Business Sectors

Contents

2024 in maritime technology: digitalisation, connectivity, decarbonisation, AI and cyber risks predominate

2024 was the year the industry adopted low Earth orbit satellite communications to improve crew welfare, cloud-based shipmanagement, AI-driven analytics and autonomous navigation

Optimising vessel operations has become crucial for the industry to achieve sustainability and decarbonisation goals. In the long term, large investments will focus on building ships ready for alternative fuels, but in the meantime, owners and operators are turning to digitalisation technologies to save fuel and emissions by becoming more energy efficient.

Owners and operators are also using faster low-latency satellite communications to tackle the challenges of retaining and retraining crew, and to keep track of growing fleets and changing trading patterns. Communications, digital applications and electronic hardware help to tackle these issues, enabling owners to offer career development pathways, almost limitless communications, and technology to make seafarer’s lives easier.

Shipping has turned to digital applications, low-latency connectivity, cloud-based solutions, artificial intelligence and machine learning, while tackling cyber risks with enhanced security.

New LEO constellations overtake established GEO

One company run by an established billionaire, who will soon be part of Trump’s new US administration, has transformed maritime satellite communications during 2024 with owners installing new technology to keep up.

Elon Musk’s SpaceX’s Starlink low Earth orbit (LEO) satellite constellation has revolutionised maritime and offshore communications, providing fast connectivity with low latency to vessels, for crew welfare services and operational applications.

LEO satellite communications has taken the maritime sector to new heights in terms of providing connectivity and welfare support to seafarers. Starlink has become popular with the masses with shipmanagers, owners and operators increasing its deployment across fleets. Whereas two years ago, flat-panel antennas for Starlink were only just being tested, now it is difficult to find a ship without Starlink on board.

Another LEO constellation gaining traction is Eutelsat OneWeb, albeit at a slower pace, with early adoption on offshore vessels, drilling and production facilities. As this global coverage is implemented, more cruise and commercial ships will consider this as a viable alternative. Marella Cruises is investing in OneWeb to operate alongside Starlink on its cruise ships.

Despite the rise of LEO, there is still demand for reliable geostationary orbit (GEO) satellite communications and very small aperture terminal (VSAT) connectivity, but distributors are integrating these services into hybrid smart solutions, where connections will take the cost-efficient, secure pathways. There is also still a need for L-band through Inmarsat, Iridium and Thuraya for maritime safety and security communications.

Inmarsat has reacted to LEO competition by launching a combined hybrid of GEO with LEO and long-term evolution (LTE) in one package. Global container shipowners K Line and Hapag-Lloyd are testing out NexusWave with an eye to roll it out across their fleets.

Class raises requirements for cyber resilience

As the maritime industry adopts more digitalisation applications and ships become more connected, they come under greater risk of cyber attacks. Therefore, enhancing cyber resilience and security is essential to ship operators, owners and builders.

In 2024, the International Association of Classification Societies (IACS) introduced unified requirements (URs) for cyber security and outlined how to demonstrate compliance with them. These URs, E26 and E27, are seen as new benchmarks for shipping’s response to its growing exposure to cyber attacks.

As of 1 July 2024, updated URs E26 and E27 require newbuild vessels and their connected systems to meet certain minimum and unified cyber-resilience standards.

UR E26 is aimed at ensuring the secure integration of both operational technology (OT), information technology (IT) and equipment in a vessel’s network, during the design, construction, commissioning and operational life of the ship.

This UR targets the ship as a collective entity for cyber resilience and covers five key aspects: equipment identification, protection, attack detection, response and recovery.

UR E27 is written to support manufacturers and OEMs of onboard operational systems and equipment in evaluating and improving their cyber resilience. This has led to suppliers and system integrators introducing upgrades to ensure cyber resilience. It also encouraged classification societies to develop and introduce their own interpretations of these URs.

Introducing IACS requirements and raising awareness and demand for enhanced cyber security has led to a trend of class societies acquiring companies with these skills. One of the main deals in 2024 was DNV’s acquisition of CyberOwl, which regularly reports on the shipping industry’s risks and responses to cyber attacks.

