Business Sectors

Contents

Register to read more articles.

Offshore report: CO2 capture pipeline at risk in UK; Saipem lands US$1.9Bn in contracts

A Westwood Global report shows government funding and licensing delays could stop the UK from hitting its carbon capture and storage targets, and with a pair of new contracts, Saipem has added nearly US$2Bn to its ledgers

A new report from Westwood Global Energy Group reveals that while the UK has potential to far exceed its carbon capture and storage (CCS) targets, delays, cancellations and under-delivery still pose a significant risk.

"Following the UK’s first Carbon Storage Licensing Round, the findings underscore the critical nature of setbacks in government funding, congested licence work programmes, and challenges in securing access to CO2," the company said.

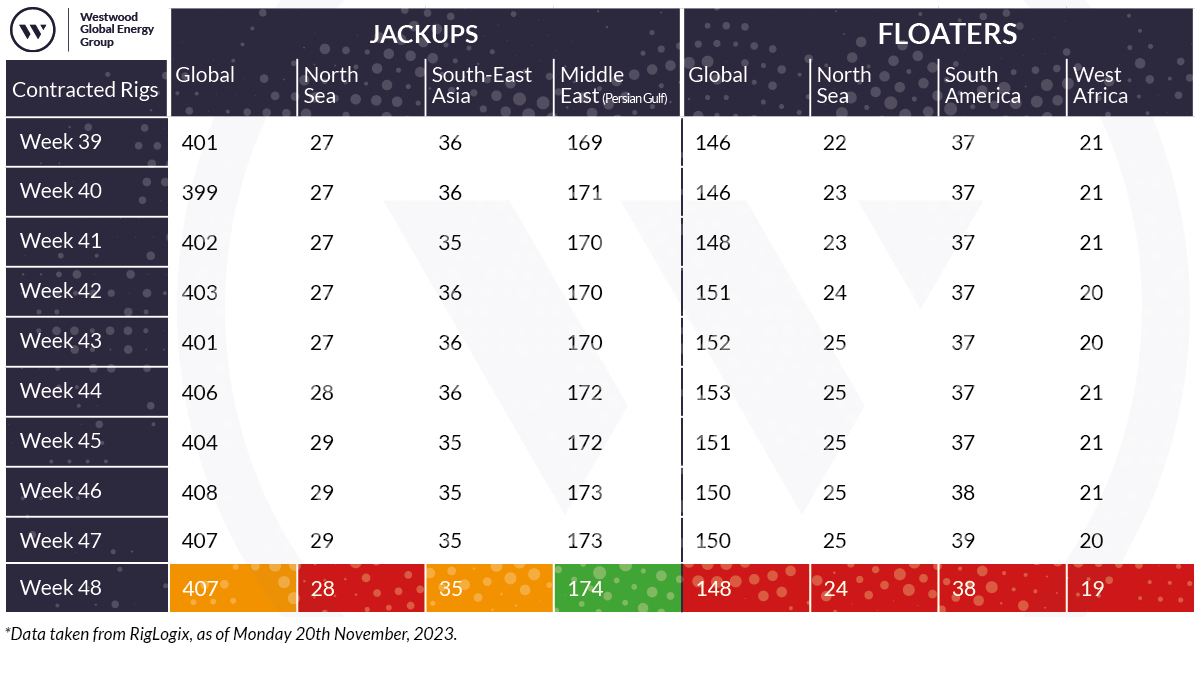

According to Westwood’s analysis of current project schedule reports, the UK is on track to exceed its upcoming carbon storage targets.

"By 2030, there is potential for up to seven carbon storage sites with capacity for over 45M tonnes per annum (mta), double the lower end of [the UK’s] target. Encouragingly, the research uncovers that the UK is also well-placed against its 2035 ambitions and could look to reach over double its 50 mta target," Westwood said.

However, even minor delays to these carbon storage project pipelines could derail the UK’s ability to hit its targets.

Westwood senior analyst for northwest Europe Catherine Horseman-Wilson said, “The industry is grappling with a series of challenges, from funding delays and congested work programmes, to access to CO2 and co-location and infrastructure re-use difficulties, so the likelihood of delays can’t be ignored. The UK has a significant opportunity, with a strong capability to surpass its targets, but contingency planning will be a crucial element in securing its full potential, particularly in ensuring the strict adherence to schedules and maintaining a reliable CO2 supply.”

In recent weeks, UK-based carbon capture and storage investor and consultancy Carbon Catalyst Ltd (CCL) has announced the backing of two international partners for CCS projects in UK waters. Sumitomo subsidiary Summit Energy Evolution Ltd (SEEL) has taken a 10% working interest farmout on the Orion carbon storage licence located in the Southern North Sea sector of the UK Continental Shelf. SEEL joins CCL and licence operator Perenco on two carbon storage licences CS017 and CS018, which cover the Perenco UK-operated and decommissioned Amethyst and depleted West Sole gas fields.

