Business Sectors

Events

Contents

Register to read more articles.

Digital navigation prepares to claim the crown from paper charts in the sub-ECDIS sector

International regulations and standards are required for e-navigation for sub-ECDIS vessels before paper chart production is halted

There are growing calls in the maritime sector for the development of international regulations and/or standards for electronic navigational charts (ENCs) for sub-ECDIS vessels.

There are moves to introduce national standards for ENCs to improve navigational safety, but there is a growing wave of interest in international parity, as exists with ECDIS. All this comes as hydrographic offices are either considering or implementing end-dates for paper chart production.

Following from the National Oceanic and Atmospheric Administration’s (NOAA) announcement to suspend US production in 2025, in 2022, the UK Hydrographic Office (UKHO) became the second major hydrographic office to announce the sunset of traditional paper nautical charts. The UKHO is anticipating to be producing paper charts until at least 2030.

Despite objections from some distributors and end-user groups (such as fishing vessels), there are many who feel this decision reflects a natural decline in usage that was already well in evidence.

Some feel transitioning to ENCs from paper charts may not only improve chart production efficiency, but, in parallel, may add useful safety and information features that are absent on paper charts.

These include alarm features, selecting and deselecting layers and overlays, and the ease of updating the charts compared with paper versions, all leading to potential improvements in maritime safety.

Advances in both hardware and software have made use of ENCs accessible to large and small commercial vessel operators, and recreational boaters alike.

During research and interviews, London-based maritime strategy consultancy The Strategy Works discovered the upstream ECS market segment was readying itself for change.

One of the main findings from this research was the universal desire from the protagonists for the ECS sector to be regulated. It is not just the end users operating sub-ECDIS vessels who need to know the boundary lines Many pointed out that, without regulation, upstream ENC suppliers will be reluctant to continue to invest in new technology.

Royal Institute of Navigation chairman of the Small Craft Group and chair of the Pleasure Vessel Navigation Systems Working Group, Paul Bryans, has just submitted the working group’s final report to the UK Safety of Navigation committee, who make recommendations to the UK government on safety of navigation improvements.

“There actually needs to be a digital standard for the sub-ECDIS market, that is all commercial vessels that are not obliged to fit ECDIS need systems that are approved for their use,” said Mr Bryans.

“Leisure vessels also need access to such approved systems. Neither of these sectors have access to approved systems at present.”

The other issue is international parity, as exists with ECDIS, said Mr Bryans. “Sub-ECDIS chart standards need to be agreed internationally because you cannot have a situation where you sail across the Channel and what was agreed and approved in the UK is not agreed and approved in France,” he said. Commercial vessels need a system that works wherever they sail.

“Additionally, electronic chart publishers and original equipment manufacturers are international businesses and cannot be expected to tailor their products for each coastal state,” said Mr Bryans. “So, the only thing that makes sense is to have standards approved internationally.” He recognised this would still take four to five years to accomplish.

Teledyne Geospatial group product director Anders Bergström believes there are already national standards in place that could be used for international markets. “The US, of course, is the best example of a country that has standardised the hardware and the cartography for that segment.”

Given that US companies dominate the ECS sector, this bodes well for a regulatory body such as IMO to set the ground rules.

“It will be extremely difficult today to change hardware requirements because there is so much value in products that are already installed on pleasure craft and semi-commercial boats,” said Mr Bergström, who would welcome an international standard for semi-commercial shipping.

“The legislation needs to address how we can approve or allow equipment to be used for navigation without the risk of the liability for the national states; that is the biggest problem,” he said.

Voyager director for product management and marketing Hayley van Leeuwen also sees it in global terms. “It does need the UK Maritime Coastguard Agency, the US Coast Guard, the Singapore Maritime and Port Authority; all those regulators to come together and agree a standard,” she said.

C-MAP manager of data sourcing Ivano Colombo believes industry consultation is the answer. “We could possibly see a scenario whereby the regulators engage with us to understand the future of these products, as we can contribute our experience and technical knowhow built over the last 30 years.”

