Business Sectors

Events

Contents

Register to read more articles.

Alternative fuel newbuild ordering binge in 2024 pushes global fleet past 2,000 vessels

While green fuel availability remains uncertain, shipowners signed contracts for a record 515 alternative fuel-capable newbuilds, representing a 38% year-on-year growth, led by orders for 264 LNG-fuelled ships

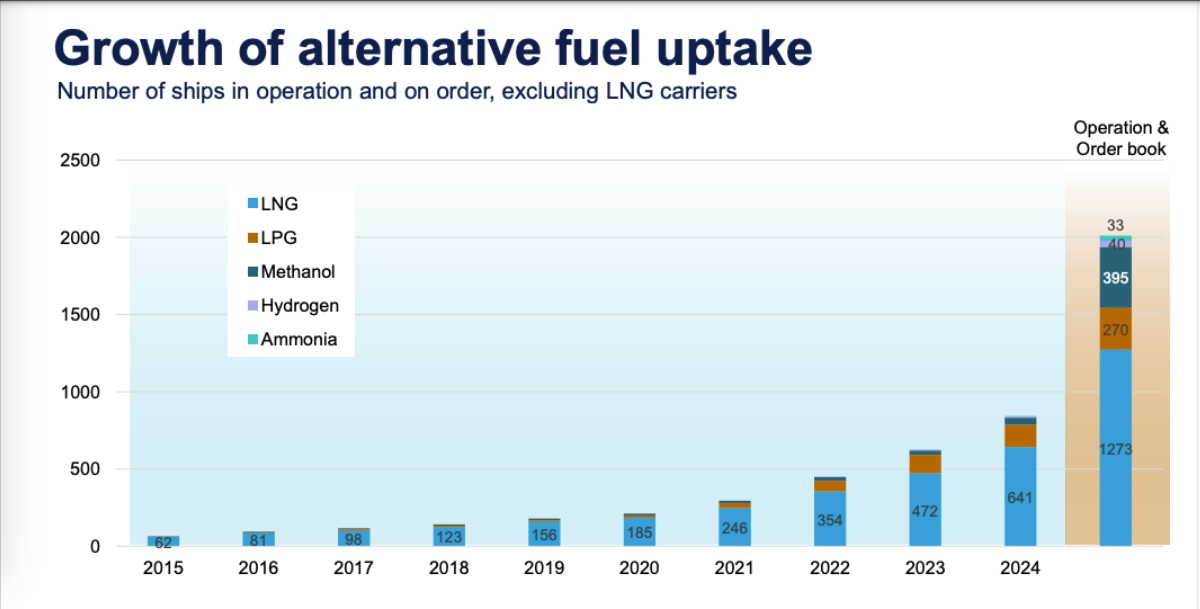

Shipowners ordered alternative-fuel-capable ships at record levels in 2024, signing contracts for 515 newbuilds, representing a 38% year-on-year growth. As result of the newbuilding boom in 2024, the global fleet of alternative fuel-capable ships in operation and on order has now eclipsed 2,000 vessels.

The global fleet and orderbook results, revealed by DNV’s Alternative Fuels Insights (AFI) platform, were characterised as “promising,” by DNV Maritime chief executive Knut Ørbeck-Nilssen, but he urged shipping, “must keep pushing forward” if it is to meet IMO’s greenhouse gas (GHG) emissions reduction targets, and its overall maritime decarbonisation ambitions.

The sobering reality is that despite the massive amount of investment in alternative-fuelled capable ships over the last decade, only 3.3% (on a gross tonnage basis) of the global fleet in operation can operate on LNG, LPG, methanol, hydrogen or ammonia. If one assesses the alternative fuel-capable fleet by number of ships, it’s even worse, with less than 1.0% equipped to burn ‘green’ fuels.

And availability of those green fuels at scale is still highly uncertain. “The technological transition is underway, but supply of alternative fuel is still low,” pointed out Mr Ørbeck-Nilssen. “As an industry, we need to work with fuel suppliers and other stakeholders to ensure that shipping has access to its share of alternative fuels in the future.”

LNG fuel of choice in 2024

Over the last three years, the container shipping and car carrier sectors have been frontrunners in ordering alternative fuel-capable newbuilds, and their fuel of choice has emerged as LNG, at least for the moment. In total, the container and car carrier segments made up 62% of all alternative fuel orders in 2024.

LNG experienced a renaissance in 2024, with more than double the orders placed in 2023 (130 newbuilds). Overall, 264 LNG-fuelled newbuilds were ordered (excluding LNG carriers) in 2024, of which 142 were container ships.

Methanol, an early leader in ordering in 2024, accounted for 32% of the orderbook of alternative fuels, with contracts signed for 166 vessels. Most of these methanol orders (85) were in the container segment.

A total of 27 orders were placed for ammonia-fuelled vessels, including the first non-gas carriers.

A record 169 LNG-fuelled ships were delivered in 2024, growing the in-service fleet to 641 LNG-powered ships. According to DNV’s AFI orderbook, this number is expected to double by the end of the decade.

DNV points out that while the bunkering infrastructure for some alternative fuels remains underdeveloped, LNG bunkering is maturing. The number of LNG bunker vessels in operation grew from 52 to 64 over the last year, with continued growth expected in 2025. The significant gap between LNG bunkering supply and demand is expected to widen over the next five years.

“Market conditions, infrastructure development, fuel production updates and cargo owners’ needs are all shaping the demand for different fuels, both in the short and long term,” said DNV global decarbonization director, Jason Stefanatos. “The shifting trends in LNG and methanol orders this year might be due to the slow development of green methanol production. In the long run, green methanol has potential to be part of the energy mix along with ammonia,” he said.

But Mr Stefanatos also noted, “LNG offers a vital bridging fuel option benefiting from existing infrastructure and short-term emissions reductions while being capable of acting as a long-term solution as well, assuming renewable natural gas will be available and provided at a competitive price."

Riviera’s Maritime Decarbonisation Conference Asia, will be held in Singapore, 15-16 April 2024. Use this link for more information and to reserve your place.

Related to this Story

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.