"These fields are the most geographically proximal offshore storage sites to Humberside, the UK’s largest industrial cluster, and are directly connected by pipeline to the PUK-operated onshore Dimlington Gas Terminal," according to CCL.

And German energy company Wintershall Dea has taken a 10% working interest farmout in the Poseidon carbon storage licence located in the Southern North Sea sector of the UK Continental Shelf. Wintershall Dea joins CCL and licence operator Perenco on the project.

Poseidon marks Wintershall Dea’s entry into a second UK CCS project and fifth in the wider North Sea, including the Greensand CCS project in the Danish North Sea. In March 2023, together with INEOS, Wintershall Dea successfully demonstrated the first full cross-border CCS value chain in Europe with the pilot injection of CO2 from a Belgian emitter which was safely stored in the depleted Nini West oil field.

And this week in the UK, Aquaterra Energy secured a contract with INEOS to undertake life extension work for the Nini platform to enable its use for CO2 injection through 2045.

"Greensand is the most mature CO2 storage project in Demark. It aims to store up to 1.5M tonnes of CO2 per year by 2025, making it a key project in meeting the International Energy Agency’s sustainable development scenario goal of 5,635 megatonnes of CO2 stored globally per year by 2050. The CO2 will be captured from European emitters and transported to the platform located in the North Sea. It will then be sent underground via the existing offshore platform to be stored permanently in a sandstone reservoir 1,800 m below the seabed," Aquaterra said.

In oil and gas offshore project development news in South America, Italy-headquartered Saipem has notched up two contracts worth US$1.9Bn; one in Brazil with Equinor and the other in Guyana with ExxonMobil.

For the Raia project, the development of a presalt gas and condensate field in the Campos Basin, located about 200 km offshore from the state of Rio de Janeiro in Brazil, Saipem’s scope of work encompasses the offshore transport and installation of a subsea gas export line and associated equipment in water depths of around 2,900 m, and the horizontal drilling activities for the shore approach. Saipem will deploy its state-of-the-art pipelaying vessel Castorone for the installation works.

In Guyana, ExxonMobil’s subsidiary ExxonMobil Guyana Ltd awarded Saipem a contract for the proposed Whiptail oilfield development located in the Stabroek block offshore Guyana, at a water depth of approximately 2,000 m. Saipem’s scope of work includes the design, fabrication and installation of subsea structures, risers, flowlines and umbilicals for a large subsea production facility.

Saipem will perform operations using its vessels FDS2, Constellation and Castorone vessels, and will deploy its Guyana Offshore Construction Facility located at the Port of Georgetown. Subject to government approvals, a project sanction from investors and an authorisation to proceed with the final phase, the award will allow Saipem to begin some limited activities, namely detailed engineering and procurement.

In West Africa, Equinor has sold its Nigerian business, including its share in the Agbami oil field, to Nigeria-owned Chappal Energies.

The entity representing the oil field stake, Equinor Nigeria Energy Co, holds 53.85% ownership of oil and gas lease OML 128, including the unitised 20.21% stake in the Agbami oil field, operated by Chevron. Since production started in 2008, the Agbami field has produced more than 1Bn barrels of oil.

In rigs news, off the coast of the Republic of Congo, Italy-based energy multinational Eni has purchased floating drill rig Scarabeo 5 from Saipem. The floater is currently being converted into a floating production unit for installation off the coast of the Republic of Congo.

In Asia, Malaysia’s Velesto Energy won a contract extension for its 2015-built jackup drilling rig Naga 8 from Petronas-Hess joint venture Carigali Hess. The US$75M contract will see the rig in work for 18 months from April 2024 in Block A-18 of the joint development area administered by a Malay-Thai joint authority. The rig’s initial US$130M contract was set for three years, starting in late 2020 and had three six-month extension options.

In the US Gulf of Mexico, Seadrill has won contracts for its West Neptune and West Vela rigs, totalling US$76M. Following the end of the third quarter, Seadrill secured a short-term campaign for West Vela with QuarterNorth Energy, set to begin after the rig finishes with Beacon Offshore in the first half of 2024 and transitions to Seadrill from its current third-party manager. And the company said it secured an extension for West Neptune with LLOG. As of 27 November 2023, the company’s order backlog stands at US$2.2Bn.

And back in the UK, Dolphin Drilling announced its Borgland Dolphin rig had won a firm, 137-day drilling contract including a contribution for the rig’s reactivation and an additional option. The contract, from Enquest, covers the potential "to extend for a significant additional work scope as part of a strategic alliance over a five-year period. Within this five years, Dolphin Drilling would have schedule flexibility," the company said.

Riviera Maritime Media’s Offshore Support Journal Conference, Middle East will be held 6 December 2023 in Dubai, UAE. Use this link for further information and to register your interest

Related to this Story

Events

Reefer container market outlook: Trade disruption, demand shifts & the role of technology

Asia Maritime & Offshore Webinar Week 2025

Marine Lubricants Webinar Week 2025

CO2 Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.