According to a study led by CyberOwl published in Q4 2024, a typical fleet of 30 cargo vessels now experiences an average of 80 cyber incidents a year. The study found the average cost of unlocking computer systems in the maritime sector reached US$3.2M.

We can expect more advanced and integrated solutions to be unveiled and new innovative cyber threats to emerge in 2025.

Transformational adoption of artificial intelligence

Developments in artificial intelligence (AI) accelerated during 2024, with shipowners and managers implementing elements to enhance operations. AI is transforming the shipping industry, providing the digital engine to optimise voyages, reduce fuel consumption and emissions and improve safety. It is increasingly seen as a game-changer for the sector and for the whole global supply chain.

Benefits from AI include faster data processing to provide greater insights to seafarers and managers, safer navigation, better predictive maintenance and improved crew training.

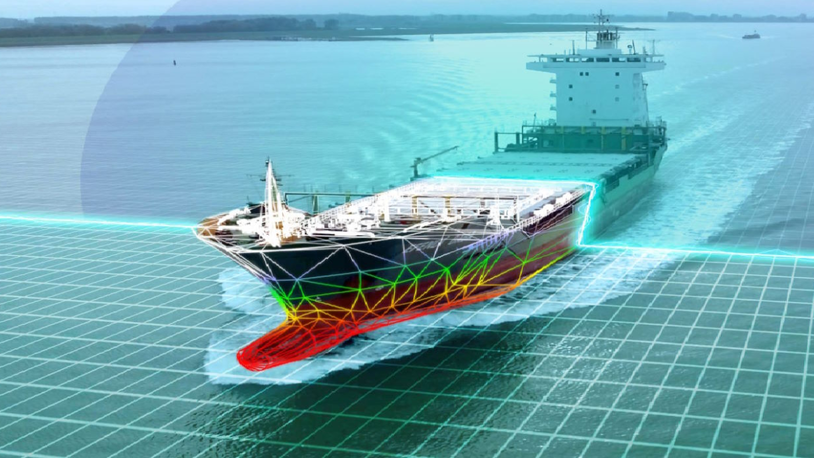

Shipowners are incorporating AI-driven software and digital twins of their vessels to accurately forecast fuel consumption and improve vessel operations and maintenance scheduling.

This is especially the case if owners have invested in energy-saving technologies such as onboard batteries, wind sails, solar panels or shaft generators, or retrofitted propulsion to become more efficient.

AI can be used to discover issues with machinery prior to them causing incidents and failures, identify navigational hazards during voyages, and process data from onboard equipment to provide insights to crew and shore staff. Ship voyages could be optimised by AI to avoid adverse weather and sea conditions, or to reduce fuel use and emissions. AI can also be used to manage cargo, ship trim and weight distribution.

AI is also poised to revolutionise port risk management, as it can rapidly analyse data, provide information to managers, identify emerging trends and risks and offer solutions.

But AI’s success rests on the availability of high-quality data and may require substantial infrastructure changes. There are potential pitfalls to avoid in implementing AI, including ensuring humans are involved to collaborate the intelligence and to monitor the results.

Shipowners need to ensure AI is cyber secure and does not amplify data bias, or use incorrect information. If safeguards are introduced and AI is rigorously checked regularly, benefits can be achieved across the maritime industry.

