Business Sectors

Events

Ship Recycling Webinar Week

Contents

Register to read more articles.

E-fuels will power maritime by 2045 if industry is allowed to pace itself

75% of owners will embrace e-fuels by 2045 – if regulators are sensible

E-fuels will be crucial in tackling the maritime sector’s decarbonisation challenge, but significant hurdles remain, including issues related to availability, costs and adapting existing assets within the limited timeframe available, according to a survey of 700 senior maritime executives and technical specialists.

Respondents were drawn from a diverse mix of shipping companies and vessel operators headquartered in Spain, Germany, Belgium and the Netherlands. Chief executive of turbocharger specialist Accelleron, Daniel Bischofberger, who commissioned the survey, says this targeted European cluster is highly representative of the global industry, given the region’s density of large shipping firms and importance as a maritime hub.

The survey revealed notable differences among the countries sampled. Dutch ship operators were particularly confident e-fuels will play a major role by 2030 and become essential by 2040, while German firms were more cautious. Biofuels were seen as a preferred transitional fuel in the Netherlands and Spain, while liquefied natural gas (LNG) led in Germany and Belgium. Belgian companies were especially concerned about near-term e-fuel availability and costs remaining higher than conventional fuels. Germany placed the most emphasis on policy incentives and legal frameworks to enable the transition.

