Business Sectors

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

Contents

2025 in maritime optimisation and communications: LEO constellations, GPS jamming, AI and USVs drive development

LEO satellite communications, navigational risks, artificial intelligence, autonomous and remotely operated vessels and digital twins drove investments in developing maritime technology in 2025

Digitalisation and communications technologies are becoming ever-more important to the shipping industry as it tackles decarbonisation and rising security risks.

Ship operators, owners and managers are benefiting from faster connectivity through low Earth orbit (LEO) satellites and fuel savings from optimised voyages, while managing cyber risks in a world where geopolitical concerns constantly change.

Fleet optimisation is now critical for the industry to achieve sustainability and decarbonisation goals this decade, especially as environmental fuels are not yet widely available.

And digital technologies, such as artificial intelligence, cloud applications, bonded and hybrid networks, weather routeing, voyage optimisation, digital twins and real-time remote analysis and diagnostics, are enabling owners and operators to overcome other operational challenges. These include retaining and retraining crew, keeping track of growing fleets and changes in trading patterns, avoiding dynamic and evolving high-risk areas and mitigating cyber and GPS jamming risks.

LEO constellations become mainstream

Elon Musk’s SpaceX Starlink LEO satellite constellation has revolutionised maritime and offshore communications, providing fast connectivity with low latency to vessels for crew welfare services and operational applications.

Starlink is enabled by flat-panel antennas, enabling low-cost, efficient hardware installations across fleets of merchant ships and workboats.

Owners worldwide have installed these antennas using a growing network of distributors and system integrators, making Starlink the go-to technology for fast connectivity, opening new applications for seafarer welfare and vessel management.

Starlink has become the primary communication tool on ships, with other technologies such as very small aperture terminal (VSAT) and L-band becoming secondary, all part of hybrid networks that will seamlessly transfer between them.

The latest contracts covered by Riviera brands include installations on vessels managed by Aquarius, Tankerska Plovidba and Atlantska Plovidba, Genden Lines, Polestream and those in the offshore sector, such as Bibby Marine, Solstad, Fairplay and Noatum Maritime.

But it is not all one-way traffic. Inmarsat Maritime has reacted to LEO competition by implementing its bonded service, NexusWave, combining Global Xpress GEO with Eutelsat OneWeb’s LEO constellation and long-term evolution (LTE) in one.

The latest installation contracts for NexusWave were with Coastal Transportation, K-Line, Stena Bulk, Norse Ship and Hadley Shipping.

It is probably a sweet-spot period for Starlink before it gets too congested by its own success, and new players ramp up their LEO services, particularly Amazon’s Kuiper constellation which is due to come online in 2026. There will be a battle ahead for global domination of maritime satellite communications.

Artificial intelligence transforms fleet efficiency

Developments in artificial intelligence (AI) have accelerated in 2025, with more shipowners and managers implementing software and platforms driven by machine learning algorithms to advance their fleets and enhance operations.

AI is transforming the maritime and offshore industries, providing rapid solutions for optimising voyages, reducing fuel consumption and emissions and improving safety and maintenance.

It is seen as critical for the sector and for the whole global supply chain and ports sector, but companies recognise it needs humans to check its output.

Demonstrated benefits from AI include faster data processing to provide greater insights to seafarers and managers, safer navigation, better predictive maintenance and improved crew training.

AI can identify issues with machinery before they cause incidents and failures, optimise vessel voyages, manage navigation to avoid hazards, and reduce fuel consumption and emissions. Algorithms can process huge silos of data to provide analytics to crew, shipmanagement, port authorities, naval architects, shipyards, classification societies, insurers, P&I Clubs and many other stakeholders.

AI has become a must-have for owners, operators and managers, providing the backbone of digital solutions for fleet and vessel management, but with humans in the loop to interpret analytic insights, ensure AI is rigorously checked regularly and is cyber secure.

