Business Sectors

Events

Contents

Register to read more articles.

LNG imports to China tumble 20% in 2022

LNG imports to China fell 20% in 2022, driven lower by strict Covid lockdowns and increasing use of natural gas from domestic production and pipeline sources, including Russia

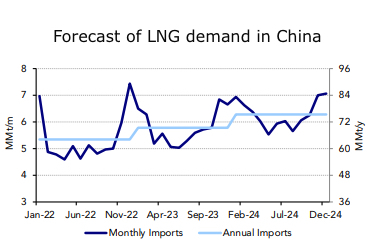

Analysis by Poten & Partners showed LNG imports to China declined by 20% year-on-year in 2022 to 64.4M tonnes, hitting their highest monthly level to 7.5M tonnes in December.

The Chinese Government’s strict zero-tolerance Covid-19 restrictions, increasing domestic production of natural gas output and the substitution of other various means of covering energy demand led to a decline in LNG imports.

“Sentiment towards LNG demand has improved since Covid-19 restrictions have been lifted and LNG prices have dropped due to present ample supplies in Europe,” noted the commodity and ship broker and energy analyst.

While the shift away from zero-Covid on 8 December led to LNG imports hitting their highest monthly levels in December, this is not be taken as an indicator of robust growth in demand from China for 2023 and 2024.

“However, China continues to resell cargoes from new contracts that started in 2022 and from contracts that start in early 2023. This evidences a weaker market than indicated by the re-opening of the economy and higher imports in December 2022,” said Poten & Partners.

The energy analyst is forecasting “moderate growth” of about 8% year-on-year in LNG imports in 2023 to 69.6M tonnes and almost 9% year-on-year to 75.7M tonnes by 2024.

Domestic natural gas rising

While LNG imports decreased by 20% in 2022, gas demand only fell by 1% year-on-year from 378 billion cubic metres (bcm) in 2021 to 373 bcm in 2022. At the same time, domestic gas production jumped by 6% to 220 bcm in 2022 which accounted for roughly 60% of demand – up from 55% in 2021, according to Poten & Partners.

Expectations are that domestic Chinese production will continue to make up a larger share of the country’s energy mix, a trend that has been seen for the past few years.

Poten & Partners projects domestic production’s share of gas demand will “hold constant” at 60% as demand rises by 8% in 2023 to 238 bcm and 3% in 2024 to 245 bcm.

China reported record output in 2022 and continues to invest heavily in increasing natural gas output.

Besides increasing natural gas output from domestic production, China is also increasing its natural gas imports, including those from Russia.

Poten & Partners reported pipeline imports increased from 47 bcm in 2020 accounting for 14% of demand to 64 bcm in 2022, accounting for 17% of demand.

“China has not released data showing the volume and source of pipeline imports since the war in Ukraine broke out, but data on the value paid for Russian pipeline gas is available,” noted the energy analyst.

This, they pointed out, was shown by the cost of pipeline gas from Russia jumped from US$4Bn in 2021 to nearly US$7Bn in 2022, indicating larger flows.

“All these factors indicate that China is likely to remain out of the spot LNG market for much of 2023,” concluded Poten & Partners.

Domestic natural gas rising

While LNG imports decreased by 20% in 2022, gas demand only fell by 1% year-on-year from 378 bcm in 2021 to 373 bcm in 2022. At the same time, domestic gas production jumped by 6% to 220 bcm in 2022 which accounted for roughly 60% of demand – up from 55% in 2021, according to Poten & Partners.

Expectations are that domestic Chinese production will continue to make up a larger share of the country’s energy mix, a trend that has been seen for the past few years.

Poten & Partners projects domestic production’s share of gas demand will “hold constant” at 60% as demand rises by 8% in 2023 to 238 bcm and 3% in 2024 to 245 bcm.

China reported record output in 2022 and continues to invest heavily in increasing natural gas output.

Besides increasing natural gas output from domestic production, China is also increasing its natural gas imports, including those from Russia.

Poten & Partners reported pipeline imports increased from 47 bcm in 2020 accounting for 14% of demand to 64 bcm in 2022, accounting for 17% of demand.

“China has not released data showing the volume and source of pipeline imports since the war in Ukraine broke out, but data on the value paid for Russian pipeline gas is available,” noted the energy analyst.

This, they pointed out, was shown by the cost of pipeline gas from Russia jumping from US$4Bn in 2021 to nearly US$7Bn in 2022, indicating larger flows.

“All these factors indicate that China is likely to remain out of the spot LNG market for much of 2023,” concluded Poten & Partners.

Riviera Maritime Media is holding the LNG Shipping & Terminals Webinar Week, 14-16 February 2023, use this link to access more information and register for these free webinars

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.