Business Sectors

Events

Contents

Singapore setting standards for the future

Singapore has retained its position as the leading bunkering port in the world, but is facing increased competition from other ports in Asia and the Middle East. In 2013 bunker sales in Singapore were at 42.7 million tonnes identical to the figure in 2012. This was a fall from the historic peak of 43.2 million tonnes achieved in 2011, according to figures from the Maritime and Port Authority of Singapore (MPA).

Simon Neo, executive director, Piroj International, in Singapore, and immediate past chairman of the International Bunkering Industry Association until April 2014, said that a lot of ports in Asia are investing in bunkering infrastructure that have not done so previously for many years. For example Indonesia is setting up bunkering storage and infrastructure facilities. Malaysia is setting up bunker storage capacity. But he questioned how much is being invested with regard to meeting low sulphur regulations.

Singapore is not in an ECA but there are incentives to burn MGO in port. Hong Kong is introducing low sulphur rules in its port area. China is also considering low sulphur rules for ships in port due to the major overall emissions and air pollution problems being experienced in many Chinese port cities. “Currently there are limited supplies of low sulphur fuels in Asia,” he commented. “When new low sulphur rules come in, the cost of fuel will rise sharply.”

The introduction of different types of fuel will pose challenges for traditional bunker suppliers, he suggested. “LNG is still new in Asia and operational issues for bunkering are not settled yet, including availability of LNG bunkering vessels and training standards for crews involved in bunkering. Operating costs will rise and also financial issues for bunkering companies as not all will be able to sustain the necessary investment. Bunker suppliers will have to train crews to handle different types of fuel. Bunkering will become even more marginal for suppliers, financially and will not be viable for all existing suppliers. There will be increasing uncertainty of demand and prices of high sulphur fuel oil after the sulphur limits come into effect.”

The use of mass flow meters to measure bunker volumes will be mandatory in Singapore from 1 January 2017. Under the provision all existing bunker suppliers must install approved mass flow meter systems by the end of 2016. MPA will make available grants to help existing suppliers to make the change. Any new bunker vessels applying to MPA for a bunkering license from the beginning of 2015 must have a mass flow meter system fitted.

Mr Neo said that under Singapore SS600 rules the final bunker quantity figure is based on the bunker barge measurement, not the receiving vessel, and that will not change so the barge mass flow meter figure will be the definitive figure.

“The introduction of mass flow meters will result in a short-term reduction of bunker volumes in Singapore, but it will recover in the longer-term. But it will not affect the bunker market dynamics as all suppliers will be on a level playing field. I expect that the introduction of mass flow meters, although adding costs for suppliers, will not affect Singapore’s position as the cheapest bunkering port. So far there have been no disputes involving bunkering operations where mass flow meters are used and tests so far show good accuracy. Variance of up to 0.5 per cent is allowed but the actual experience so far shows variance of no more than 0.2 per cent.”

He told Fuels Lubes & Emissions Technology: “Changes in bunkering will lead to consolidation among bunker suppliers. Only the bigger players that are financially strong and able to make investments in higher standard bunkering vessels and training crews will survive. In Singapore some major ship operators are considering setting up their own bunker supply operations to have greater control and save costs. In particular some container ship operators have sufficient vessel calls and volumes of bunkers to justify their own operations.”

Dennis Ho, Aegean Petroleum (Singapore) said that although mass flow meters are a positive step their introduction will not see the end of quantity disputes. “It is not yet clear if it will have any impact on price. It will be interesting, when mass flow meters are made compulsory, whether some bunkering players will move from Singapore to other ports.”

The first bunkering vessel to be fitted with a mass flow meter was Emissary, owned by Hong Lam Marine, and operated by ExxonMobil. The first delivery using a mass flow metering system approved by the MPA for bunker fuel delivery took place in June 2012.

The oil major has since fitted flow meters on two more chartered bunker barges that it operates in Singapore. There are now four bunker barges fitted with flow meters.