CII comes into force

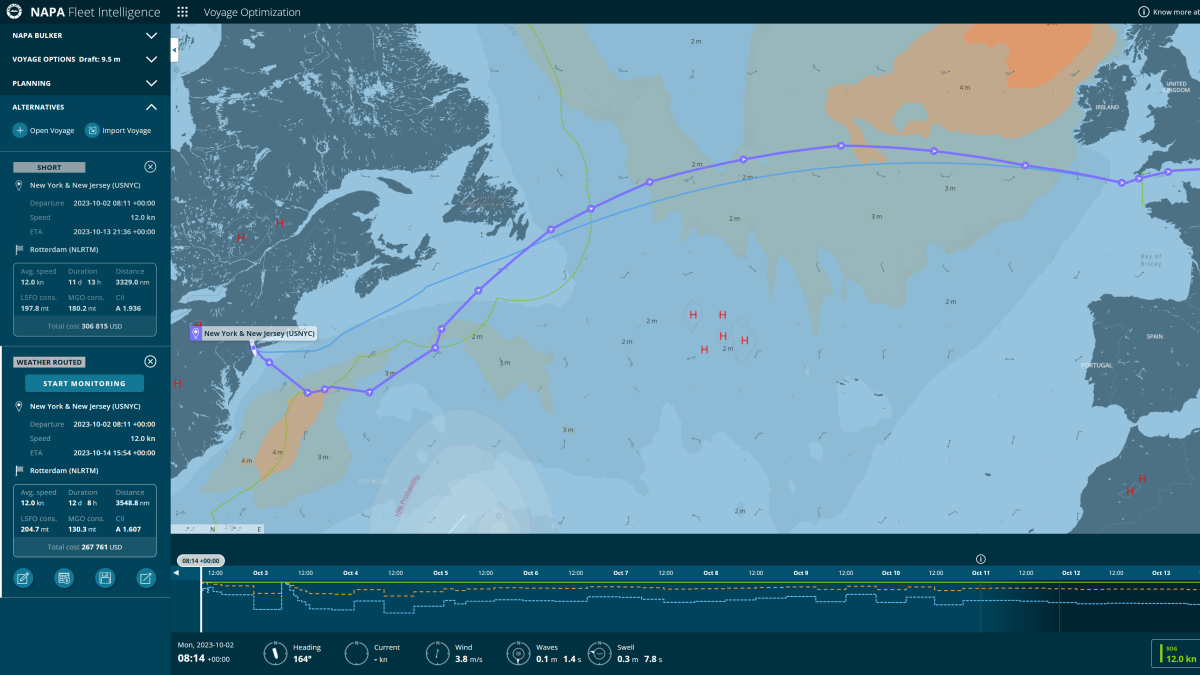

Shipowners, managers and operators are implementing digitalisation and advanced voyage planning to optimise ship operations and reduce fuel consumption and emissions. If the commercial reasons are not enough to invest in these technologies, then IMO’s carbon intensity indicator (CII) regulation has become so.

CII came into effect 1 January 2024 for vessels 5,000 gt and heavier, and requires shipowners to collect and report data that measures a vessel’s annual operational carbon intensity. This data feeds into the CII rating system that ranks vessels in alphabetical bands from A through E, with A being the highest rating for the vessels with the lowest carbon intensity in their operations.

Vessels that fall into the bottom two categories, D and E, are required to take remedial efforts to lower their carbon intensity. Ships rated D for three consecutive years and ships rated E for one year will be required to submit their corrective action plans to regulators.

Methods of improving a ship’s CII rating include optimising voyages to burn less fuel per tonne-mile, lowering waiting times outside ports or finding ways to cut onboard energy use. There are many software suites available to record data and analyse it to optimise vessels and voyages… the question is how effective they are.

Autonomous surface vessels demonstrate abilities

Recognition of technologies enabling autonomous navigation and unmanned vessels has taken time to build, but slowly and steadily vessels are being introduced in select niche markets.

A few have been built for shortsea routes in local areas, such as in Norwegian fjords, or point-to-point passenger ferries. Small unmanned surface vessels (USVs) have been introduced for research and surveying for the offshore renewable industries.