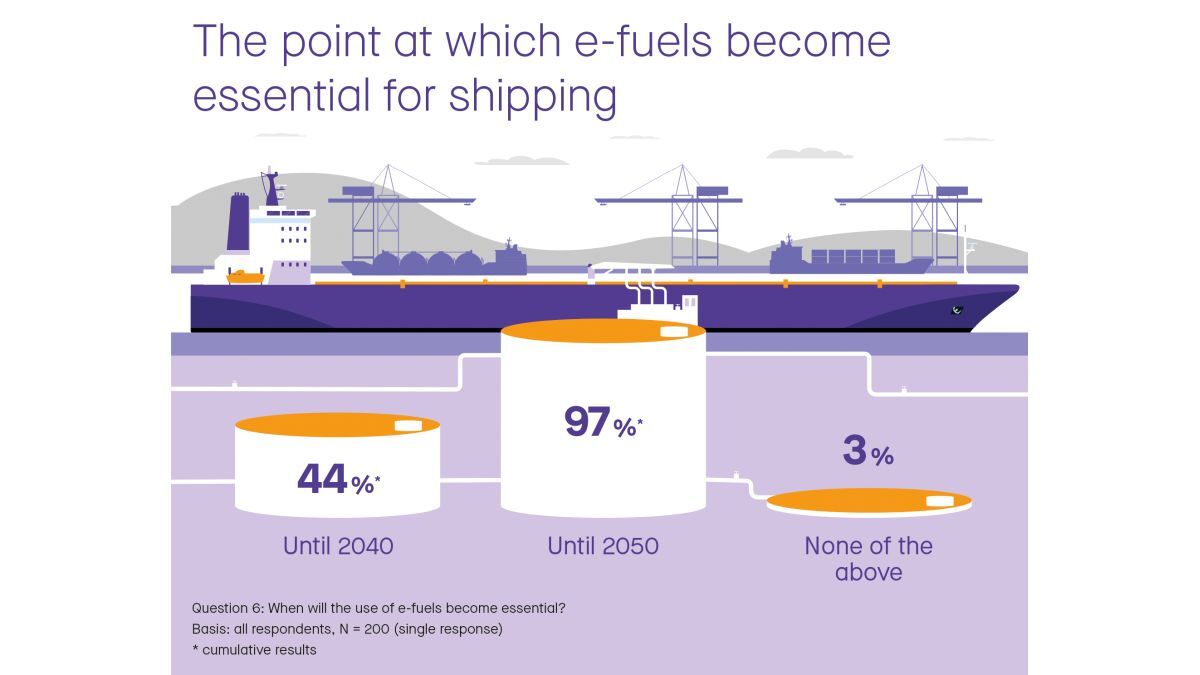

The survey reveals most companies see implementing e-fuels as technically complex (82%), though larger firms are less concerned. Beyond supply uncertainties, high transition costs and infrastructure challenges (46%) also impede adoption. Nevertheless, given e-fuels’ advantages, two-thirds (66%) see competitive benefits, with nearly half (47%) having concrete investment plans. For many, retrofitting existing ships is the best near-term decarbonisation strategy, with over a third (36%) already planning modifications. To ready their fleets, firms are focused largely on training (47%), securing fuel supplies through partnerships (41%), and targeted retrofits (36%). Three-quarters expect e-fuels will be indispensable by 2045.

82% of respondents say zero-carbon ‘e-fuels’ such as green hydrogen, ammonia and methanol will be essential for achieving full decarbonisation of the sector, especially in the 2030-2040 timeframe as emissions targets tighten.

However, 68% also express serious doubts on whether adequate large-scale supplies of these new fuels can be scaled up quickly enough to meet rapidly growing demand, raising the spectre of potential fuel shortages or price spikes. As Mr Bischofberger starkly observes, "There are very serious risks of disastrous supply shortfalls if the demand for these fuels grows too quickly before massive production capacity can be built up worldwide. It’s a recipe for trouble."

76% see extremely high investment costs for transitioning to new fuels and radically adapting port and ship infrastructure as a major obstacle to adoption. Mr Bischofberger notes the sheer magnitude of the financial challenge, "The absolutely massive capital investments needed for enough renewable electricity generation, very large-scale fuel production facilities, and totally modifying shipping infrastructure will be multiple trillions of dollars globally. It’s an enormously complex and expensive undertaking far beyond what many appreciate.

"Even today, total global biofuel production is only around 50M tonnes annually – a small fraction of the 300M tonnes of bunker fuel maritime currently consumes each year. There are also sustainability concerns if diverting huge amounts of crops or land for biofuel production. LNG offers a modest 10-30% combustion efficiency gain over conventional bunker fuels, but its lifecycle advantages diminish substantially when factoring in systemic methane leakage throughout its production and supply chain. Under IMO’s new comprehensive ‘well-to-wake’ emissions accounting framework, LNG’s climate benefits largely evaporate.

"Green hydrogen and converted e-fuels like ammonia and methanol seem essential as the only viable options for achieving deep decarbonisation by 2050. However, ammonia has major toxicity and handling safety issues requiring substantial new protocols and training at all levels.

"For shorter, regional marine shipping routes, compressed gaseous hydrogen or ammonia may be feasible, but globally traded liquid e-fuels will likely be imperative for longer transoceanic voyages to practically maximise range. This energy density challenge is a critical factor.

"So-called ‘blue’ hydrogen or ammonia using fossil fuels plus carbon capture can provide transitional solutions to significantly reduce emissions, though they cannot enable full decarbonisation. Such technologies may provide an interim bridge while fully green hydrogen scales up."

The survey reflected 39% of operators are taking initial preparatory steps, including early-stage fuel supply studies, conducting pilot R&D projects on various e-fuels, and tentatively retrofitting some vessels where feasible. But so far, only 13% report making any concrete large-scale investment commitments due to the uncertainties.

This outlook, says Mr Bischofberger, motivated turbocharger specialist Accelleron’s June acquisition of Officine Meccaniche Torino (OMT), an Italian manufacturer specialising in high-precision fuel injection equipment for medium and low-speed engines.

According to Mr Bischofberger, OMT, which generates around €50M (US$53M) in annual revenues and has approximately 250 employees, expands Accelleron’s ability to serve growing demand as marine engines adapt for new fuels, "As the industry transitions to sustainable fuels like ammonia and methanol, upgraded fuel injection systems will be absolutely essential – but there is limited global production capacity currently. Our major investment in OMT directly addresses this bottleneck." He adds that OMT’s fuel injection revenues are projected to grow at an above-market rate. "Dual-fuel engines will be the standard for the foreseeable future, requiring more injectors per engine, while the precision and materials for injectors compatible with new fuels are more complex."