The MPA’s strong efforts to improve the quality and reliability of bunkering in Singapore appears to be having a positive effect. Mr Neo said: “We have not seen any major quality issues in Singapore for more than 10 years, only some relatively minor problems.”

DNVPS, which was recently sold by class society DNV GL, and has rebranded Veritas Petroleum Services, undertakes detailed and forensic testing of bunker fuel in its Singapore laboratory which can identify contaminants as well as testing for standard fuel oil properties.

In past years Singapore saw frequent fuel quantity disputes, with allegations of short deliveries by some suppliers and also disputes over quality. A Singapore bunker trader was recently sentenced to eight months in prison for stealing US$24,000 worth of fuel oil.

There were also increasing concerns about the ageing fleet of bunkering vessels and the ability of some operators to run them safely. In an effort to weed out suppliers and bunker barge operators that were compromising standards, MPA applied tougher standards, with strict licensing requirements. All bunker suppliers and bunker vessel operators in Singapore waters are licensed and must be accredited by MPA. To maintain bunkering licences suppliers must have this accreditation.

According to MPA, at the end of 2013 there were 68 accredited bunker suppliers in Singapore. The increasingly tough regulatory regime and financial requirements are likely to make it more difficult for smaller independent suppliers to compete indicating a trend towards suppliers that are part of larger groups. Singapore’s tightening of policies on the employment of foreign labour in 2013 is also making it tougher on bunker tanker operators to find crew for their vessels, especially when coupled with the tighter regulation of working conditions of seafarers through the application of the Maritime Labour Convention 2006.

MPA has a regulatory role regarding the accreditation of bunker suppliers, bunker vessels and their operators, and the safety and fuel quality assurance for bunkers delivered within the port of Singapore. It applies several standards and codes of practice to ensure that standards are maintained. MPA has been increasingly rigorous in applying these standards and in withdrawing accreditation from suppliers that do not comply.

In recent years MPA has applied increasingly tough standards on the operators of bunker supply vessels and on the vessels themselves to promote safer and more environmentally friendly bunkering operations. To help phase out single hull bunker tankers and secure a younger, more efficient bunkering fleet, it introduced its so-called Gate system, which sets age limits and other conditions for granting licences for bunker tankers operating in the port.

The use of mass flow meters as a more reliable and transparent system for verifying fuel quantities than traditional tank measurements, is a further weapon in the battle to eliminate sharp practices such as short deliveries.

As an example of the tough approach being taken, in January 2014 MPA cancelled the bunker supplier licences of two suppliers, Excel Petroleum Enterprise and Lian Hoe Leong & Brothers, for contravening the terms and conditions of their bunkering licences. According to MPA both companies were found to have allowed other companies to use their bunker delivery notes (BDNs) to supply bunkers. There have been a number of incidents where companies illicitly using others’ BDNs have undercut bunker prices and engaged in short deliveries.

In April the MPA cancelled the licences of bunker supplier and barge operator Coteam Petroleum Trading for allowing other companies to deliver bunkers under its bunker supply notes and for delivering bunkers on behalf of an unlicensed supplier. “Any bunker supplier or bunker craft operator found to have contravened any terms and conditions of MPA bunkering licenses will have their bunkering license suspended or cancelled,” MPA commented.

Setting the pace for LNG bunkering

Singapore is developing major new LNG import facilities. This is primarily to meet future electricity needs, but it will also facilitate Singapore becoming a major LNG bunkering port. A new LNG terminal and storage facility has been built on Jurong Island with further expansion underway.