Mr Colombo also sees this as an IMO initiative, “We believe in the involvement of IMO in shaping the future carriage requirements.”

Oliver Schwarz business development director of digital navigation and voyage planning solutions provider ChartWorld, agrees there is a need for regulation but feels “It is not the sub-ECDIS system on board but the licensing and pricing scheme of the digital navigation data that requires a rethink in the aftermath of the sunset of paper charts.”

“Electronic chart plotters are widely in use on millions of recreational boats; the equipment is not regulated by authorities, but by market demand and customer preference. This has proven to be effective without compromising safety at sea.” adds Mr Schwarz.

This view is supported by Raymarine senior director of global product management and digital services Brian Jensen, “the boat of 2030 will probably not have 2D traditional map presentation. It is likely to be a completely decluttered, AR, decision support tool. Therefore, the focus should be on data integrity, not presentation.”

Presentation on displays, including symbology and animations, is a differentiator for leisure charts and standardisation could eliminate competitive forces.

“Simplicity in the user experience is a key differentiator for marine electronics. Too rigid a standard could hurt or diminish competitive advantages.” explains Mr Jensen.

The political mood of the suppliers is to embark on the official journey of certification of digital products, but Furuno sales and deepsea manager Paul Mckenzie believes the initiative is with the regulators.

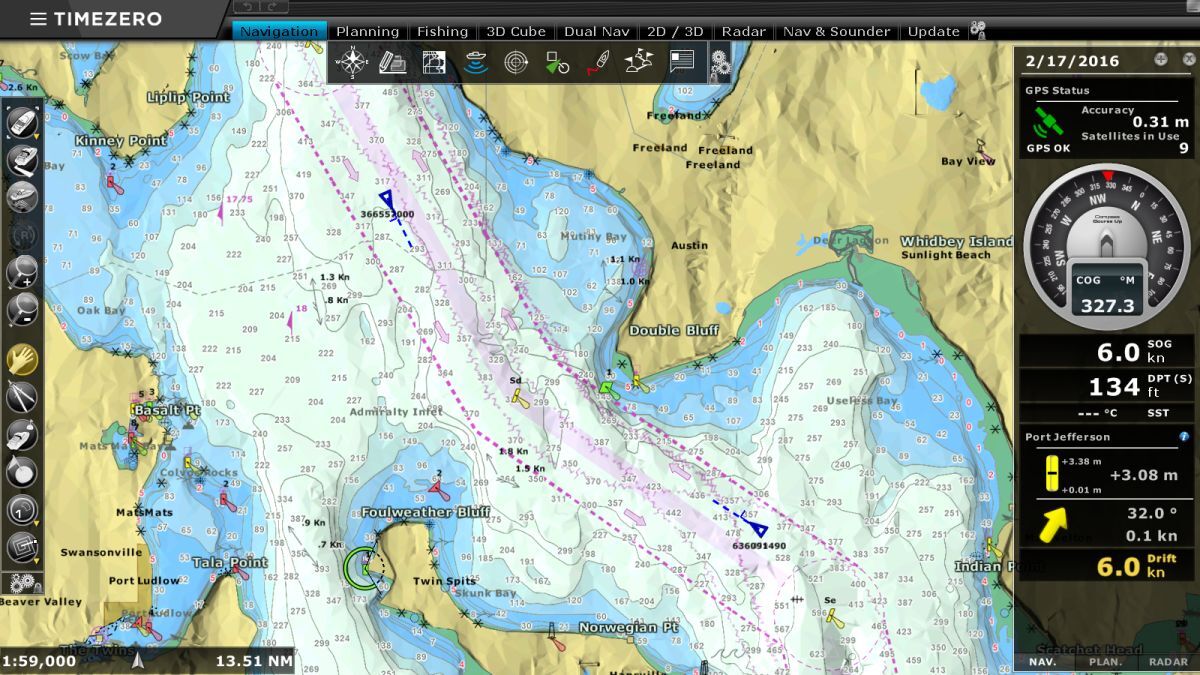

“Although we have a very good solution in TimeZero with the ENC module, until such time as IMO or MCA or UKHO decide the strategy for the replacement of paper charts, we do not really know what to advise them,” he said. “We can give them a solution, but, whether it will be the correct solution in the long term it is not so easy to judge.”