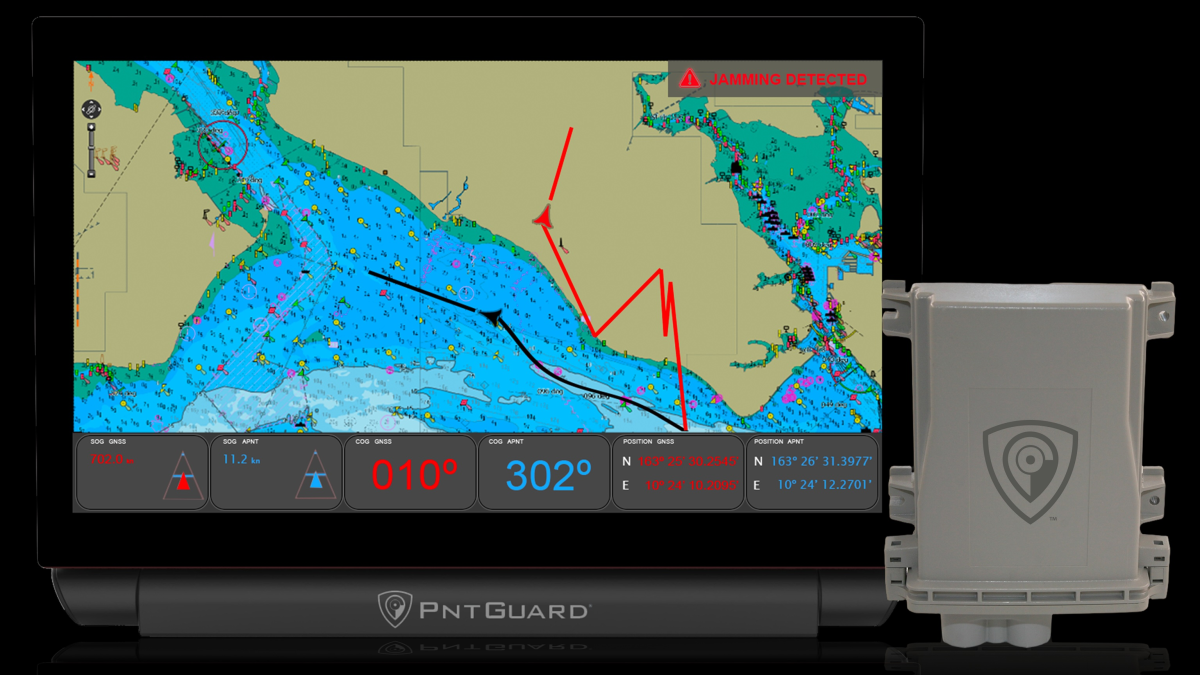

GNSS jamming hits new lows

Changing geopolitics in 2025 led to more sea areas becoming unsafe for maritime trade. Ships were attacked in the Red Sea, piracy has started rising again off Africa and Global Navigation Satellite System (GNSS) signals are being jammed or spoofed more frequently and over wider areas.

Interruptions have affected US-backed GPS in the eastern Mediterranean, Black Sea, Red Sea, Arabian Gulf, Russia’s far east and in the Arctic seas.

Jamming means no GPS signal reaches bridge systems that depend on the information for positioning, navigation and timing (PNT), such as ECDIS and AIS and dynamic positioning.

Spoofing can be even more dangerous as ships can be digitally located out of position, causing collisions, groundings and other accidents.

These attacks are almost always state-driven, with Russia’s invasion of Ukraine and counteractions resulting in jamming in the Black Sea; while Israel’s actions in Gaza resulted in GPS interruptions in the eastern Mediterranean and Red Sea; and Iran has been cited as being responsible for jamming in the Middle East seas.

Technology developers and satellite operators have responded with several anti-jamming and spoofing detection and alternative positioning products becoming available. These use inertial navigation sensors and some connect to Iridium’s LEO satellite L0band network that transmits secured PNT signals which are 1,000 times more powerful than GPS and are resilient to jamming and spoofing.