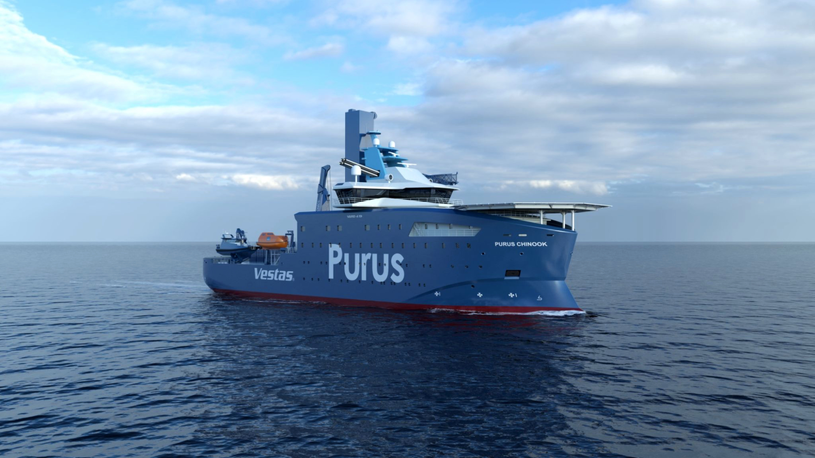

In 2024, the first USVs for deploying remotely operated vehicles (ROVs) in the offshore oil, gas and renewables sectors were unveiled to demonstrate technology advances and commercial advantages.

Reach Subsea welcomed the first of two Reach Remote USVs in Q4 2024 and completed construction of a second of these vessels. Construction also started on Fjord1’s new fleet of double-ended, zero-emissions autonomous ferries.

These projects demonstrate the maritime industry is pushing autonomous and remote-control functions beyond small vessels to applications in passenger, military, survey and hydrographic ships.

IMO is preparing to regulate unmanned shipping and remote control of vessels, with more progress and projects expected to come in 2025.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

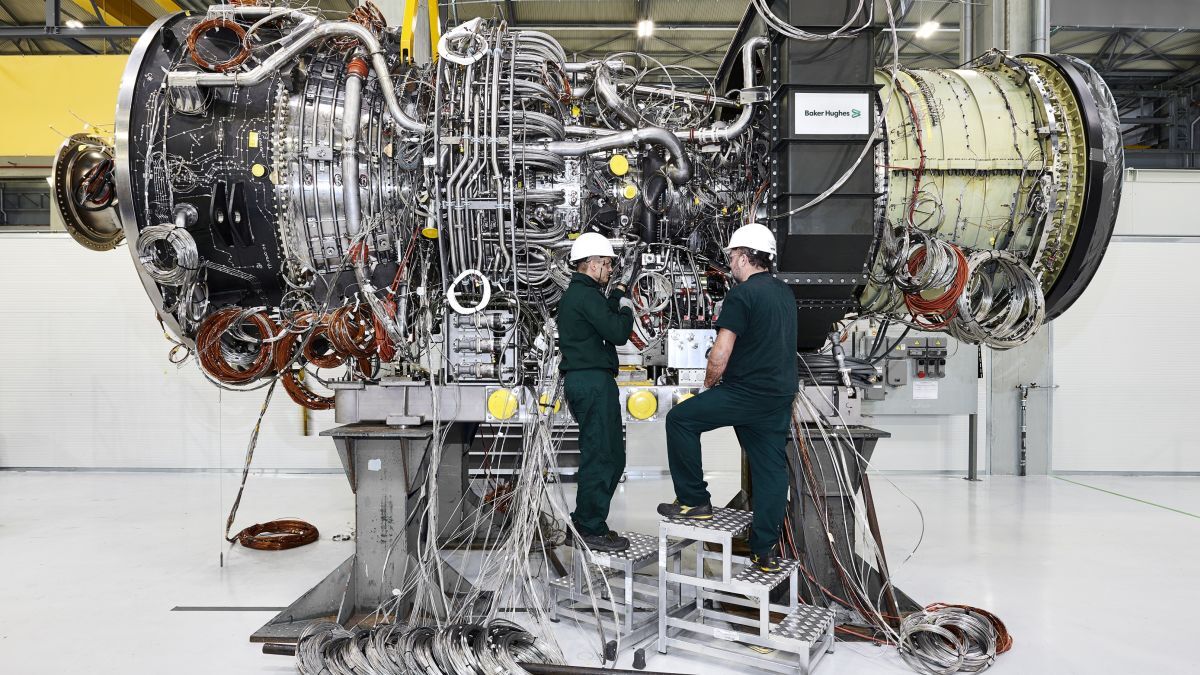

AI, digital twins help design cyber-secure, green SOVs

Events

LNG Shipping & Terminals Conference 2025

Vessel Optimisation Webinar Week

Marine Coatings Webinar Week

© 2024 Riviera Maritime Media Ltd.