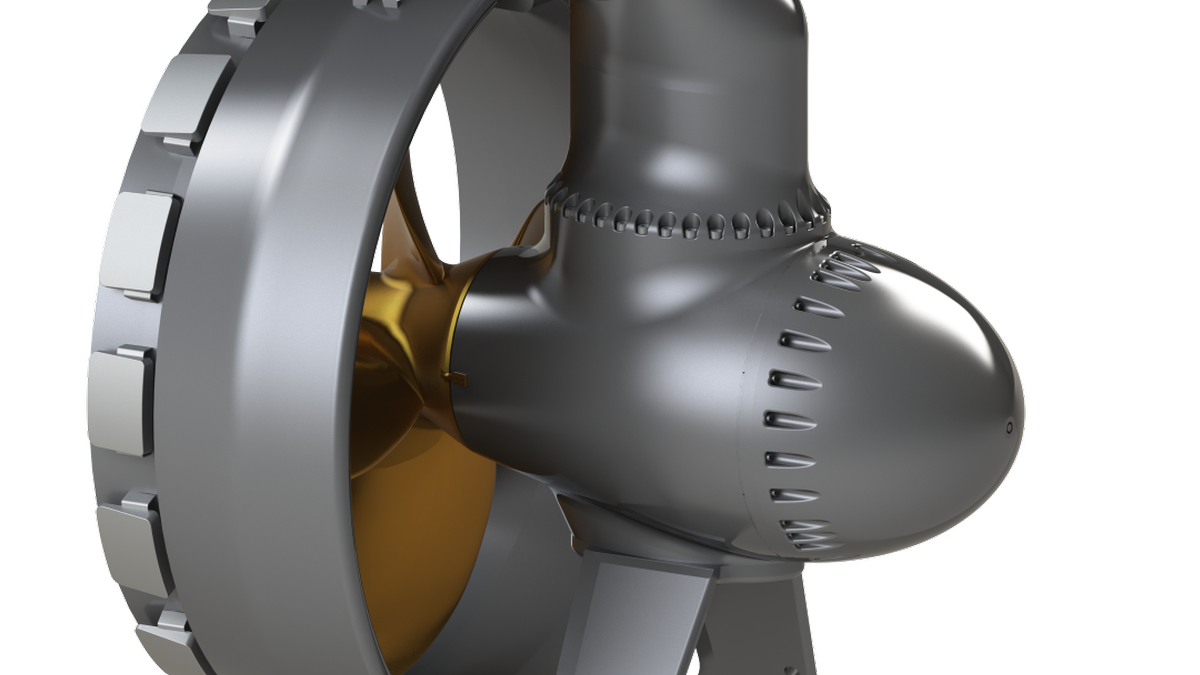

An integral part of this growth to become a major LNG import and trading hub is Singapore’s ambition to establish itself as the primary LNG bunkering location in the region. This will require bunker suppliers to step up to the plate with LNG bunkering vessels and associated technology and trained personnel to enable LNG bunkering to take place safely.

Singapore has taken the initiative to develop new operating standards and procedures for LNG bunkering. The MPA initiated a study on the technical standards and procedures for LNG bunkering in Singapore and appointed Lloyd’s Register as a consultant in this project. MPA formed a group of interested industry organisations in Singapore to develop the new set of standards to cover LNG bunkering operations.

The study concluded that before LNG bunkering can take place five areas of information must be established. These are: LNG bunkering standards and procedures within the port's limits; technical requirements and specifications for LNG bunker tankers and receiving vessels with regard to transfer system, fittings and safety equipment; safety standards for LNG bunkering operations; identification of safety exclusion zones and emergency procedures; and competency standards for personnel handling LNG bunkering.

It is expected that the MPA LNG bunkering standard will be published by the end of 2014, depending on how quickly the various working groups complete their work. Singapore wants to start LNG bunkering by late 2014 or early 2015 and it is intended that the standard should be in place in time for LNG bunkering operations to start.

Muhammad Segar, MPA assistant chief executive of operations said: “The completion of the study is an important milestone in the development of LNG bunkering in the port of Singapore.” FLET

Related to this Story

Events

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

© 2024 Riviera Maritime Media Ltd.