Virtual, digital twins bring greater benefits

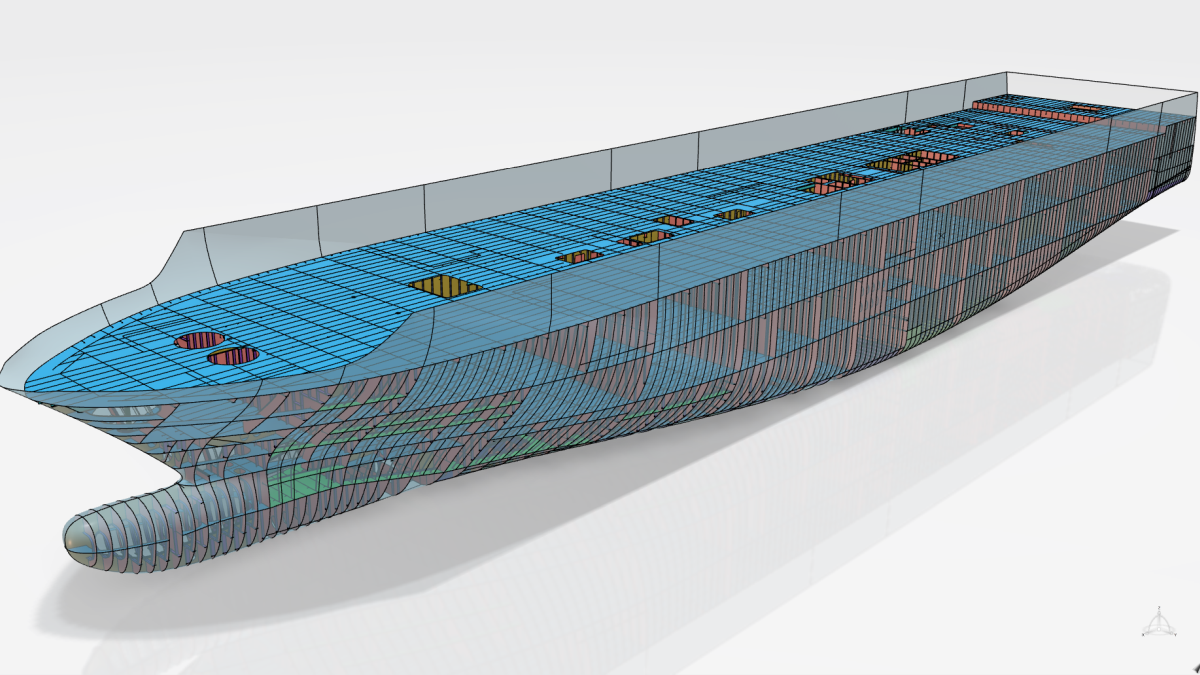

Virtual or digital twins of ships have opened new applications in vessel classification, safety and lifecycle maintenance.

Maritime companies are using them for predictive analytics, system maintenance, fuel efficiency and voyage optimisation, while 3D models are increasingly used for ship design, engineering and classification.

Many of these applications were highlighted during Riviera’s Digital Twin Integration: From Concept to Fleet-Wide Value webinar, which was held on 24 October 2025 during Riveria’s Vessel Optimisation Webinar Week.

During this webinar, Indian Register of Shipping (IR Class) chief technology officer Rabindra Sah outlined how the classification society was spearheading the use of virtual twins to classify ships and approve newbuilding designs at shipyards.

IR Class is using Systemes’ digital platform 3DExperience to create virtual twins of ships for lifecycle assessments and 3D classification, and intends to develop technology to enable more opportunities for collaboration and improve the efficiency of ship design, engineering and construction.

Kongsberg Maritime vice president for special projects and product line manager for performance and fleet management, Anders Bryhni, explained to webinar delegates how digital twins are used in maritime and offshore applications, enabling greater simulation of operations, better maintenance decisions, improved vessel efficiency, better crew training and to implement remote and autonomous technologies.

More applications will be implemented as the technology develops, and digital modelling becomes more sophisticated and can be integrated with other digitalisation tools for vessel-specific voyage optimisation.

Autonomous vessels make waves

In 2025, the first commercial autonomous and remotely controlled offshore support vessels started operating. While the first unmanned surface vessels (USVs) were for naval, defence and research purposes, larger versions have entered service for offshore surveys and subsea infrastructure maintenance.

Two European vessel owners defined remote operations with uncrewed vessels deploying ROVs for subsea inspections and exploration in 2025, while innovators developed USVs for other maritime applications.

Reach Subsea is determining the future of autonomous and remote offshore operations with Reach Remote 24-m USVs developed for ROV offshore operations. One is operating in Norway and has been deemed safe enough to operate from Q4 2025 without a support ship. Another has reached Australia to start trials with Woodside Energy.

With this success, Reach Subsea ordered two more Reach Remote vessels from the shipyard and technology providers, seeking to double the fleet in three years.

Fugro is also ramping up its USV deployments, having entered into a five-year co-operative research and development agreement with the US National Oceanic & Atmospheric Administration’s (NOAA) ocean exploration programme. This public–private partnership intends to use Fugro’s USVs, electric-powered ROVs and cloud-based data workflows that link offshore surface platforms and underwater systems with onshore teams in real time.

In the Middle East, ADNOC Logistics & Services has started constructing two vessels that will be remotely controlled from a base in the UAE to support logistics to offshore facilities and artificial islands. It expects two 60-m landing craft to be delivered and ready for sea trials in Q4 2026.

In the UK, the MROS consortium secured funding in May 2025, as part of the UK Department for Transport’s CMDC programme, to develop a 43-m hybrid-electric USV.

MROS comes four months after USV Pioneer became the first – and so far only – USV to achieve UK Maritime Coastguard Agency Workboat Code 3 regulatory approval.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Floating energy: successfully unlocking stranded gas using FLNGs and FSRUs

© 2024 Riviera Maritime Media Ltd.