Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

Register to read more articles.

Rethinking the electric drive to maximise efficiency, minimise opex

With marine hybrid and electric applications increasing, propulsion experts at a webinar discussed the benefits of a streamlined electric drive that can minimise energy losses, improve environmental performance and lower opex

Participating in Riviera Maritime Media’s The case for frequency converters and motors webinar were GasKraft Engineering owner Dr Hinrich Mohr and Berg Propulsion managing director - west hemisphere Jonas Nyberg. The event was produced as part of Marine Propulsion Webinar Week and was sponsored by Berg Propulsion. A Swedish propulsion system manufacturer and systems integrator, Berg Propulsion has been designing and manufacturing propulsion systems for more than 100 years.

When it comes to electric drives, Mr Nyberg said, “Many traditional parts are not present in modern electrically propelled vessels, with new technologies and components making their way in.” He said this is “new ground” for engineers, builders and operators, “making their first acquaintance with these technologies.”

Traditionally, ship propulsion has been supplied by a main engine burning fossil fuels driving a propeller through a reduction gear, explained Mr Nyberg. In this application, electrical power can be tapped from the gear box, typically fed through a frequency converter and then to power distribution.

Mr Nyberg said this method was “great” and “straightforward.” He added, “Your biggest power consumer – your propeller – is getting power almost instantly from the source, but it is not something that works for all of the operation profiles. As soon as you get out of your design condition… typically efficiency drops.”

More than half (59%) of the delegates responding to a poll at the webinar said the main driver to use frequency converters on ships was economy. The remaining respondents were evenly split between ecology and regulations.

As ship operators look for ways to reduce emissions to comply with stricter environmental standards, there are challenges, particularly posed by new fuels and the new ways of driving vessels.

“What do we mean when we say, electric propulsion?” said Mr Nyberg. In one application, Mr Nyberg showed in his presentation the use of two gensets and a Power Cell fuel cell. The power goes to power distribution, then frequency converters, to an electric motor, to a reduction gear and to the propeller, describing a traditional diesel-electric commercial vessel. “The issue, however, is that in every one of these steps we are losing power. The case here is that we are taking the entire power through all of these steps.”

He questioned whether there was an opportunity for consolidation to “make fewer components to drive efficiency.”

