Business Sectors

Contents

Register to read more articles.

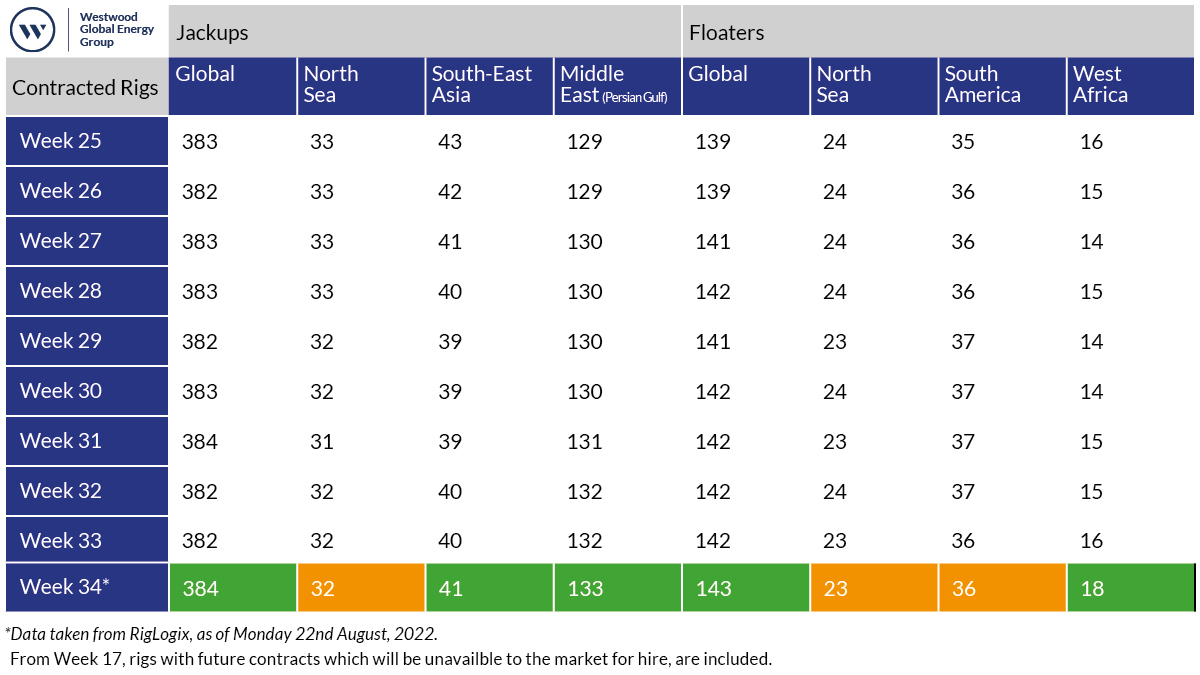

Rigs report: improved jack-up rates in North Sea in 2023; utilisation remains high

In its Q2 2022 quarterly report, Maersk Drilling said it foresees increases in jack-up rates in the North Sea from 2023 as the offshore rigs market continues to show high utilisation rates

Reporting its quarterly earnings figures this week, Maersk Drilling noted its rigs had an 87% utilisation rate at an average day rate of US$201,000 per day, which was below the average of US$214,000 in Q1 this year.

Earnings, however, rose for Q2 2022 to US$284M, an improvement on the US$248M in Q1 2022, and the company said its revenue backlog stood at US$2Bn as of 30 June 2022.

According to Maersk, the North Sea drove much of the company’s new revenue: of the US$160M in new contracts added during the quarter, the North Sea accounted for US$115M.

Maersk Drilling chief executive Jorn Madsen remarked, “I am very pleased with our strong operational performance in the first half of 2022. A market recovery is now materialising, especially in the floater segment, and our financial guidance for the full year is maintained.”

Maersk Drilling said it expects to see increases in day rates for North Sea jack-ups driven by a tightening UK market in 2023.

Maersk Drilling added that seven deepwater floaters were contracted for most of Q2 2022. Utilisation of its seventh-generation drillships is now close to full capacity, driven by demand in the US Gulf of Mexico, West Africa, Brazil and Asia Pacific.

Diamond Offshore is another contractor that looks set to benefit from the improving North Sea market. Its Ocean GreatWhite unit was awarded five wells in the region, with an estimated duration of 300 days. The vessel’s US$80M contract is expected to commence in Q1 2023.

Elsewhere, BW Energy announced the BW MaBoMo offshore production facility is en route to Gabon.

The facility is currently on board a heavy-lift vessel in transit to the Dussafu licence offshore Gabon, where it will be installed to produce oil from the Hibiscus and Ruche fields.

BW MaBoMo – a jack-up that has been repurposed as an offshore production facility – will arrive at the end of September for installation and hook-up, with first oil planned late in Q1 2023.

The Hibiscus/Ruche development is expected to add up to 30,000 barrels per day of gross production once all six horizontal production wells are on stream.

Norwegian oil and gas operator DNO will acquire a stake in Mondoil Petroleum from RAK Petroleum. The all-share transaction comprises Mondoil Enterprises’ 33.33% indirect interest in privately held Foxtrot International, whose principal assets are operated stakes in offshore production of gas in Côte d’Ivoire.

Foxtrot holds a 27.27% interest in and operatorship of Block CI-27 offshore Côte d’Ivoire which contains the West African nation’s largest reserves of gas, produced together with condensate and oil, from four offshore fields tied back to two fixed platforms, meeting more than 75% of the country’s gas needs.

TotalEnergies and Eni reported a significant gas discovery at the Cronos-1 well offshore Cyprus, in the Eni operated Block 6. This discovery follows the Calypso-1 discovery made on the same Block in 2018.

Cronos-1 is located 160-km southwest of the Cyprus coast and encountered several good quality carbonate reservoir intervals and confirmed overall net gas pay of more than 260 m, according to TotalEnergies. Another drilling of another exploration well on Block 6 is planned.

However, the French major came up dry in Block 58 offshore Suriname where it serves as operator, although block partner APA Corp reported an oil discovery in the Baja-1 well, the first such discovery in Block 53.

Baja-1 was drilled to a depth of 5,290 m using Noble Gerry de Souza and encountered 34 m of net oil pay. APA reported preliminary fluid and log analysis indicated light oil with a gas-oil ratio of 1,600 to 2,200 standard cubic feet per barrel, in a good quality reservoir.

The drillship will now mobilise to Block 58 following the completion of current operations, where it will drill the Awari exploration prospect, approximately 27 km north of the Maka central discovery.

Finally, Malaysian firm Sapura Energy agreed to sell three tender-assisted drilling rigs to NKD Maritime Ltd for an aggregate cash consideration of US$8.2M. In a statement, Sapura Energy said the rigs were either ageing, (2005-built Sapura Setia), or not technically competitive, (Sapura T-19 and Sapura T-20), and it could not obtain a fair market value for the rig and has opted to scrap the units instead.

The Offshore Support Journal Conference, Asia will be held 19 October 2022. Register your interest and access more information here

The Offshore Support Journal Conference, Middle East will be held 6 December 2022. Register your interest and access more information here

Related to this Story

Safe Bulkers reports improved carbon intensity and eyes 'green' technologies

Events

Reefer container market outlook: Trade disruption, demand shifts & the role of technology

Asia Maritime & Offshore Webinar Week 2025

Marine Lubricants Webinar Week 2025

CO2 Shipping & Terminals Conference 2025

© 2024 Riviera Maritime Media Ltd.