including batteries and alternative fuels, in crew transport vessels (CTVs) and fast crewboats.

“There is no one solution that fits all”

A second, detailed in September, would see Caterpillar collaborate with Strategic Marine, which has delivered over 600 vessels worldwide for maritime, the offshore energy industry, tourism and naval defense applications. Strategic Marine has incorporated lower-emission propulsion technologies into its product range of CTVs and fast crewboats.

“We are looking to support our customers’ efforts with new solutions, depending on whether it is to reduce emissions or total cost of ownership,” explains Mr Watson. He sees collaboration with shipbuilders as an opportunity to prove the technologies in the field.

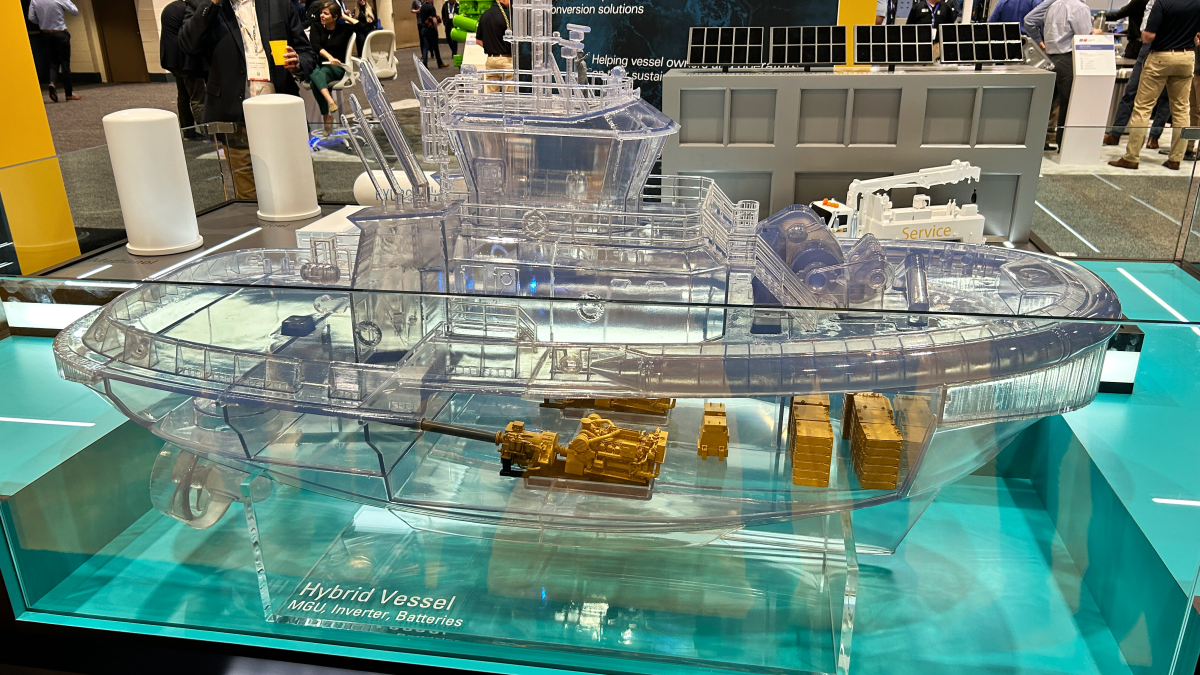

Much of Caterpillar’s vision for the future of marine propulsion was on display at the International Workboat Show in New Orleans in December. A detailed translucent model at the booth showed a hybrid-battery tug connected to shore-power charging, with power supplied via a hydrogen-fuelled microgrid.

“Shoreside charging is a testament to the breadth of applications Caterpillar is involved with,” says Mr Watson. He points out that Caterpillar’s business covers far more than marine, encompassing the power generation, mining and construction sectors. One example is the Cat Microgrid System, which incorporates photovoltaic solar modules, energy storage and reliable power generation using renewable and alternative fuels. Another is its experience in autonomy in mining, where trucks have been equipped with Cat Minestar Command for hauling.

“We are able to bring solutions developed for land-based applications to the marine sector, pairing them with our other marine offerings,” Mr Watson observes.

But Mr Watson is fully aware of the challenges and opportunities presented by the energy transition and the implications and expectations for engine designers and builders for the marine sector.

“Today’s primary technology for energy on board a vessel is an internal combustion engine — a technology that’s been around for about 100 years. You can start to bring in electrification and batteries, and, potentially later, other technologies, such as fuel cells,” he says.

Applying batteries and energy storage opens the possibility of using the stored power for peak shaving operations, or potentially installing only one generator, lowering a vessel’s opex and capex.

“But,” concludes Mr Watson, “there is no one solution that fits all.” Technology choices will have to be made based on on an owner’s goals and a vessel’s operational profile.

Related to this Story

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.