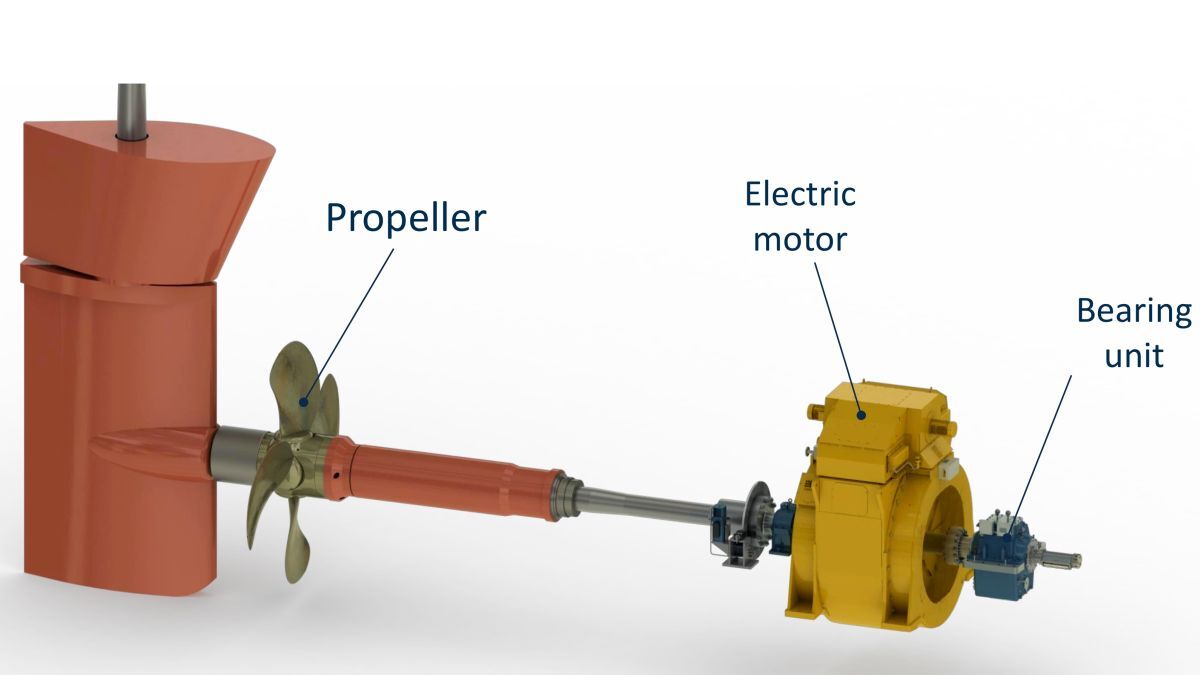

In the traditional diesel-electric propulsion application, there are three main components: propeller, reduction gear and an electric motor.

In a drive towards fewer components and more efficiency, Berg has evolved the configuration for an electric direct drive, making the electric motor part of the shaftline.

In a patent-pending configuration, Berg places the rotor from the electric motor on the propeller shaft with the motor stator mounted on the hull. “We are going for the simplest possible solution. The propeller shaft is actually the electric motor,” he said, adding that while this “introduces very few new components, it introduces a very new concept.”

New electric drives for bulk carriers

Research at Berg is continuing, exploring the use of a Superdrive, a DC hub that connects a vessel’s energy storage and power generation for distribution. He said Berg has taken the sophisticated diesel-electric propulsion plant and made it “rather simple.”

Berg, in partnership with The Switch and Techsol Marine, has delivered new electric direct drive propulsion for 240-m Canada Steamship Lines (CSL) bulk carriers being built in China. These are the first vessels to feature the patent-pending direct-drive propulsion with the electric motors being part of the shaftlines.

Berg believes the application will “change some portion of the marine industry in terms of electric propulsion.”

In the case of the CSL bulk carriers, Berg is working with The Switch to deliver an innovative package of electric drive-train technology in a twin-fin propulsion system. The Switch is delivering two permanent magnet (PM) propulsion machines, four PM generators, two DC-Hubs, two electronic bus links (EBL) and 20 electronic DC breakers (EDCB) for each vessel.

The compact, light, highly efficient and simple-to-maintain PM machines – which capture mechanical energy and convert it to electrical vessel power – are well suited for the limited space available in the slim profile of the twin fins.

The Switch DC-hubs, meanwhile, offer a flexible choice of power generation, energy storage, charging, propulsion and clean power, while the EBL links and protects them.

EDCBs are installed to protect the individual frequency converters within the DC-Hubs.

The newbuild bulk carriers feature large internal power plants – with energy supply through The Switch technology – to satisfy the demand for cargo conveyor belts, propulsion and associated vessel operations.

Hybrid-electric favoured in newbuilds

The uptake of hybrid-electric propulsion is clearly gaining in the marine market. In a poll, almost half (49%) of those responding said they would install hybrid systems in newbuilds, with 24% saying they would after 2025 and another 19% said they already have such vessels in operation. Only 8% said they would never install hybrid systems in their vessels.

Hybrid propulsion technology adds a level of complexity to maintaining a vessel. More than 51% of delegates responding to a poll said they plan to build up inhouse expertise to support their fleet, while 36% said they would depend on external support. The remaining of those polled – 13% — said they were uncertain of the path they would take.

New technology often comes at a cost premium. Capex and opex are always concerns for any business, particularly those in the shipping business. In a poll, delegates were asked to weigh the benefits of spending more capex to lower opex. It might be somewhat surprising that 62% of those responding to a poll said they would accept a 5% higher vessel capex against a 5% lower vessel fuel cost, while another 26% said they would accept a higher vessel capex, too, but not as high as 5% for a 5% lower vessel fuel cost. 12% said they would not consider accepting a 5% higher capex for the same amount in fuel cost savings.

