Business Sectors

Contents

Register to read more articles.

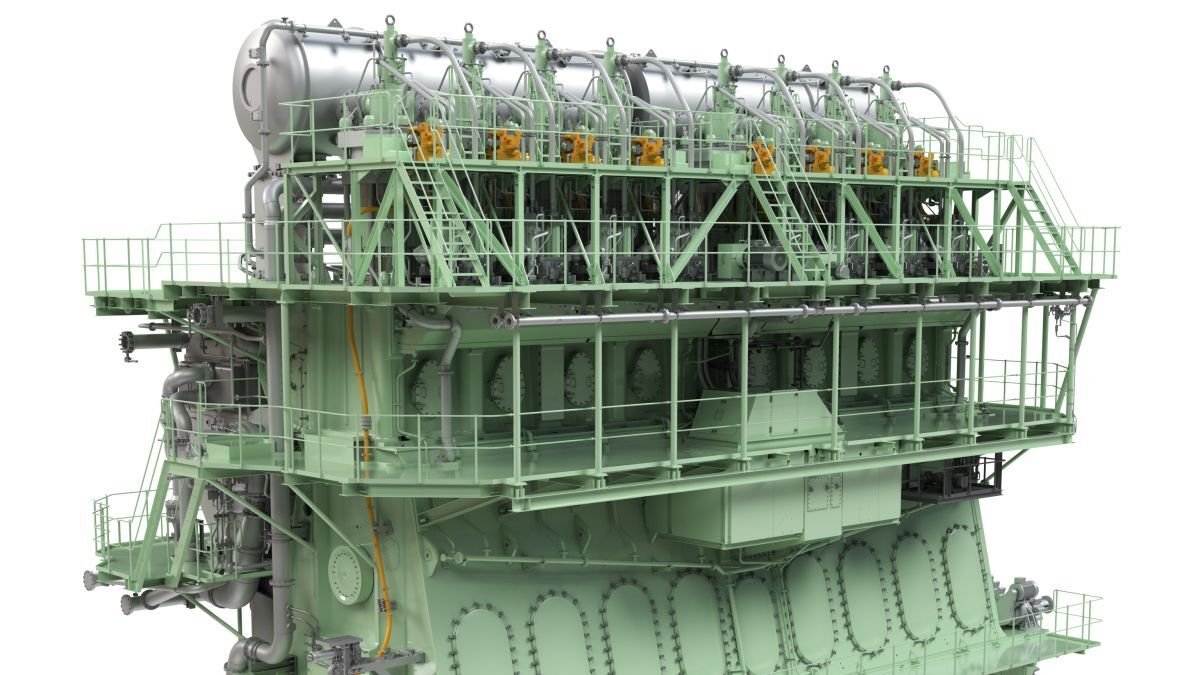

The secret to lowering fuel consumption is in the engineroom

Improving the efficiency of an existing turbocharger by swapping out older components or undertaking EPLO can yield significant fuel savings, says Accelleron service division president, Roland Schwarz

Ships with mechanically controlled engines face major operational hurdles from tightening international and regional emissions regulations on energy efficiency, such as the Carbon Intensity Indicator (CII). Where can ship operators turn to make improvements to remain compliant?

“A peak performing turbocharger is still one of the best ways to lower fuel consumption,” says Accelleron service division president, Roland Schwarz.

“If they want to remain compliant, there is not enough capacity to replace all those vessels,” says Mr Schwarz, noting the tight capacity at shipyards. As a result, owners are asking how they can extend the service life of their vessels by between three to five years. “This is something they would not have done in the past,” says Mr Schwarz.

In an interview at SMM 2024, Mr Schwarz detailed the role the Swiss company’s portfolio of turbocharger, fuel injection and other marine products and services can play in lowering fuel consumption and improving a ship’s CII.

One opportunity to improve efficiency is to upgrade an existing turbocharger with newer components, which can often be done without dismantling the engine, says Mr Schwarz. “It’s normally rotating parts that we exchange, and customers can still expect fuel savings between 3% to 6%. There is a return on investment around three years,” he says.

Another solution that Mr Schwarz highlights is engine part load optimisation (EPLO). Accelleron teamed with South Korean enginebuilder Hanwha Engine for Höegh Autoliners, supporting long-term energy efficiency for its 7,850-CEU car carrier Höegh Detroit.

Sea trials showed the EPLO demonstrated fuel saving of 10g/kWh - equivalent to 5% of total fuel consumption, according to Accelleron. The EPLO enables the vessel to operate in a higher CII rating, lowers fuel costs, cuts CO2 emissions and reduces expenses under the EU Emissions Trading System (EU ETS). Following the project, an order was placed for EPLOs on a further seven vessels owned or operated by Höegh.

“Customers can still expect fuel savings between 3% to 6%”

“Today has shifted towards retaining the asset’s value because customers have their vessels in the balance sheet,” observes Mr Schwarz. “If they are no longer compliant, then it becomes a much bigger impact on the business.”

Mr Schwarz says Accelleron is growing its portfolio of products and services to support ship operators’ decarbonisation journey. He points to the acquisition of OMT, a leading developer of fuel injection equipment for alternative fuels used in two-stroke dual-fuel marine engines.

In July, OMT entered into an agreement to acquire four-stroke fuel injection specialist OMC2 Diesel SpA. Accelleron has also been strengthening its digital solutions to complement its Tekomar XPERT Marine and Turbo Insights that enhance vessel performance. Accelleron has inked a deal to acquire True North Marine, a Canadian digital weather routeing and vessel optimisation company.

And, in its latest partnership, Accelleron was named as an authorised global service provider for Somas Instrument’s marine customers. This will see Accelleron personnel trained to service Somas valves on marine installations, primarily in exhaust after-treatment systems, such as selective catalytic reduction and exhaust gas recirculation.

On the research front, Accelleron is developing new two-stroke turbochargers designed to operate with future fuels such as methanol and ammonia. “The aim is to design turbochargers that are flexible for future fuels that can be tuned to either ammonia or even methanol,” says Mr Schwarz.

Related to this Story

Events

Maritime Decarbonisation, Europe: Conference, Awards & Exhibition 2025

Offshore Support Journal Conference, Americas 2025

LNG Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.