Mr Mckenzie summed up the frustration felt by many in the industry. “The standards that current regulation refers to are very old,” he said. “They were written in the past during the early development of chart plotting systems, which in the last 10 years has been phenomenal.

“We have gone from machines that traditionally ran a scanned paper chart to full ENCs that are running the same kind of chart portfolio as what would be on an ECDIS.”

UKHO welcomes the move to digital navigation, but fully supports the call for a common standard within a global regulatory environment.

“The UKHO recognises that for many, navigation is now being done digitally, with paper charts providing navigational support and in some cases compliance,” UKHO product manager for paper charts and sub-ECDIS, Steve Bastable commented.

“We fully support the safety and time advantages which digital navigation brings and aspire to be at the forefront of the development of next generation digital navigation data services.”

The transition to digital only charting is well under way, but UKHO sees barriers remain, especially in having common global regulations for the use of digital products below ECDIS thresholds.

“Our focus therefore is to support the development of these regulations and the update and development of the products and services which they will bring, while understanding and removing barriers to uptake and use,” said Mr Bastable.

The roll-back of the sunset of paper charts by UKHO until at least 2030 does provide the shipping industry with the breathing space it needs to develop regulations for the sub-ECDIS space. Enabling a framework for safe navigation for all vessels above a nominated size – whether commercial; semi-commercial or leisure – will replace speculation with a legislative structure and a workable timetable.

Mr Bergström thinks the introduction of the S100 series of standards will provide opportunity for introducing international regulations for ENCs. “S100 will be significant for all these segments, because that is how the data will be produced,” he explained.

“There will be additional layers like tidal and marine safety information. Also, bathymetric data will have an important impact on the leisure side. In summary, good navigational data should be the same for all types of users,” said Mr Bergström.

Major players evolve in ENCs and electronic chart systems

Manufacturers of electronic chart systems (ECSs) for non-mandated vessels below 3,000 gt have their roots in the leisure market, dominated by US manufacturers who enjoy significant domestic demand.

The North American market is by far the largest leisure boating market in the world accounting for 17M users in the US and around 4M in Canada, in total representing 70% of the 30M leisure craft boats globally.

A realisation of the similarities between small commercial and leisure vessels in terms of their navigational needs has energised convergence within the industry, as major US ECS businesses recognise they need to be vertically integrated across hardware and software, which in turn has driven consolidation and acquisitions within the sector.

This has resulted in a few power-players now dominating the ECS segment.

Teledyne Technologies is a US$20Bn corporation listed on NASDAQ with interests ranging from the defence industry to cameras fitted onto the James Webb telescope. In 2021, Teledyne acquired the FLIR Group and within that harbour was Raymarine, which has been established for 100 years and built a strong reputation for marine navigation systems for leisure.

Teledyne Geospatial Group holds a large share of global chart production systems, and Raymarine has direct agreements with more than 40 hydrographic offices, according to Teledyne Geospatial group product director Anders Bergström.

“We have our own Lighthouse Charts. These are derived products, electronic charts without the same status as official ENC’s used by commercial shipping for navigation.”

Coupled with Teledyne’s marine and geospatial surveying capability, Mr Bergström believes it is the only supplier of bathymetric surveys, chart production and end-user delivery, from ECDIS to the sub-ECDIS value chain.

Earlier in 2023, Teledyne consolidated this position by acquiring ChartWorld and 7Cs as Mr Bergström explains, “7Cs manage a lot of OEM agreements with various ECDIS manufacturers to provide the kernel in their systems, so 7Cs is an important provider of kernels for ECDIS.

“The kernel is the engine that runs the chart in the system and the various ECDIS manufacturers add on their look, feel and additional functionality.”

Teledyne’s acquisitions clearly signal its view that the digital space is going to be the future, and a natural step to move from the recreational leisure market into the semi-commercial segment.