Delegates were asked their thoughts on the future of ship electrification, and how much of a role batteries and fuel cells would contribute to helping the fleet meet future requirements. In a poll, only 26% of voters strongly agreed or agreed that 50% of cargo ships (tankers, container ships) will have electric propulsion before 2030. More than half (54%) said they either strongly disagreed or disagreed with that statement. 20% said they were neutral.

Meanwhile, asked about the contribution of batteries and fuel cells to meeting future requirements, 36% said they were the future for shipping, but the majority said they will help, but were not the solution. Just 2% said they would have an insignificant role.

Dr Mohr said, “The optimisation of all ship systems is important to reduce the environmental footprint.”

While he pointed out there were small potential efficiency gains from optimising the engine – less than 5% — the much larger portions — as much as 25% — were available from the system itself. This means considering an integrated propulsion system with dedicated power and energy management, energy storage, energy recovery and assisting systems for optimised routeing.

Electric drives should work with variable speeds so they can adjust to the actual needs. This means that when we talk about AC grids, we also talk about frequency converters.

When it comes to talking about hybrid-electric propulsion, Dr Mohr said it was remiss to only discuss diesel engines for such applications. He said more applications in the future will have gas-fuelled engines, methanol-fuelled engines, and on the horizon, ammonia-fuelled engines.

“The vessel application plays a major role in the configuration of the specific system. This also relates to vessel performance and fuel consumption expectations, and the integration of batteries and electrification of the powertrain,” he said.

As this electric drive system is a step change from the traditional ship propulsion systems, both Dr Mohr and Mr Nyberg said shipowners, operators, shipyards and suppliers will need support in understanding the technology to further its adoption. In this regard, Dr Mohr mentioned CIMAC, the Association of Internal Combustion Machinery Industry, as a resource for the industry.

Mr Nyberg asked just how long it would take before frequency converters and motors were more widely adopted by shipping. “You know the marine industry is always a bit conservative,” answered Dr Mohr. “They like to use proven solutions.”

While noting that frequency converters are already being used in the auxiliary systems on newbuilds for pumps and cargo vents, Dr Mohr said, “It will take another five to eight years.”

Mr Nyberg said adoption would be impacted by the traditional design cycle of marine components as frequency drives associated with the auxiliary systems are usually supplied as a complete solution.

“Shipowners and yards realise these small components make a very big difference on the larger scale,” said Mr Nyberg.

“Even the small things matter when you add them up.”

Applications for electric drives

Commenting on Berg’s new electric drive concept, Dr Mohr said it was reminiscent of what is considered the most efficient ship propulsion system, “the two-stroke engine directly coupled on the propeller. No losses with the gearbox,” he said. “You are replacing the two-stroke engine with the electric engine.”

Mr Nyberg embraced this analogy. “I think depending on the vessel segment, we are already there. There are vessels already under construction using this technology,” said Mr Nyberg.

He noted Berg was holding discussions across various vessel applications, noting the electric drive solution was “perfect” for the offshore segment, cargo vessels and bunker vessels, which have very diverse operational profiles. “We’ve had discussions with ferry operators, which can benefit from these electric plants where powers are upwards 15 MW per shaft line.” In such an application, Berg would use two motors in series on to the same shaft line.

"We believe that within five years this is going to be one of the larger propulsion options. The challenge is that it’s so different to the traditional setup we can’t go to a shipyard and propose this. We need to have discussions with shipowners and designers and show this is how much you’re going to save. It is a premium solution, but there is no comparison when it comes to efficiency. This will be the most efficient you could ever get. But we need to find the way to have that dialogue with owners and shipyards, up front so that the vessel can be designed and catered to this.”

Related to this Story

Events

Maritime Regulations Webinar Week

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.