Returning to the complexity of meeting industry’s decarbonisation challenge, Mr Bischofberger cautions there are risks if regulations move too far ahead of the capabilities of existing ships and engines to transition to new fuels and meet efficiency requirements. Premature mandates could result in regulations essentially ‘banning’ older vessels by setting standards they simply cannot comply with, even after incorporating all feasible upgrades.

This could force massive numbers of otherwise serviceable ships into premature retirement before the end of their useful lives. At the same time, he notes there is not enough shipyard capacity to rapidly replace so many retired vessels with newbuilds. New ship construction is only around 1,500 ships per year globally, far short of the fleet that would potentially require replacement. Combined with the multi-year backlog to build new vessels, this capacity mismatch could severely constrict global shipping capacity and disrupt supply chains. Staging requirements gradually while funding retrofit incentives on older ships will be crucial to managing the transition, rather than imposing mandates that instantly render large segments of the fleet obsolete before green replacements are viable.

For context, Mr Bischofberger highlights how the economics of energy-efficient investments have rapidly and radically changed. A few years ago, Accelleron marketed to vessel operators a relatively inexpensive turbocharger upgrade that would improve engine efficiency by 3-4% and payback the investment in around three years due to fuel savings. "Hardly any customers opted for this retrofit, as fuel prices were lower and payback periods longer than what operators preferred."

This contrasts with today’s situation, where impending emissions regulations such as IMO’s CII mean ship operators face significant financial penalties if their ships are not efficient enough.

"Today, there is much more impetus to make a US$10M investment in a substantial engine down rating that can improve efficiency by 10%, with a five-year payback, due to regulatory drivers," he says. Undertaking major engine modifications across thousands of ships will be extremely capital intensive and could pose a threat to world trade if a substantial number of vessels need to be taken out of service at the same time.

Mr Bischofberger expresses particular concern for smaller, independent shipowners, which may lack resources to effectively plan the transition. The survey reflected only 35% of firms with annual revenues under €100M have a decarbonisation transition strategy. "These companies could face severe disruption to their operations if requirements accelerate without regard for their limitations."

Companies with a higher annual turnover are less concerned by complexity. The main obstacles cited by these entities are lack of availability (46%), high switching costs (50%), and infrastructural problems (43%).

In the long run, renewable e-fuels will probably always have inherently higher costs than convenient fossil fuels, says Mr Bischofberger. "But the environmental costs of continued reliance on high-carbon fuels are immeasurable. Policymakers must strike a prudent balance between economic and ecological burdens by phasing in realistic frameworks. Without practical transition pathways, unrealistic targets could jeopardise orderly progress."

The Accelleron survey polled a broad cross-section of 200 maritime industry executives and technical specialists across four European countries – Germany, the Netherlands, Belgium and Spain.

The largest share of respondents (44%) came from logistics and operations roles directly in the shipping industry. This was followed by 35% from shipping companies and ship operators, the critical end-user constituency.

The remaining 21% of respondents represented other stakeholders such as port operators, shipping financiers, and ship classification societies. 59% of respondents were from medium-sized firms with 250-999 employees. 29% were from smaller companies with 50-249 employees, and 13% were from larger corporations with more than 1,000 employees. The majority of respondents (60%) were from companies with €50-500M in turnover. 23% were from smaller firms with €10-50M in revenues, while 17% represented corporations above €500M in annual turnover. A third of survey respondents held top management positions such as chief executives or board directors. Another third represented middle management or specialists like project managers, engineers and technical roles.

Related to this Story

Chemship advances fleet optimisation with new contract

Events

Ship Recycling Webinar Week

International Bulk Shipping Conference 2025

Tankers 2030 Conference

Maritime Navigation Innovation Webinar Week

© 2024 Riviera Maritime Media Ltd.