Another significant US player in the market is Navico, acquired in 2021 by Brunswick Corp, with market capitalisation of US$6.1Bn. This rolled C-MAP, B&G, Lowrance and Simrad brands into Brunswick’s Advanced Systems Group, ushering in a new era of integrated marine electronics systems.

C-MAP managing director Max Cecchini explains, “Our products are built from the official ENC data, and we enhance them with additional data content that is of value to a wide range of users that goes beyond the recreational boaters we target. We ingest and harmonise to produce high-resolution bathymetry with discrete contour lines,” he says.

C-MAP data sourcing manager Ivano Colombo adds, “We are not only a company that makes hardware and software; we are chart manufacturers.

“We believe we have the knowhow on both the data and on the cartography sides. Furthermore, over the years we have developed tools for chart production that have been adopted by many hydrographic offices worldwide. The core of our products is, and will remain, the ENC.”

Another formidable force combining hardware and software into an integrated ECS solution is Furuno, which owns a 48% stake in TimeZero (TZ). Sales and marketing director Frederic Algalarrondo explains how they are already well established in the commercial market.

“We developed a weather routeing algorithm, and other software for commercial fishing, workboats and recreational boating over the years, so today we have approximately 100,000 active users globally.”

Furuno’s navigation software has been translated into 16 languages. Most of its business comes from the non-ECDIS market, and 60% of revenue comes from the commercial market.

TZ offers a ‘crossover product’ as its ECS software can be used with either leisure charts or ENCs.

Vessel owners can use a module device to run approved ENCs and subscribe to an ENC service as they would do for an ECDIS. “In effect it is an ‘ECDIS-like’ ECS,” says Furuno sales and deepsea manager Paul Mckenzie.

“If vessels generally do not have the space to accommodate ECDIS, we are able to talk to them about the Maxsea TimeZero ECS system, running the ENC modules used by workboats and super yachts already.”

Garmin, with a market capitalisation of US$18.5Bn, is another international corporation headquartered in the US and incorporated in Switzerland, which purchased Navionics, with its cartography, in October 2017. Navionics and C-MAP both have the same origins. Both were founded by two Italian business partners who had initially worked together and then split into separate companies.

iPhone and iPad solutions could take off

There were mixed opinions on this, but there is some support from those shaping the market for the concept of using mobile electronic communications devices as electronic charting systems.

“There is definitely a market for navigation systems on phones and tablets and navigation apps provide useful additional information and backup support,” says RIN’s Paul Bryans. “However, RIN has concerns about the use of phones and tablets as primary navigation aids on leisure vessels for several reasons.” These include navigational safety concerns.

Teledyne Geospatial’s Anders Bergström feels pilots have already set the precedent, “Pilots are already using PPUs, that are iPad or Android-based tablets,” he says. “They are officially navigating container ships into a port and taking responsibility using those type of systems.”

Chart plotters graduate to the ECS space

Fishing vessels often rely on their chart plotters. Chartworx is a market leader in the fishing industry with its Quodfish and TRAX fish plotters. A sizable number of trawlers in western Europe are equipped with Chartworx fish plotters.

The Norwegian Olex brand also combines navigation with fish plotting and is popular with UK fishing vessels. TimeZero also has an ECS tool for commercial fishing vessels – TZ Professional – and Furuno is a major player in commercial and semi-commercial fishing boats with its range of combined fish finder and navigation solutions.

With a countdown of seven years to 2030, the shipping industry does appear to have the breathing space it needs to develop an international regulatory structure for the sub-ECDIS space. Enabling a framework for safe navigation for all vessels above a nominated size – whether commercial, semi-commercial or leisure – will end speculation and set a workable timetable.

This article was prepared by Michael Herson of London-based The Strategy Works - a strategy insight and value chain consultancy specialising in the marine sector. He can be contacted at: mherson@thestrategyworks.com

Related to this Story

Events

Maritime Environmental Protection Webinar Week

Cyber & Vessel Security Webinar Week

The illusion of safety: what we're getting wrong about crews, tech, and fatigue

Responsible Ship Recycling Forum 2025

© 2024 Riviera Maritime Media Ltd.